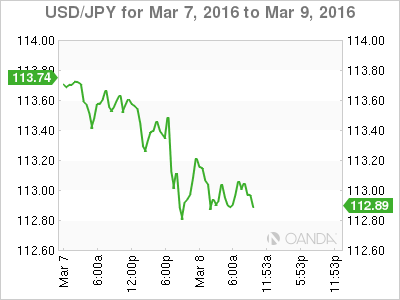

USD/JPY continues to lose ground this week, as the pair trades at the 113 line in the North American session. In Japan, the markets were treated to a host of weak releases. Current Account posted a smaller surplus than expected, while Japanese GDP posted a weak reading of -0.3%. Consumer Confidence and Economy Watchers Sentiment also missed expectations. In the US, the sole event on the schedule is the NFIB Small Business Index. The indicator slipped to 92.9 points, missing expectations.

Japanese fundamentals continue to point downwards, indicative of a downturn in economic activity. Japanese Final GDP in the fourth quarter came in at -0.3%, just above the forecast of -0.4%. The current account surplus dropped sharply to JPY 1.49 trillion, well off the estimate of JPY 1.66 trillion. These soft numbers will only intensify pressure on the BoJ to take further monetary action at its policy meeting later in March. The BOJ took drastic action in January, shocking the markets by adopting negative interest rates. However, this move failed to kick-start the weak economy or blunt the yen’s rise, which has had a negative impact on the critical export sector. If the BoJ decides to implement additional easing measures, it would likely push the yen to lower levels.

Last week’s US job data was mixed. Nonfarm Payrolls impressed with a reading of 242 thousand in January, much higher than the estimate of 195 thousand. This was much stronger than the previous (revised) reading of 171 thousand. The US economy has added an average of 225,000 jobs per month since December, an impressive number considering that the economy has softened in the early part of 2016. Still, employment news was mixed, as wage growth declined by 0.1%, shy of the estimate of a 0.2% gain. This marked the first drop in wages since December 2014. This indicator is closely linked to inflation, since an increase in wages means workers have more money to spend. The indicator’s decline means that that Federal Reserve’s inflation target of about 2.0% remains far off, so the Fed, which is keeping a close eye on the weak inflation picture, is unlikely to press the rate trigger at its policy meeting later this month.

USD/JPY Fundamentals

Monday (March 7)

- 18:50 Japanese Current Account. Estimate 1.66T. Actual 1.49T

- 18:50 Japanese Final GDP. Estimate -0.4%. Actual -0.3%

Tuesday (March 8)

- 00:00 Japanese Consumer Confidence. Estimate 42.3. Actual 40.1

- 1:00 Japanese Economy Watchers Sentiment. Estimate 47.5. Actual 44.6

- 6:00 US NFIB Small Business Index. Estimate 94.5. Actual 92.9

- 18:50 Japanese M2 Money Stock. Estimate 3.2%

*Key releases are highlighted in bold

*All release times are EST

USD/JPY for Tuesday, March 8, 2016

USD/JPY March 8 at 9:15 EST

Open: 113.49 Low: 112.73 High: 113.51 Close: 112.96

USD/JPY Technicals

| S3 | S2 | S1 | R1 | R2 | R3 |

| 109.87 | 111.50 | 112.48 | 113.86 | 114.65 | 115.85 |

- USD/JPY posted losses in the Asian session and has leveled off in European trade

- There is resistance at 113.86

- 112.48 is a weak support line

- Current range: 112.48 to 113.86

Further levels in both directions:

- Below: 112.48, 111.50 and 109.87

- Above: 113.86, 114.65, 115.85 and 116.65

OANDA’s Open Positions Ratio

USD/JPY ratio continues to show little movement this week. Long positions retain a strong majority (60%), indicative of strong trader bias towards the pair reversing directions and moving to higher levels.