German Markit Manufacturing PMI (Feb) was 60.3 v an expected 60.6, from 61.1 previously. Markit Services PMI (Feb) was 55.3 v an expected 57.0, from 57.3 previously. Markit PMI Composite (Feb) was 57.4 v an expected 58.5, from 59.0 prior. EUR/USD moved lower from 1.23318 to 1.23168 following this data release.

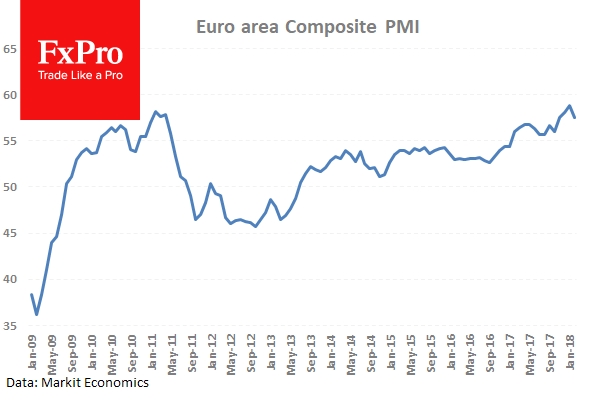

Eurozone Markit Manufacturing PMI (Feb) was 58.5 v an expected 59.3, from 59.6 previously. Markit Services PMI (Feb) was 56.7 v an expected 57.6, from 58.0 previously. Markit PMI Composite (Feb) was 57.5 v an expected 58.5, from 58.8 prior. EUR/USD moved higher from 1.23168 to 1.23393 in reaction to this data.

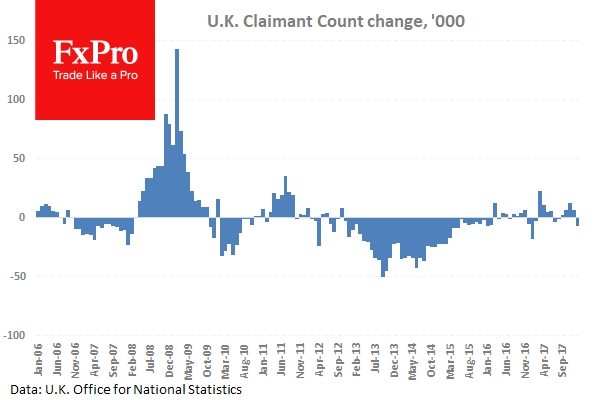

UK Average Earnings excluding Bonus (3Mo/Yr) (Dec) was 2.5% v an expected 2.4%, from 2.4% previously, which was revised down to 2.3%. Claimant Count Change (Jan) was -7.2K v an expected 4.1K, from a previous reading of 8.6K, which was revised down to 6.2K. ILO Unemployment Rate (3M) (Dec) was 4.4% v an expected 4.3%, from 4.3% previously. Average Earnings including Bonus (3Mo/Yr) (Dec) was, as expected, at 2.5%, from 2.5% previously. Claimant Count Rate (Jan) was 2.3% against a reading of 2.4% previously. Public Sector Net Borrowing (Jan) was £-11.620B against an expected £-11.100B, from £0.979B prior, which was revised down to £0.280B. GBP/USD sold off from 1.39736 to a low of 1.39280 before recovering briefly and then setting a daily low of 1.39043 after this data release.

In his speech, FOMC Member Harker said that US inflation would reach or exceed the 2% goal by the end of 2019. The Unemployment rate is to fall to 3.6% by the beginning of H2 2019 and then retrace higher. US GDP is expected to grow as much as 2.5% this year and 2% in 2019. He also said that a trade war would not be good for the US economy. Changes to the FED’s long-term policy strategy would probably not need legislative change and he was in no rush to make changes to the Fed’s strategy framework. He said that he would have to think long and hard about raising the inflation target. USD moved to a low of 1.07333 from 107.477.

BOE Governor Carney and MPC Members Broadbent, Haldane and Tenreyo took part in the Parliament’s Treasury Committee Hearings and Inflation Report Hearings. Comments made were as follows:

BOE Governor Carney said he does not ever commit to a specific path of interest rates except in exceptional circumstances. He said he generally uses a “conditioning path” and the path at the November report was two rate hikes but is now almost three. He also said that the UK is not in exceptional circumstances currently. The horizon to bring inflation back to the target has moved to less than three years but is not two years in the collective opinion of the MPC. Further stimulus withdrawal will be needed in the coming years. The FX pass-through has a prolonged effect on the UK. The biggest uncertainty is Brexit. The monetary policy is nimble and can react to changing circumstances. The case for a withdrawal of stimulus will arise if GDP exceeds 1.5%. The financial markets are starting to price in rate hikes due to the underlying data.

