The first results of the US presidential election rocked financial markets. Donald Trump wins in key states like Florida, North Carolina and Ohio, achieving such success, which no candidate from the Republican Party did achieve from 2004. Trump's victory in the three largest "fluctuating" states brings the chances of candidates. At the same time, more than half of voters did not approve any of the candidates.

In response to the information received US dollar fell to Euro-currency and safe haven, such as precious metals, yen, franc, but sharply appreciated against the commodity currencies. Asian and US stock indexes fell sharply. Japanese Nikkei Stock Average fixed maximum percentage drop since June 24, and ended the day down 5.4% to 16,251.54 points. The pair USD/CHF, US dollar was down against the Swiss franc on 230 points with the opening of today's trading session. By the beginning of the European session, the pair USD/CHF is trading near the 0.9600 mark, which is 180 points below the opening price of the trading day.

USD/CHF has fallen to key support levels near which was previously observed to rebound due to increased risk of interference in the trading National Bank of Switzerland. SNB continues to restrain the excessive strengthening of the national currency of Switzerland. Earlier in the week were presented data according to which, foreign currency reserves amounted to Switzerland in October, 630 billion Swiss francs, an increase of 2 billion francs more than in September. SNB sells franc by buying other major currencies. SNB still sees franc overbought, and periodically announces the possibility of intervention in trading on the foreign exchange market with sales of the franc. About the same step, the SNB announces never, either before or after the intervention. And it is a deterrent against excessive strengthening of the franc. In September, the Swiss National Bank left rates on deposits at the level of 0.75%. The range for the 3-month LIBOR interest rate also remained unchanged (-0.25% - -1.25%). In the accompanying statement, the SNB said that the "negative interest rate and the statement about the readiness of the central bank to intervene in the currency market aimed at reducing the attractiveness of the Swiss franc, which should ease the pressure on him," in the direction of increasing its rate. The next meeting of the SNB on its monetary policy will be on December 15, immediately after the two-day Fed meeting on 13-14 December.

In the meantime, the main driver in the financial markets continues to be a topic of the US presidential election. From the results of the elections depends on how further US economic policy and the dynamics of the whole global financial market. Another important piece of news today will be the decision of the RBNZ interest rate in New Zealand. The decision will be published in the 20:00 (GMT). Prediction - rate will be reduced by 0.25% to 1.75%. Earlier, the RBNZ stated the need for further easing of monetary policy. Current interest rate in New Zealand is 2.0%, is one of the highest in the world among countries with developed economies, which attracts investors and foreign investment in the form of trade "carry-trade". If the RBNZ will refrain from lowering rates, it can cause severe strengthening of the New Zealand dollar on the currency market. In any case, the period of publication of the decision is expected to increase the volatility of the financial markets, primarily - to trade the New Zealand currency.

Technical analysis

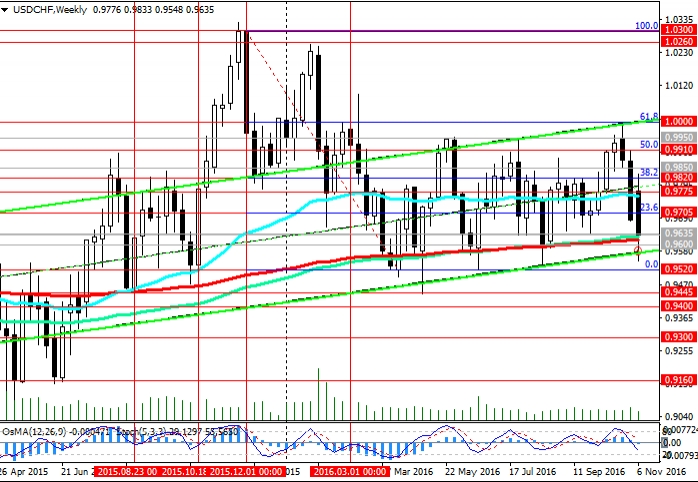

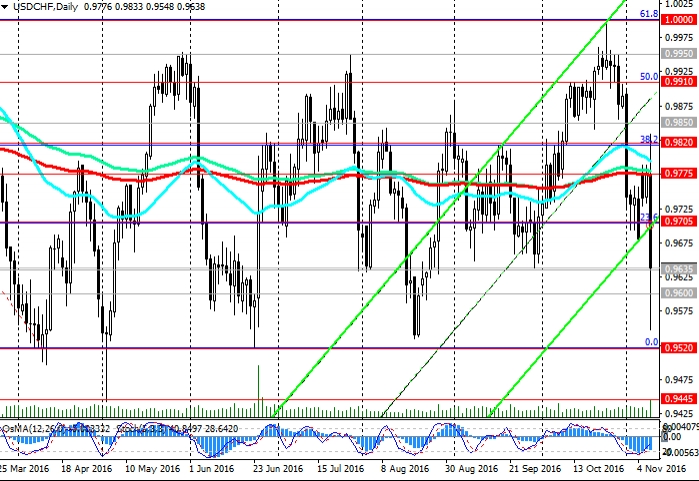

Due to the high importance of the financial markets of the election results in the US, there is the highest volatility in the financial markets. USD/CHF has broken the important support level 0.9775 (EMA200, EMA144 on the daily chart), 0.9705 (23.6% Fibonacci level of the correction to the last wave of the global decline in December 2015 and at the level of 1.0300 and the lower line of the rising channel on the daily chart).

The pair reached critical support levels 0.9635, 0.9600 (EMA200, EMA144 on the weekly chart). In the case of reducing the level of 0.9520 (2016 lows and the Fibonacci level of 0%, as well as the lower boundary of the range formed between the levels of 1.0000 (Fibonacci level of 61.8%) and 0.9520) dramatically increases the risk of intervention in the auction National Bank of Switzerland.

If you still win Clinton, the market will move sharply in the opposite direction.

From a technical point of view, the positive dynamics of the pair USD/CHF is preserved while the pair is above 0.9600.

OsMA and Stochastic indicators at different time intervals indicate short positions, however, the technical analysis of the current situation fades into the background. Further dynamics of the dollar and the pair USD/CHF will be directly related to the outcome of the US election. The influence of this factor on the global financial markets is extremely high.

In case of breakdown of the balance sheet and the resistance level of 0.9775 the immediate goal-line growth will be the level 0.9820 (38.2% Fibonacci level). The long-term objective in the case of continuation of growth of pair will be the levels of 0.9910 (Fibonacci level of 50.0%), 0.9950, 1.0000.

Support levels: 0.9600, 0.9520

Resistance levels: 0.9705, 0.9775, 0.9820, 0.9850, 0.9910, 0.9950, 1.0000