The value of the U.S. dollar had surged through the end of 2016, but the trend has clearly reversed back down this year — and there may be significantly more downside ahead.

That’s because technicals are beginning to roll over for the dollar, from a short-term perspective. As analyst Gary Savage at Smart Money Tracker points out, the 10-day moving average for the dollar is the important level to watch right now:

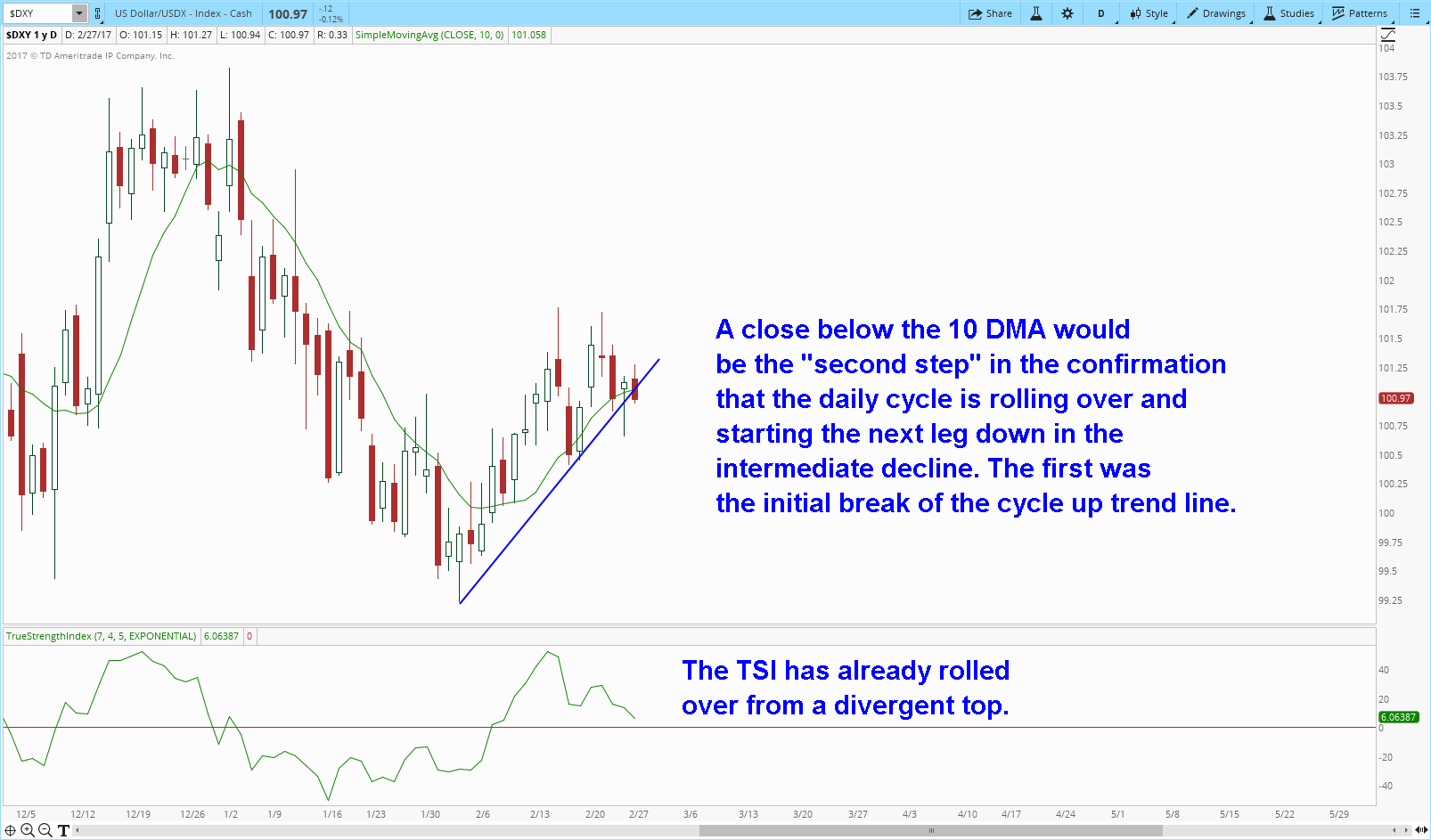

A close below the 10 DMA on the US Dollar would be the “second step” in the confirmation that its daily cycle is rolling over and starting the next leg down in the intermediate decline. The first confirmation was the initial break of the daily cycle up trend line.

As you can see in the chart above as well, the True Strength Index (TSI), represented by the green line, has already rolled over from a divergent top. The last time this happened, the U.S. dollar plunged significantly.

On the ETF side of things, the PowerShares DB US Dollar Index Bullish (NYSE:UUP was trading at $26.07 per share on Monday morning, down $0.06 (-0.23%). Year-to-date, UUP has declined -1.47%, versus a 5.86% rise in the benchmark S&P 500 index during the same period.

UUP currently has an ETF Daily News SMART Grade of A (Strong Buy), and is ranked #1 of 25 ETFs in the Currency ETFs category.