Carney also said that Brexit uncertainty is weighing on business investment. The traditional boost from the weaker pound on trade has held but there hasn’t been an added boost to investment. He is seeing a variety of indicators that are consistent with firming wage pressures, and most recent figures still show firming in private sector wages ex-bonuses and high-quality job creation. We are probably at the peak point of impact of a weaker sterling on inflation but some impact will last for years. Currency depreciation is not a good economic strategy and makes a country poorer. It was becoming unhealthy how little volatility there was in the markets but it is healthy that the correlation between bonds and equities has changed. A pick up in volatility is not a concern in terms of the path of UK interest rates.

Haldane said that there are reasons for a more hawkish view including a stronger UK and global economy. Momentum was stronger than expected last year. The trade-offs facing rate-setters have been less acute and look set to disappear completely. The slack in the economy is close to being fully absorbed. The level of heightened Brexit uncertainty is a downside risk. The risks in the latest BOE projections are to the upside, with a potential for greater than forecast global momentum. The BOE would hike rates gradually and in a limited manner. There is some distance to travel in order to get back to even 1% productivity in the UK. He also said that it was more likely to see a pickup in wage growth, and that average weekly wage growth would reach 3%.

Broadbent said that the spare capacity in the UK has shrunk and inflationary pressures are firming. Brexit uncertainty is weighing on business investment and if that uncertainty was lifted, then there would be a marked rise in investment. The UK interest rate futures and bond yields are more sensitive to economic news, this is welcome.

US Markit Manufacturing PMI (Feb) was 55.9 v an expected 55.4, from 55.5 previously. Markit Services PMI (Feb) was 55.9 v an expected 54.4, from 53.8 previously. Markit PMI Composite (Feb) was 55.9 v an expected 54.0, from 53.3 prior.

The Federal Open Market Committee Minutes were published from the last meeting three weeks ago. The majority of Fed members say stronger growth increases the likelihood of more hikes, and some officials saw appreciable risk of inflation lag to target. Voters agreed that the recent strengthening of the economy increased the likelihood of further gradual rate increases, and most voters said recent data suggested a modestly stronger near-term economic outlook than was seen in December. A number of policymakers raised near-term economic growth forecasts because of stronger data and info suggesting a larger impact from tax overhauls, and a few said that it was important to monitor the slope of the yield curve. It generally judged risks as roughly balanced but several saw increased upside risks in the near-term and warned imbalances in financial markets may emerge as the economy operates above potential. The EUR/USD pair moved up to 1.23596 but then dropped to session lows around 1.22800. USD/JPY sold off to a session low of 107.287, before settling higher around 107.665. US stocks rallied initially, with the US 500 Index reaching 2749.9 before selling off to close around 2700.0. Gold tested the 1335.5 resistance before moving lower to a 1321.8 low. US 10-Year yields rose to fresh highs of 2.94% not seen since 2014.

Foreign Investment in Japanese Stocks (Feb 16) was ¥127.1B, from an expected value close to the previous number of ¥-429.5B, which was revised down to ¥-430.0B. Foreign Bond Investment (Feb 16) was ¥-553.1B from ¥-973.2B previously, which was revised up to ¥-967.3B.

US Fed’s Quarles delivered a speech titled “10 years after the Global Financial Crisis: How has the world economy changed and where will it go?” at the International Financial Symposium in Tokyo. His comments were: the US economy is performing very well and monetary policy remains accommodative. He anticipates further gradual rate increases and soft inflation is likely transitory. A gradual rise in interest rates is appropriate. Small divergences on the inflation target are not of great concern. He said that the investment drought that has afflicted the US economy may be breaking, and recent US tax and fiscal policy could help sustain the economy’s momentum. The recent volatility in equities shows that asset prices can move rapidly and unexpectedly.

Earlier, US Fed’s Kaskari spoke at a Bloomberg event and made the following comments: the US economy is doing very well, he is surprised at the confidence and optimism due to the tax cut and the best hope is that it leads to greater investment and productivity. He doesn’t really know if US is at full employment and it’s not clear how much of a long-term difference the tax cut will make. We are not sure about neutral rate, or output gap either, and the Fed should be patient and let inflation build. Reaching a 2% inflation target would give the Fed more flexibility in fighting future downturns. We are seeing some signs of inflation building but it takes more than one month’s data and the Fed will respond if inflation starts to show itself. He wants to see definitive signs of inflation rising to 2% before supporting more rate hikes. The Fed could invert the yield curve and tip the economy into recession if it raises rates too aggressively. There could be another million Americans on the side-lines of the labour market, he doesn’t want to cut that off. He is very focused on wage growth, labour market slack, and inflation.

EUR/USD is down -0.14% overnight, trading around 1.22648.

USD/JPY is down -0.19% in early session trading at around 107.567.

GBP/USD is down -0.26% to trade around 1.38811.

Gold is down -0.25% in early morning trading at around $1,320.99.

WTI is down -0.48% this morning, trading around $61.04.

