American shares rallied for a second week, leading an uneven trading week for the major asset classes through Friday's close (Feb. 3), based on a set of ETFs.

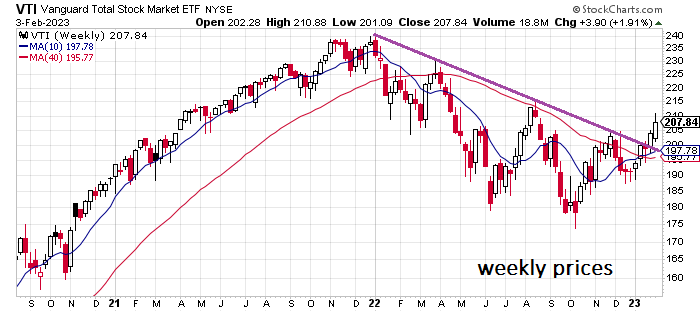

Although stocks sold off on Friday after the government reported a sharply higher gain for US payrolls, Vanguard Total US Stock Market (NYSE:VTI) rose 1.9% for the week. The gain left the fund near its highest close since August.

The rally suggests VTI has broken the downtrend that's prevailed for much of the past year. But the earnings outlook, among other factors, persuades some analysts that the stock market's upside momentum faces headwinds.

Karl Chalupa, CEO of Gamma Investment Consulting, says:

"On average, new bull markets launched when stocks were 25% undervalued. At current valuation, the S&P 500 would need to fall below 3,500 [it closed at 4136 on Friday] just to reach fair value; a decline to 25% undervaluation would see the S&P 500 fall near to its Covid-low of 2,200."

US real estate investment trusts (REITs) also rallied last week, posting the second-best gain for the major asset classes. But winners were the exception as most of the ETF asset class proxies lost ground. The deepest slide: commodities (GCC), which tumbled 3.6%, ending the week near the low end of the ETF's trading range in recent months.

Despite the mixed week, the Global Market Index (GMI.F) rallied for a second week, rising 0.8%. This unmanaged benchmark holds all the major asset classes (except cash) in market-value weights via ETFs and represents a competitive measure for multi-asset-class portfolio strategies.

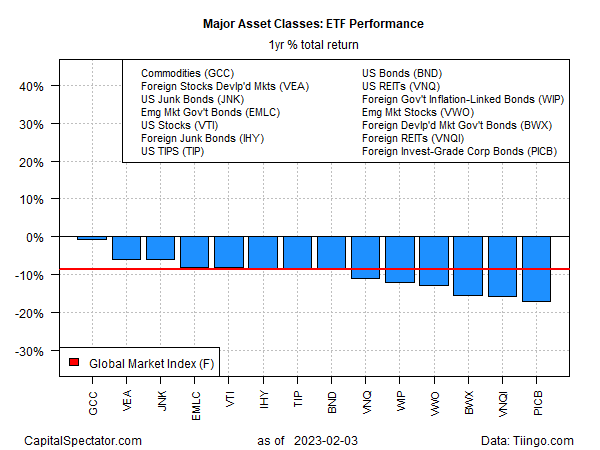

After last week's decline in commodities (GCC), all the major asset classes are now posting losses for the trailing one-year window. Commodities are suffering the least, with a slight 0.7% decline at Friday's close vs. the year-ago price.

The biggest one-year loser: corporate bonds ex-US (PICB), posting a 17.1% one-year decline.

GMI.F is also in the red via an 8.6% loss.

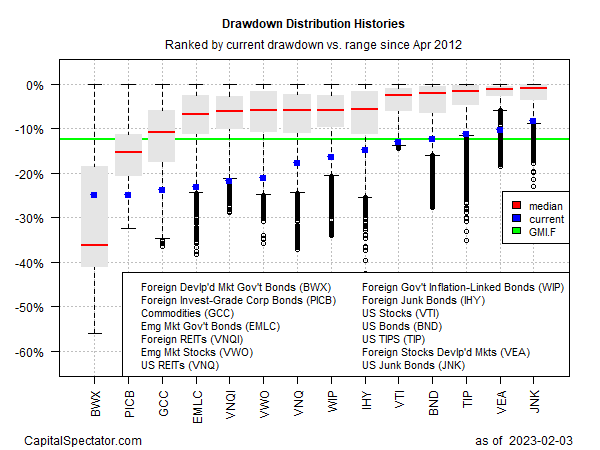

Comparing the major asset classes through a drawdown lens continues to show relatively steep declines from previous peaks for most markets around the world. The softest drawdown at the end of last week: US junk bonds (JNK), which ended the week at 8.4% below its previous peak.