Market Brief

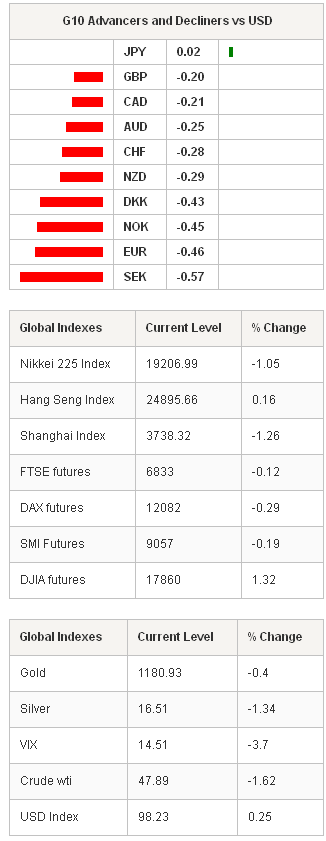

The last trading day of the quarter has been subdued. In the Asian session, FX markets were dominated by more USD strength as traders further priced in policy divergence. However, due to the short holiday week, trading volumes are already thinning and direction lacking conviction. Regional equity markets were broadly higher with only the Nikkei 225 (down -0.51%), breaking up the green across the screen. US stock futures are pointing to a higher open. Once again it was commodity currencies that led the G10 downwards slide. AUD/USD dropped from 0.7665 to 0.7620 despite the strong new homes sales data which posted a 1.1% increase. NZD/USD after a brief rally to 0.7511, fell to 0.7473. Again the better than expected data in business confidence (35.8 up from 43.4) did little to generate NZD demand. NZD/USD is now trading below the 65d MA putting the immediate risk of a retest of cycle lows at 0.7200. USD/JPY bounced around 120.0 and 120.35 for most of the session with no directional bias. USD/JPY base is complete the next bullish target should be 121.20 (3/20/15 high). Oil futures fell as Iran and world powers seem to have moved closer to a deal that could lessen sanctions and open up more Iranian crude to the worlds markets.

In the European, session traders will be watching UK final Q4 GDP growth expected to be unrevised at 0.5% q/q. GBP/USD has been consolidating loses around the 1.4790 areas but our bias is towards further downside. Despite UK accelerating economy, inflation is worryingly low which will keep the BoE from any policy action in the foreseeable future. In the short term growing political risk generating from the upcoming, highly uncertain, election will weigh on the sterling. With GBP/USD comfortable below the short term downtrend at 1.4880 indicates a test of 1.0458 low.

From the Eurozone, expect flash HICP inflation to rise from -0.1% y/y to 0.0% y/y in March. Markets expect euro area unemployment to stay at 11.2% while German unemployment rate to be flat in March at 6.5%. With the markets focus on US data (payrolls) and developments around the Greek reforms negotiations, this data will go unnoticed unless we see a significant surprise. Yesterday, Prime Minister Alexis Tsipras hit the wires again to appeal for a "honest compromise" with creditors but warned that “unconditional” deals would not be accepted. With the Greek debt situation still far from being resolved, our short term bias is to the downside for EUR/USD. A close below the 21d MA would indicate a bearish move towards 1.0458.

Swissquote SQORE Trade Idea:

Stat Arb FX Model - Buy USD/RUB @ 57.82 Sell @ USD/CHF @ 0.9698

| Today's Calendar | Estimates | Previous | Country / GMT |

|---|---|---|---|

| AU 29.mars ANZ Roy Morgan Weekly Consumer Confidence Index | - | 111.4 | AUD / 22:30 |

