Without a doubt, the most important announcement coming out during the Thursday session will be the US Unemployment Claims. Because of this, we believe that paying attention to the US dollar and US stock markets, as well as commodities, will be the way to go.

The Light Sweet crude markets fell again during the session on Wednesday, but quite frankly, we are towards the top of the consolidation area so it makes perfect sense. With that, we are simply looking to buy calls somewhere closer to the $59 level as it should offer support. We have no interest in buying puts because we believe eventually, the oil markets will break out to the upside.

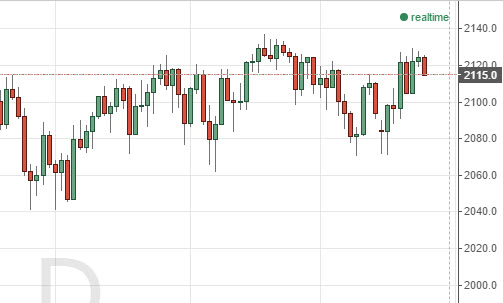

The S&P 500 struggled as well, but just like the oil markets, we find ourselves at the top of consolidation. With that, a pullback makes a lot of sense and quite frankly, we look at it as value. Remember, summer trading can be very quiet, and as a result, consolidation would be normal. We are looking to buy calls at lower levels, on signs of support. We believe as long as we stay above the 2070 handle, we are going to go higher.

The EUR/USD pair simply did not go anywhere during the session, and any attempt at a rally failed. However, if we can break above the top of the range for the Wednesday session, we are buyers of calls. On the other hand, if we pullback as low as 1.10 and find support or bounce, we are buyers of calls there as well. We have no interest in buying puts at this moment.