US equities extended the bull run overnight in response to Republican's win in the mid term election. DJIA rose 100.69 pts, or 0.58% to 17484.53 while S&P 500 rose 11.47 pts, or 0.57% to 2023.57. Both made new record highs. It's noted that investor sentiments were lifted as the Republicans are seen as more business friendly, favoring lower taxes and less regulations. Meanwhile, S&P Capital IQ also pointed out that the stocks markets usually performed best in case of a Democratic president and Republican controlled Congress. Historically since 1945, S&P 500 has risen an average of 15.1% in the years with such situation. In the currency markets, the theme of strong dollar and weak yen remained. USD/JPY breached 115 handle today for the first time since November 2007.

Released from Australia, employment rose 24.1k in October, more than double of expectation of 10.3k. Full time jobs were up 33.4k while part time jobs dropped 9.4k. Participation rate rose to 64.6%, up from 64.5 % in September. Unemployment rate was unchanged at 6.2%. Nonetheless, the positive job data was largely ignored by the markets. AUD/USD dropped through 0.8642 key near term support level and reached a four year low on broad based strength in dollar, and being weighed down by falling commodity prices.

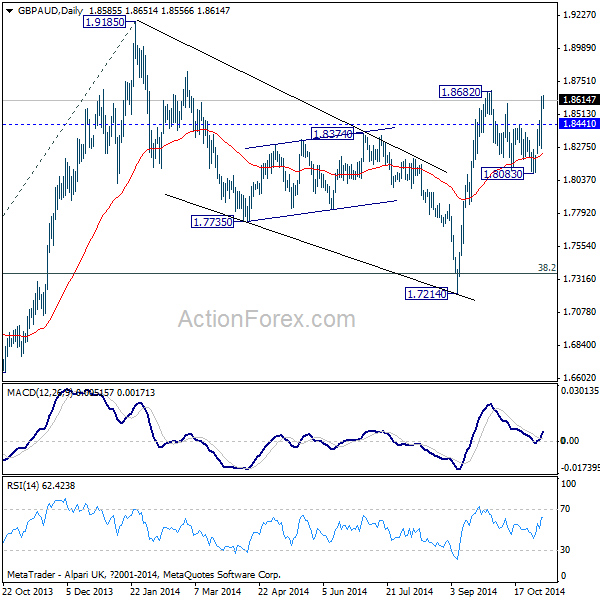

Following up on GBP/AUD, we noted earlier this week that there might be an upside break out this week. The development so far affirmed our view. To recap, correction from 1.9185 should be finished at 1.7214 and rebound from there is still in progress. The break of 1.8441 minor resistance argues that pull back from 1.8682 is completed at 1.8083 already. Intraday bias is now on the upside for 1.8682. Break will pave the way to retest 1.9185 high.

Looking ahead, ECB and BoE rate decision are the main focus today. It's highly unlikely that ECB will announce any new stimulus today and the central bank will take more time to assess the impact of past moves. Back in September ECB lowered all three main rates and that was followed by details of the asset purchase program in October. BoE is expected to keep rate unchanged at 0.50% and maintain the asset purchase target at GBP 375. Only a brief statement would be released and it's likely a non-event.

Looking ahead, ECB and BoE rate decision are the main focus today. It's highly unlikely that ECB will announce any new stimulus today and the central bank will take more time to assess the impact of past moves. Back in September ECB lowered all three main rates and that was followed by details of the asset purchase program in October. BoE is expected to keep rate unchanged at 0.50% and maintain the asset purchase target at GBP 375. Only a brief statement would be released and it's likely a non-event.

On the data front, Sterling will look into industrial production and manufacturing production from UK. Eurozone will release retail PMI and German factory orders. US will release jobless claims, non-farm productivity. Canada will release building permits and Ivey PMI.