US equities were propelled to new record high last week as Republicans took control of Senate after the mid-term election and gained majority in the Congress. It's noted before analysts that stocks performed best historically when a Democratic president was opposed by Republican controlled Congress. DJIA closed at 17573.93 while S&P 500 closed at 2031.92, both at record high. The positive sentiments were not much bothered by the slightly disappointing non-farm payroll report from US. In the currency markets, dollar ended as the strongest currency. The Japanese yen extended BoJ triggered sharp fall and ended as the weakest one. While it's widely reported that ECB president Mario Draghi delivered a dovish post meeting press conference, Euro was indeed the third strongest currencies, after dollar and Swiss Franc, and ended mildly higher against others.

Technically, we'd like to highlight a few developments. Firstly, while dollar registered broad based gain last week, momentum was a bit unconvincing. In particular, the greenback gave up some gains after NFP. Mild divergence condition is seen in 4 hours MACD in USD/JPY, EUR/USD and USD/CHF. The dollar index is now close to 88.70/89.62 key resistance zone, on overbought condition in weekly RSI. We'll be cautious to see if dollar lose momentum further and stage a more sizeable pull back ahead.

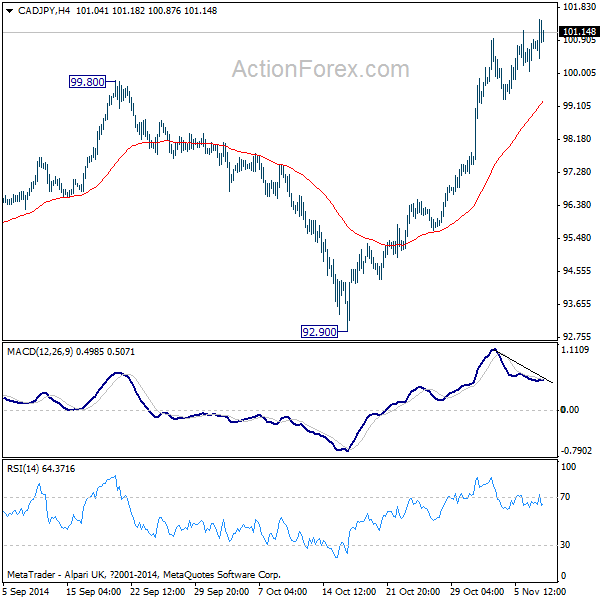

Secondly, yen crosses also showed sign of loss on upside momentum in 4 hours charts. Yen was down around 5% against dollar, and over 4% against others over the past two weeks. A brief recovery should be due as markets digests the moves. Even the relatively strong CAD/JPY showed bearish divergence condition in 4 hours MACD as it lost momentum after breaking 100 handle. Thus, we'll anticipate pull back in yen crosses in near term.

The situation in Euro is quite tricky. The dovish Draghi should have given Euro bears to push for another selloff last week but it didn't quite happen. EUR/USD did extend recent downtrend and took out 1.25 to as low as 1.2357. But, EUR/GBP lost some momentum ahead of 0.7766 low. EUR/AUD also staged a strong rebound and seemed to be turning into sideway consolidation above 1.4221 instead of developing a fall back to 1.3792. Also, it should be noted that EUR/CHF is now at 1.2035, rather close to SNB's 1.2 floor. SNB might intervene any time and trigger a recovery in Euro.

Hence, overall, we'll adopt a wait-and-see strategy this week regarding trading. Overall, we're still favoring dollar long and yen short, but we'll decide the pair to trade and the timing at a latter stage. Ideally, we'd like to see pull back in USD/JPY to position for a long trade next week. We sold AUD/USD on break of 0.8642 and will stay with the position, with a tight stop at 0.88.