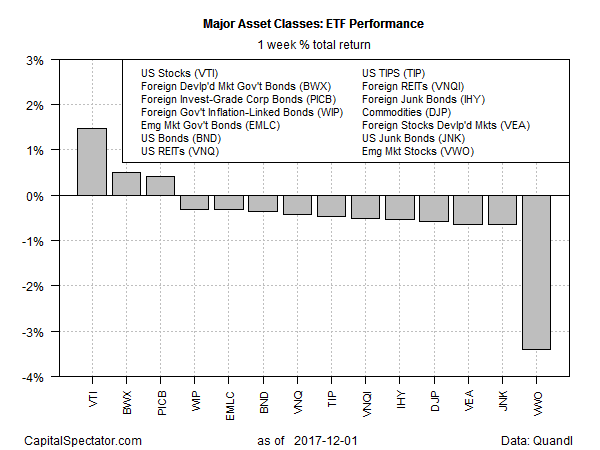

Selling dominated trading last week for the major asset classes, based on a set of exchange-traded products. The main exception: US equities, which posted a solid advance.

Vanguard Total Stock Market (NYSE:VTI) increased 1.5% over the five trading days through Dec. 1. The weekly rise marks the ETF’s third straight weekly gain, leaving the fund just below a record high.

The bullish trend for US equities last week was supported by the Senate’s approval of tax-cut legislation, which is expected to be signed into law by President Trump before Christmas. The resulting stimulus will deliver a modest boost for US economic growth in 2018, according to a survey of economists via the National Association for Business Economics.

Last week’s big loser: stocks in emerging markets. Vanguard FTSE Emerging Markets (NYSE:VWO) slumped a hefty 3.4% — the fund’s biggest weekly decline in more than a year.

Despite the latest slump, the macro outlook for emerging-markets remains bright, says Natalia Gurushina, chief economist for emerging markets at VanEck. She points to “several tailwinds, many of them cyclical, that we think should support young growth in the coming months.”

High commodity prices is one factor. The improved credit impulse in emerging markets is another one worth mentioning. In many emerging markets we also see strong investment growth and still very sizeable policy cushions. Developments like broader growth in developed markets and the recovery in global trade, despite all the concerns about NAFTA negotiations, should also help.

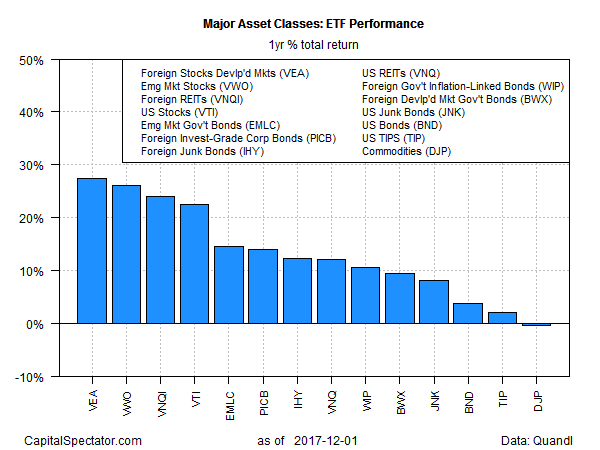

For the trailing one-year return through Friday’s close, emerging-markets stocks remain a top performer, second only to equities in developed markets ex-US.

Vanguard FTSE Developed Markets (NYSE:VEA) is currently in the lead among the major asset classes for the one-year total return, posting a strong 27.4% gain. Vanguard FTSE Emerging Markets (VWO) is a close runner-up with a 26.1% increase.

The only loser at the moment for the one-year window: broadly defined commodities. The iPath Bloomberg Commodity Total Return Exp 12 June 2036 (NYSE:DJP) was off a slight 0.3% on Friday vs. the year-earlier price.