Forex News and Events

Fed expects strong retail sales

April retail sales were strong, increasing by 1.3% m/m. May advance data is expected to be released this early afternoon and market consensus is at 0.3% m/m. However, this will not affect the Fed's rate decision at the FOMC tomorrow, where it is expected rates will be kept unchanged at 0.25% - 0.50%. For the time being financial markets have completely ruled out a June rate hike and good data today would provide some relief to the American central bank whose monetary policy results are somewhat cumbersome. Strong results would also provide some support to its medium-term view of increasing rates.

After last Friday’s disappointing jobs report, we maintain our view that no rate hike will happen this year. Financial markets are nonetheless pricing a Fed rate hike probability for September above 28%. We think that the dollar should continue weakening and we target 1.1500 over the medium-term.

Risk is running for the exit

Finally, investors are waking up to the weight of event risks generated by the FOMC meeting and the EU referendum, as well as the slew of lesser publicized risks such as the Spanish elections and the German Constitutional Court ruling on OMT. Today’s move comes on the back of new polls which indicate a widening “leave” campaign lead. Global trading behavior is exhibiting the classic pattern of accelerating risk-off sentiment. Bond yields have led the risk aversion parade, as German 10-year yields dropped below zero for the first time on record (-0.001%). Safe-haven currencies, such as JPY and CHF, have seen steady demand. EUR/CHF retraced yesterday's gains declining below 1.0844 support. Financial institutions have increased their call to use CHF to hedge a potential “Brexit”, generating significant demand for CHF and offsetting what we expect to be SNB intervention (IMF Special Data Dissemination Standard is indicating a CHF15bn monthly rise in foreign currency reserves). USD/JPY is now approaching a key support at 105.55 (May low), prompting Japanese policymakers Fin Min Aso and Econ Min Ishihara to suggest FX intervention. Global equity markets are red across the board and the S&P 500 is balanced precariously on a key uptrend support at 2079. Finally, gold’s 7-day bullish rally has taken a slight pause, consolidating around $1280 as investors wait for the results of the U.S. Federal Reserve's two-day meeting. We suspect that the nonchalant investor’s approach has now been abandoned with significant volatility and market dislocation expected until the 24th June.

EUR/JPY - Heading Towards Support At 118.73.

The Risk Today

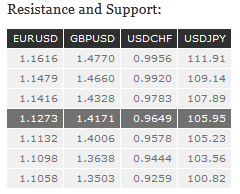

EUR/USD's very short-term move is bearish. Hourly resistance can be found at 1.1303 (13/06/2016 high). The road is still wide-open for a stronger retracement at 1.1132 (03/06/2016 low). The technical structure suggests further downside moves. In the longer term, the technical structure favours a very long-term bearish bias as resistance at 1.1714 (24/08/2015 high) holds. The pair is trading in range since the start of 2015. Strong support is given at 1.0458 (16/03/2015 low). However, the current technical structure since last December implies a gradual increase.

GBP/USD is trading lower. Resistance is given at 1.4328 (13/06/2016 high) and stronger one is located at 1.4660 (07/06/2016 high). The pair has broken support at 1.4132 (18/04/2016 low) and is now heading towards support at 1.4006 (06/04/2016 low). Expected to confirm deeper selling pressures. The long-term technical pattern is negative and favours a further decline towards key support at 1.3503 (23/01/2009 low), as long as prices remain below the resistance at 1.5340/64 (04/11/2015 low see also the 200 day moving average). However, the general oversold conditions and the recent pick-up in buying interest pave the way for a rebound.

USD/JPY's selling pressures continue. Hourly support at 106.25 (04/05/2016 low) has been broken while hourly resistance is given at 107.89 (07/06/2016 high). The medium term momentum is clearly oriented downwards. Expected to further weaken. We favour a long-term bearish bias. Support at 105.23 (15/10/2014 low) is on target. A gradual rise towards the major resistance at 135.15 (01/02/2002 high) seems now less likely. Another key support can be found at 105.23 (15/10/2014 low).

USD/CHF is consolidating below hourly resistance at 0.9662 (08/06/2016 high). Support can be found at 0.9578 (09/06/2016 low). Expected to show a continued bearish move. In the long-term, the pair is still trading in range since 2011 despite some turmoil when the SNB unpegged the CHF. Key support can be found 0.8986 (30/01/2015 low). The technical structure favours a long term bullish bias since last December.