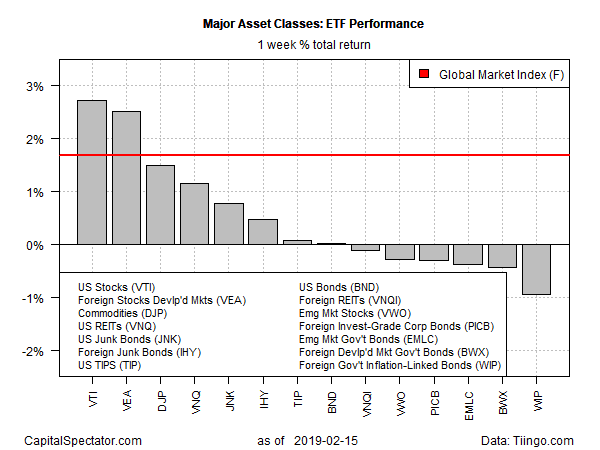

Equities in the U.S. generated the strongest performance last week for the major asset classes, based on a set of exchange-traded products. By contrast, foreign bonds posted losses, representing the weakest results for the trading week through Feb. 15.

For U.S. stocks, last week delivered another installment of upside trading. Vanguard Total Stock Market (NYSE:VTI) rallied for a fourth straight week, rising a strong 2.7%. The gain pushed the ETF to its highest close in three months.

Analysts say that the U.S. equity market is pricing in renewed optimism that the U.S. and China will soon resolve the trade war that’s been weighing on sentiment. The U.S. bond market, on the other hand, appears to be anticipating a more challenging climate ahead.

“One of these markets is going to be wrong, and it’s hard to know this time around which one it’s going to be,” notes Art Hogan, chief market strategist at National Securities. “The bond market is betting we are not going to see stabilization of growth, and that the China trade war drags on.”

Last week’s biggest setback was in foreign inflation-indexed government bonds. SPDR FTSE International Government Inflation-Protected Bond (WIP) fell 1.0%, marking the fund’s second straight weekly decline.

Meantime, an ETF-based version of the Global Markets Index (GMI.F) rallied last week. This investable, unmanaged benchmark that holds all the major asset classes (except cash) in market-value weights gained a solid 1.7%.

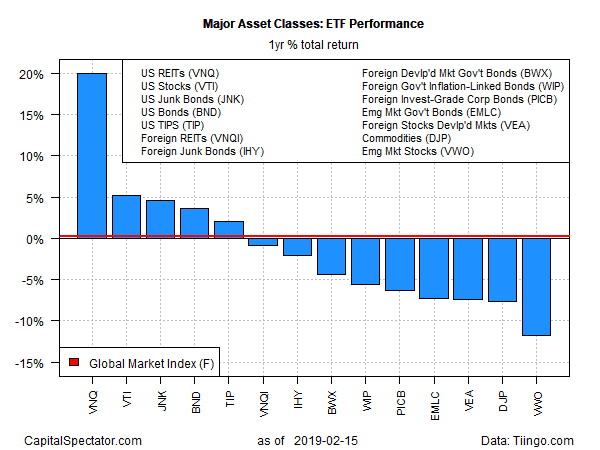

For the one-year trend (252 trading days), U.S. real estate investment trusts (REITs) continue to lead by a wide margin. Vanguard Real Estate (VNQ) is up 20% on a total return basis, far ahead of the rest of the field. Indeed, the second-best one-year gain via U.S. equities (VTI) is a relatively modest 5.1% advance.

At the opposite extreme, stocks in emerging markets are still far and away from suffering from the biggest loss. Vanguard FTSE Emerging Markets (NYSE:VWO) has shed 11.8% for the trailing 12-month period.

GMI.F’s one-year change is fractionally in positive terrain: the index is up 0.3% over the past year.

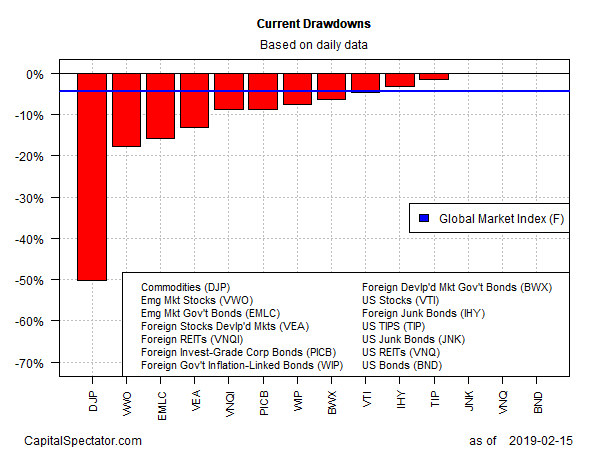

Turning to current drawdown rankings, a broadly defined portfolio of U.S. investment-grade bonds continues to post a virtually nil peak-to-trough decline via Vanguard Total Bond Market (BND).

Meanwhile, commodities overall are still suffering from the biggest drawdown for the major asset classes. DJP ended last week’s trading with a peak-to-trough slide of roughly -50%.

GMI.F’s current drawdown: -4.3%.