Global markets returned to growth on Tuesday, with demand for value stocks returning amid stronger-than-expected business reports in the US and several other countries. Strong preliminary PMI reports for Services and Manufacturing in November came as a surprise to markets and helped the dollar to halt its retreat.

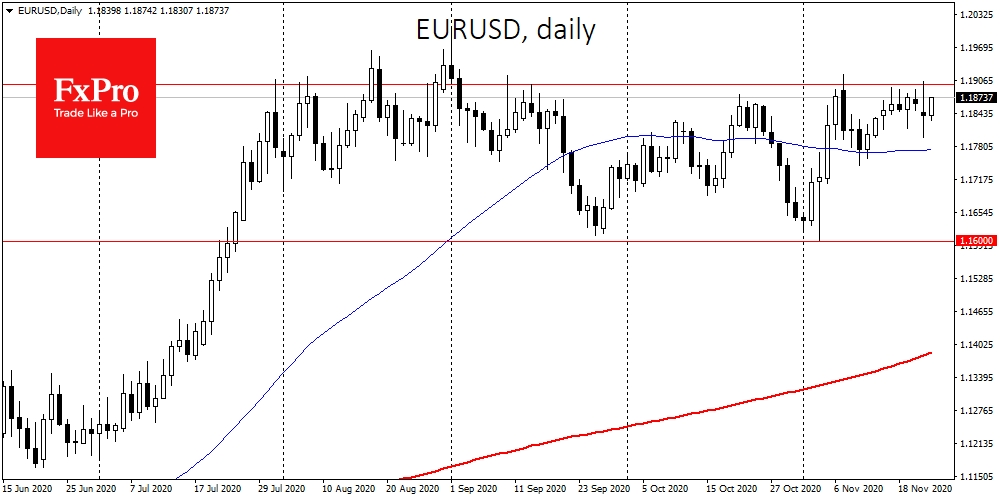

Overnight, EUR/USD once again failed to overcome 1.19. As in numerous times over the last three months, the bear attack from this level was powerful, leading the pair below 1.18 in a matter of hours. The momentum of the dollar's appreciation was short-lived, as it was due to strong data rather than the markets fleeing to safe-assets. Soon after, investors switched to buying risk assets and related currencies.

EUR/USD had already reversed half of yesterday's rollback by Tuesday morning, trading at 1.1850. The recovery in demand for risk assets often plays against the dollar, forcing it to retreat even against the euro. Thus, the dollar has received local support from an important level to the euro but continues to retreat on other fronts. Therefore, the rebound of the dollar index from the 2-year low area risks being short-lived.

The reversal to the dollar's rise on Monday night triggered USD/JPY's pullback above 104.50, and much of this increase is still with us. The growth of this pair is often accompanied by increased purchasing in the stock and commodity markets. Investors are borrowing in yen to fund purchases of risk assets, which supports the weakening of the yen during boom periods. This has not happened in recent months as the markets have found funding in dollars and euros.

The weakening of the yen is feeding a new round of growth in Japanese stocks, pushing Nikkei 225 to new highs since 1991.

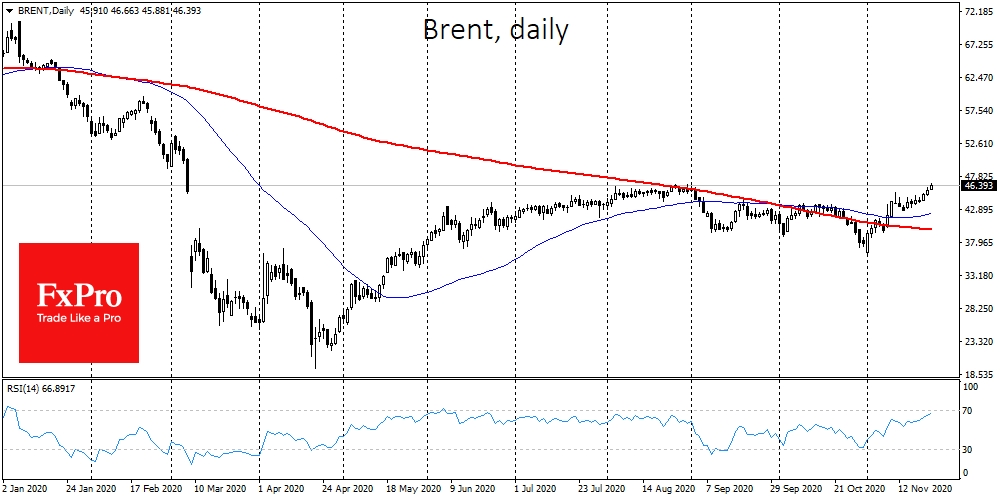

In parallel, Gold has fallen out of the trading range of the last 4.5 months, trading at $1830. By contrast, oil has soared to highs since March. Brent traded at $46.50, again testing the highs of August and earlier in the morning touched the highest values since March at $46.66. WTI has similar dynamics, rising to $43.50.

The recovery in oil quotes is fuelling strong demand for stocks of raw materials and energy companies, which added 4%-15% yesterday while continuing Crude Oil growth pushes them even higher today.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

USD Secured A Major Level Vs Euro, But. . .

Published 11/24/2020, 04:33 AM

Updated 03/21/2024, 07:45 AM

USD Secured A Major Level Vs Euro, But. . .

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.