- Treasury yields ease back as Fed’s Waller fuels hopes of inflation peaking

- Dollar skids, Wall Street rallies despite mixed earnings

- Euro edges up ahead of ECB decision, loonie buoyed by BoC hike

Yields retreat, shrug off record rise in US producer prices

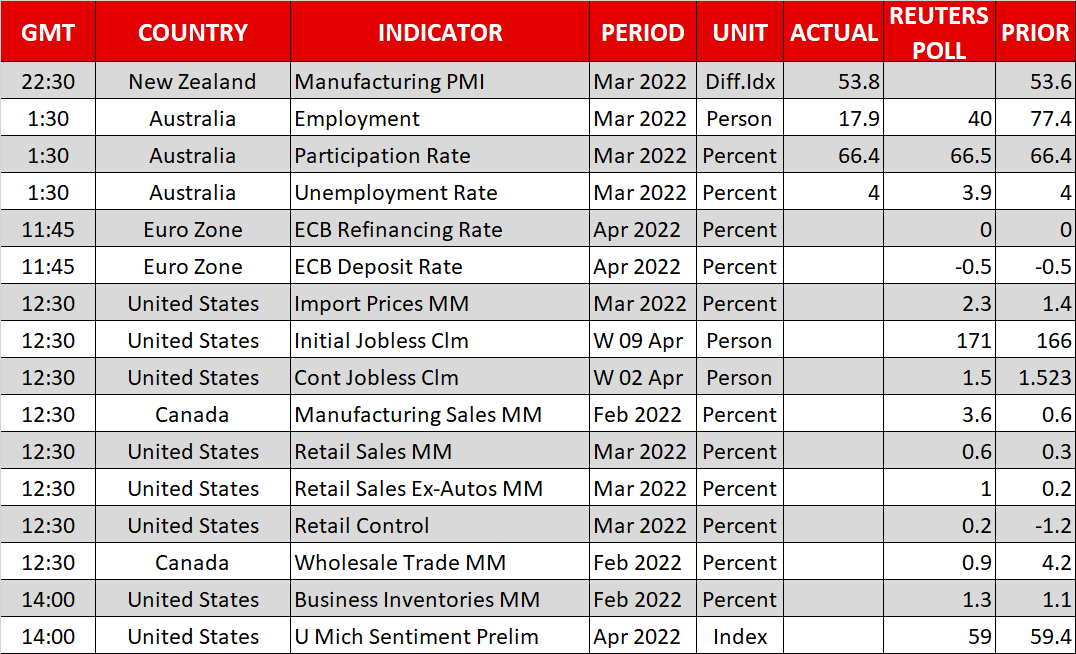

US Treasury yields are heading lower for the third day on Thursday, with the 10-year yield slipping below 2.70%, as the recent heightened expectations that the Federal Reserve will hike rates very aggressively eased somewhat. A slightly softer-than-expected increase in the March core CPI print in the US on Tuesday gave rise to hopes that inflation is plateauing – a view that seems to be shared by Fed Governor Christopher Waller. Speaking to CNBC on Wednesday, Waller said inflation is at “pretty much the peak”.

If that assessment turns out to be correct, it could mark a turning point for torrid equity markets that have been under pressure all year as central banks around the world have accelerated their normalization plans to remove pandemic-era stimulus.

However, the Fed is only just getting started with its rate hike cycle and is unlikely to let its guard down just yet. St. Louis Fed President James Bullard reiterated his hawkish stance yesterday, warning that raising interest rates to a more neutral level won’t be enough to bring inflation under control.

The producer price index for final demand jumped by the most on record in March, hitting 11.2% year-on-year, suggesting that inflationary pressures remain as elevated as ever.

Nevertheless, investors see light at the end of the inflation tunnel for the first time since the conflict in Ukraine roiled commodity markets, pushing the price of key raw materials higher.