Major data releases for today:

At 07:45 GMT, French Consumer Price Index (EU norm) (YoY) (Feb) is expected to be unchanged at 1.5%.

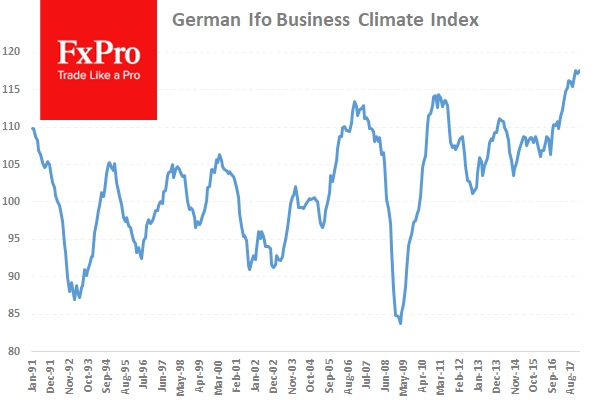

At 09:00 GMT, German IFO – Current Assessment (Feb) is expected to come in at 127.0 from 127.7 previously. IFO – Business Climate (Feb) is expected at 117.0 v 117.6 previously. IFO – Expectations (Feb) is expected to be 107.9 from 108.4 prior. EUR crosses could see a spike in volatility should the data released differ from the expected consensus.

At 09:30 GMT, UK Gross Domestic Product (YoY) (Q4) is expected to be unchanged at 1.5%. Gross Domestic Product (QoQ) (Q4) is also expected to be unchanged at 0.5%. GBP crosses could be influenced by this data release.

At 12:30 GMT, ECB Monetary Policy Meeting Accounts may impact on moves in EUR crosses.

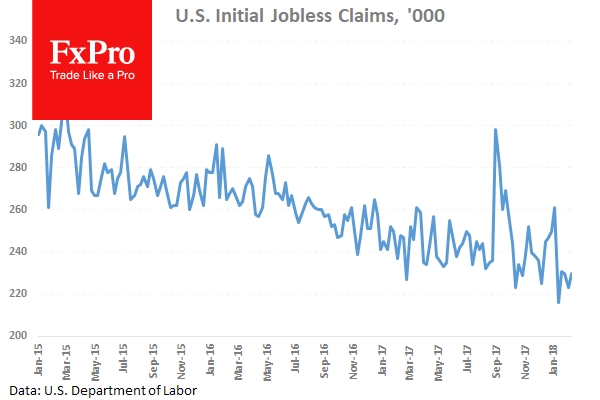

At 13:30 GMT, US Continuing Jobless Claims (Feb 9) is expected at 1.930M from a previous number of 1.942M. Initial Jobless Claims (Feb 16) is expected to come in at 230K from a prior reading of 230K. USD crosses may see increased volatility around this data release.

At 13:30 GMT, Canadian Retail Sales Ex-Autos (MoM) (Dec) is expected to be 0.3% from 1.6% previously. Retail Sales (MoM) (Dec) is expected to be unchanged at 0.2%. CAD crosses could be affected by this release.

At 15:00 GMT, US Fed’s Dudley is due to speak about the economic situation in Puerto Rico and the United States Virgin Islands following Hurricanes Irma and Maria at a press briefing hosted by the Federal Reserve Bank of New York. Audience questions are expected afterwards, with comments having the potential to move USD pairs.

At 17:10 GMT, US FOMC Member Bostic is due to speak at the Banking Outlook Conference hosted by the Federal Reserve Bank of Atlanta. Audience questions are expected to follow and this event may impact USD crosses and assets.

At 20:30 GMT, US FOMC Member Kaplan is scheduled to speak and his comments will be followed by traders for any hints on future US FOMC policy.

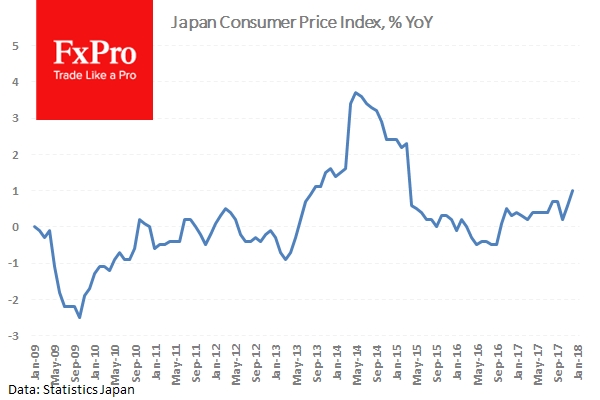

At 23:30 GMT, Japanese National Consumer Price Index (YoY) (Jan) is expected to be 1.3% against a prior 1.0% in December. National Consumer Price Index Ex-Fresh Food (YoY) (Jan) is expected to be 0.8% against a prior 0.9% in December.