| UK Mar GfK Consumer Confidence | 2 | 1 | GBP / 23:05 |

| JN Feb Loans & Discounts Corp YoY | - | 2.91% | JPY / 23:50 |

| AU Feb HIA New Home Sales MoM | - | 1.80% | AUD / 00:00 |

| NZ Mar ANZ Activity Outlook | - | 40.9 | NZD / 00:00 |

| NZ Mar ANZ Business Confidence | - | 34.4 | NZD / 00:00 |

| AU Feb Private Sector Credit MoM | 0.50% | 0.60% | AUD / 00:30 |

| AU Feb Private Sector Credit YoY | 6.30% | 6.20% | AUD / 00:30 |

| NZ Feb Money Supply M3 YoY | - | 6.20% | NZD / 02:00 |

| JN Feb Vehicle Production YoY | - | -9.70% | JPY / 04:00 |

| JN Feb Housing Starts YoY | -6.80% | -13.00% | JPY / 05:00 |

| JN Feb Annualized Housing Starts | 0.877M | 0.864M | JPY / 05:00 |

| JN Feb Construction Orders YoY | - | 27.50% | JPY / 05:00 |

| DE 4Q F GDP QoQ | 0.40% | 0.40% | DKK / 07:00 |

| DE 4Q F GDP YoY | 1.30% | 1.30% | DKK / 07:00 |

| DE Feb Unemployment Rate Gross Rate | 4.90% | 4.90% | DKK / 07:00 |

| NO Apr Norges Bank Daily FX Purchases | - | -700M | NOK / 08:00 |

| UK 4Q Current Account Balance | -22.0B | -27.0B | GBP / 08:30 |

| UK 4Q F GDP QoQ | 0.50% | 0.50% | GBP / 08:30 |

| UK 4Q F GDP YoY | 2.70% | 2.70% | GBP / 08:30 |

| UK 4Q F Total Business Investment QoQ | - | -1.40% | GBP / 08:30 |

| UK 4Q F Total Business Investment YoY | - | 2.10% | GBP / 08:30 |

| UK Jan Index of Services MoM | 0.30% | 0.60% | GBP / 08:30 |

| UK Jan Index of Services 3M/3M | 0.80% | 0.80% | GBP / 08:30 |

| UK Mar Lloyds (LONDON:LLOY) Business Barometer | - | 45 | GBP / 08:30 |

| EC Feb Unemployment Rate | 11.20% | 11.20% | EUR / 09:00 |

| EC Mar CPI Estimate YoY | -0.10% | -0.30% | EUR / 09:00 |

| EC Mar A CPI Core YoY | 0.70% | 0.70% | EUR / 09:00 |

| CA Jan GDP MoM | -0.20% | 0.30% | CAD / 12:30 |

| CA Jan GDP YoY | 2.40% | 2.80% | CAD / 12:30 |

| US Mar ISM Milwaukee | 51.5 | 50.32 | USD / 13:00 |

| US Jan S&P/CS 20 City MoM SA | 0.60% | 0.87% | USD / 13:00 |

| US Jan S&P/CS Composite-20 YoY | 4.60% | 4.46% | USD / 13:00 |

| US Jan S&P/CaseShiller 20-City Index NSA | 172.9 | 173.02 | USD / 13:00 |

| US Jan S&P/Case-Shiller US HPI MoM | 0.80% | 0.73% | USD / 13:00 |

| US Jan S&P/Case-Shiller US HPI YoY | - | 4.62% | USD / 13:00 |

| US Jan S&P/Case-Shiller US HPI NSA | - | 166.82 | USD / 13:00 |

| US Mar Chicago Purchasing Manager | 51.7 | 45.8 | USD / 13:45 |

| US Mar Consumer Confidence Index | 96.4 | 96.4 | USD / 14:00 |

Currency Tech

EUR/USD

R 2: 1.1280

R 1: 1.1043

CURRENT: 1.0812

S 1: 1.0768

S 2: 1.0613

GBP/USD

R 2: 1.5166

R 1: 1.4994

CURRENT: 1.4812

S 1: 1.4635

S 2: 1.4547

USD/JPY

R 2: 122.03

R 1: 120.50

CURRENT: 119.41

S 1: 118.33

S 2: 117.93

USD/CHF

R 2: 0.9984

R 1: 0.9812

CURRENT: 0.9685

S 1: 0.9491

S 2: 0.9450