Wall Street surges on relief from lower yields

Global stocks were mostly in positive territory on Thursday following strong gains in the US yesterday. The Dow Jones and the S&P 500 both closed up by just over 1% but the Nasdaq Composite rallied by 2%, as tech shares were boosted the most from the pullback in Treasury yields.

The advance on Wall Street came in spite of the wobbly start to the earnings season. JPMorgan (NYSE:JPM), the first of the major banks to report its Q1 results, delivered a disappointing quarterly profit, but Delta Air Lines (NYSE:DAL) announced better-than-expected revenue growth amid a strong recovery in travel demand.

Goldman Sachs (NYSE:GS), Citigroup (NYSE:C), Morgan Stanley (NYSE:MS) and Wells Fargo (NYSE:WFC) all report their earnings before today’s market open.

In Asia, stocks were lifted by speculation that China will loosen monetary policy again. Expectations are rising that China’s central bank will cut one of its key policy rates – the medium-term lending facility – on Friday, and another reduction in the reserve requirement ratio will probably follow.

China’s economy will likely slow this year amid fresh virus curbs in Shanghai and other major cities following the recent spike in infections. The country’s zero-Covid policy is causing additional strain on already constrained supply chains.

With so many uncertainties hanging over the outlook, it’s no wonder today's rebound in Europe is looking somewhat modest in comparison and US stock futures are also faltering as the European session gets underway.

Dollar bulls pause for breath, euro eyes ECB rate signal

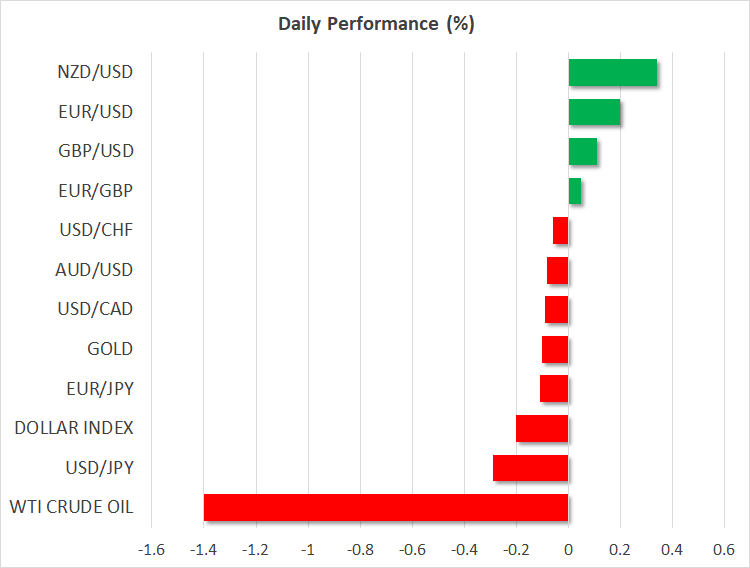

In the FX spectrum, the US dollar slipped on the back of the decline in Treasury yields. The dollar index has fallen below the 100 level, with even the battered Japanese yen gaining some ground today.

The euro has rebounded above the $1.09 level but where it goes from here will likely depend on what the European Central Bank decides later today. The ECB might announce a more precise timeline of when its asset purchases will be wound down, and even if policymakers refrain from committing to a rate hike timetable, the QE end date would be taken as a strong signal of how soon liftoff will come.

The Canadian dollar, meanwhile, has bounced to one-week highs versus the greenback, firming to around C$1.2540. As expected, the Bank of Canada raised rates by 50 bps on Wednesday, but additionally announced a plan to reduce its balance sheet as well as signal more rate hikes.

The Australian dollar underperformed, however, on Thursday following a smaller-than-expected rise in Australian employment in March.

In commodities, gold eased from yesterday’s one-month high when it reached $1,981.30/oz. The precious metal appears to have hit a resistance barrier as the renewed pessimism for peace in Ukraine and the fallback in bond yields don’t seem to have been enough to spur an even bigger upswing.