The Japanese yen has lost ground on Wednesday, continuing the downward trend we’ve seen most of this week. Currently, USD/JPY is trading at 103.70, its highest level since the end of July. On the release front, Japanese Capital Spending posted a gain of 3.1%, well shy of the estimate of 5.6%. The US will release unemployment claims and the ISM Manufacturing PMI. On Friday, the US releases three key employment indicators – the unemployment rate, Average Hourly Earnings and the Nonfarm Employment Change.

Japanese Capital Spending continues to soften, pointing to weaker spending by the business sector. The indicator came in at 3.1% in the second quarter, compared to 4.2% in Q1. This marked the weakest gain since Q4 of 2014. The manufacturing sector continues to struggle, as Final Manufacturing PMI came in at 49.5 points. The index has posted six straight readings below the 50-point level, pointing to ongoing contraction. These soft numbers have been no help for the yen, which has sagged 3.0 percent since August 22.

US numbers continues to enjoy a solid week. The ADP Nonfarm Employment Change was little changed in August, posting a gain of 177 thousand. This beat the forecast of 174 thousand, the third straight month the indicator has exceeded the forecast. This release precedes the all-important official Nonfarm Employment Change report on Friday. On the housing front, Pending Home Sales gained 1.3%, well above the forecast of 0.7%, marking a 3-month high. On Tuesday, CB Consumer confidence jumped to 1o1.1 points in August, above the forecast of 99.7 points. It marked the indicator’s highest level since September 2015 and points to strong confidence on the part of the US consumer.

A September rate hike is back on the table, following an upbeat speech from Fed chair Janet Yellen last week at the Jackson Hole summit. Yellen’s message to the markets was refreshingly clear, as she said that the case for a rate increase had “strengthened in recent months”. Yellen noted that the key economic indicators were performing well – the labor market was approaching maximum employment, inflation was steady, and consumer spending remained solid. Still, Yellen did not provide any timeline on a rate hike nor did she spell out what the Fed wants to see before pressing the rate trigger. The Fed’s signal to the markets has raised the odds of a rate move, according to the CME Group FedWatch tool, with a September hike priced at 30% in September and 57% for a December hike. However, given that any move by the Fed will be data-dependent, US numbers ahead of the Fed policy meeting on September 21 could significantly change the rate outlook.

Wednesday (August 31)

- 19:50 Japanese Capital Spending. Estimate 5.6%. Actual 3.1%

- 20:30 Japanese Final Manufacturing PMI. Estimate 49.6. Actual 49.5

- 23:45 Japanese 10-year Bond Auction. Actual -0.05%

Thursday (September 1)

- 7:30 US Challenger Job Cuts

- 8:30 US Unemployment Claims. Estimate 265K

- 8:30 US Revised Nonfarm Productivity. Estimate -0.6%

- 8:30 US Revised Unit Labor Costs. Estimate 2.0%

- 9:45 US Final Manufacturing PMI. Estimate 52.1

- 10:00 US ISM Manufacturing PMI. Estimate 52.0

- 10:00 US Construction Spending. Estimate 0.6%

- 10:00 US ISM Manufacturing Prices. Estimate 54.5

- 10:30 US Natural Gas Storage. Estimate 38B

- All Day – US Total Vehicle Sales. Estimate 17.2M

- 19:50 Japanese Monetary Base. Estimate 23.1%

Friday (September 2)

- 8:30 US Average Hourly Earnings. Estimate 0.2%

- 8:30 US Nonfarm Employment Change. Estimate 186K

- 8:30 US Unemployment Rate. Estimate 4.8%

*All release times are EDT

*Key events are in bold

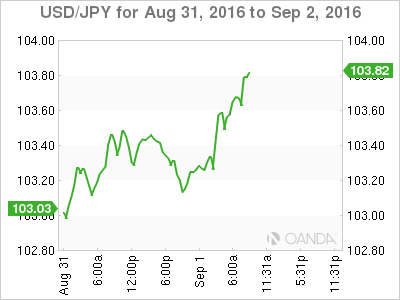

USD/JPY for Thursday, September 1, 2016

USD/JPY September 1 at 10:35 EDT

Open: 103.31 High: 103.66 Low: 103.06 Close: 103.62

USD/JPY Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 99.71 | 101.20 | 102.36 | 103.73 | 104.99 | 106.38 |

- USD/JPY was flat in the Asian session and has posted gains in European trade

- 102.36 is providing strong support

- 103.73 is a weak resistance line and could break in the North American session

- Current range: 102.36 to 103.73

Further levels in both directions:

- Below: 102.36, 101.20, 99.71 and 98.95

- Above: 103.73, 104.99 and 106.38