Market Brief

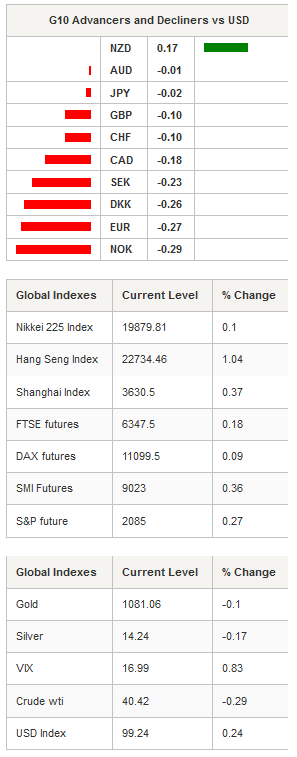

In the FX markets the USD regained some lost ground against G10 currencies after yesterday's steep decline. The US rate curve rose slightly in the short end as 2 year yields climbed to 0.909% up 5bps. In EM FX, the USD continued to lose ground with solid rallies in KRW and IDR. The PBoC lowered the USD/CNY fix slightly to 6.3780. Overall, trading volumes were subdued after the long and emotionally challenging week. USD/JPY bounced around 123.05 to 122.75, while AUD/USD traded between 0.7185 to 0.7210. EUR/USD reversed current bullish bounced trading down to 1.0704. With a thin calendar today we anticipate further range trading and would adjust to short term mean revering strategies. Although risk seeking was limited in FX, equity markets continued to see positive developments. Asia regional indices were marginally higher across the board with only Taiwan trading in the red. The Nikkei 225 and Hang Seng rose 0.10%, while the Shanghai Composite improved by 0.37%. In the US, Federal Reserve Vice Chairman Stanley Fischer suggested that financial markets were prepared for a rate hike as the Fed had communicated its strategy correctly. Fischer told the Asia Economic Policy Conference the Fed, “have done everything we can to avoid surprising the markets and governments when we move, to the extent that several emerging market central bankers have, for some time, been telling the Fed to ’just do it.’” He reiterated that no decision has been made on the precise timing of the first rate hike in ten year, yet stated: "in the relatively near future probably some major central banks will begin gradually moving away from near-zero interest rates.” Sound to us like a December hike. We remain constructive on the USD against G10 currencies based on further policy divergence.

Elsewhere, Greece’s parliament has passed reforms in order to unlock €12bn from the €85bn bailout agreement. After a contentious debate, which saw the firing of two deputies from Syriza-led coalition government, the measures were passed by 153 to 137 votes. In New Zealand, credit card spending increased 7.8% y/y in October, compared to a prior 7.3% in September.

On the docket today traders will be listening to Mario Draghi speech in Frankfurt at the European Banking Congress. Yesterday’s, ECB monetary policy October meeting minutes indicated that the Governing Council (GC) was disappointed in the ability of QE to deliver the desired effect. As a result the ECB indicated that the “degree of monetary policy accommodation would need to be re-examined in December.” This view indicates to us that additional monetary policy stimulus will be launched next month (more QE, deposit rate cuts and verbal intervention). Today's speech could help clarity Draghi’s and the ECB's stance. Given the EUR/USD recovery we anticipate the speech will have a bearish effect on the pair.

On the data front, Euro area consumer confidence is expected to fall to -8.0 in November from -7.7 in October. Canada, September Headline CPI is expected to come in at 0.1% m/m prior -0.2% and core at 0.2% prior 0.2%. The risk is for a more disappointed read as sluggish oil prices have generated disinflationary pressure. A weaker-than-expected CPI print will revised expectations for BoC easing and pushed CAD lower. Finally, Mexican Q3 GDP is anticipated to increase to 2.4% y/y, up from 2.2% in 2Q, however with the Fed on the verge of hiking and crude prices weak we remain bearish on MXN.

Currency Tech

EUR/USD

R 2: 1.1387

R 1: 1.1095

CURRENT: 1.0668

S 1: 1.0458

S 2: 1.0000

GBP/USD

R 2: 1.5659

R 1: 1.5529

CURRENT: 1.5206

S 1: 1.5027

S 2: 1.4566

USD/JPY

R 2: 135.15

R 1: 125.86

CURRENT: 123.27

S 1: 120.07

S 2: 118.07

USD/CHF

R 2: 1.0240

R 1: 1.0129

CURRENT: 1.0133

S 1: 0.9739

S 2: 0.9476