Summary

The energy sector outperformed.

The financials lagged.

But aside from the tech sector, there really isn't any meaningful, broad-based leadership.

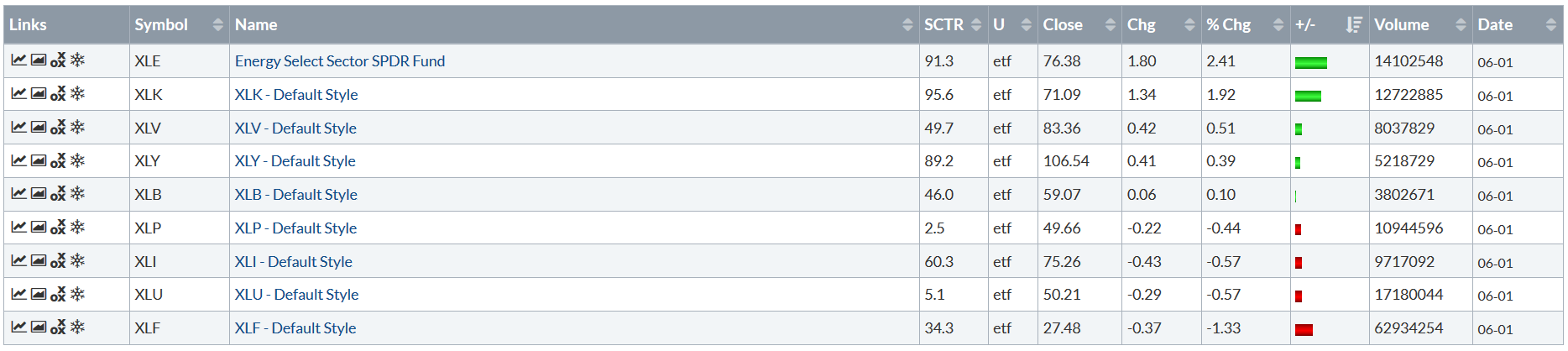

Let's start with a review of the weekly performance of the nine largest sector ETFs:

Despite oil dropping this week, the energy ETF was the top-performer, rising nearly 2.5%. But this was mostly a deal specific event; Kinder Morgan (NYSE:KMI) sold one of its pipelines to the Canadian government, which caused the stock to rise 6.36% on the week. Other energy stocks rose in sympathy while also riding this week's oil price volatility. The technology ETF rose due to Facebook (NASDAQ:FB) and Google (NASDAQ:GOOGL) rallying. At the other end of the investment spectrum, the financials fell for two reasons: comments from a Morgan Stanley (NYSE:MS) Executive that deal flow has slowed and a rise in geopolitical tensions, especially in the EU.

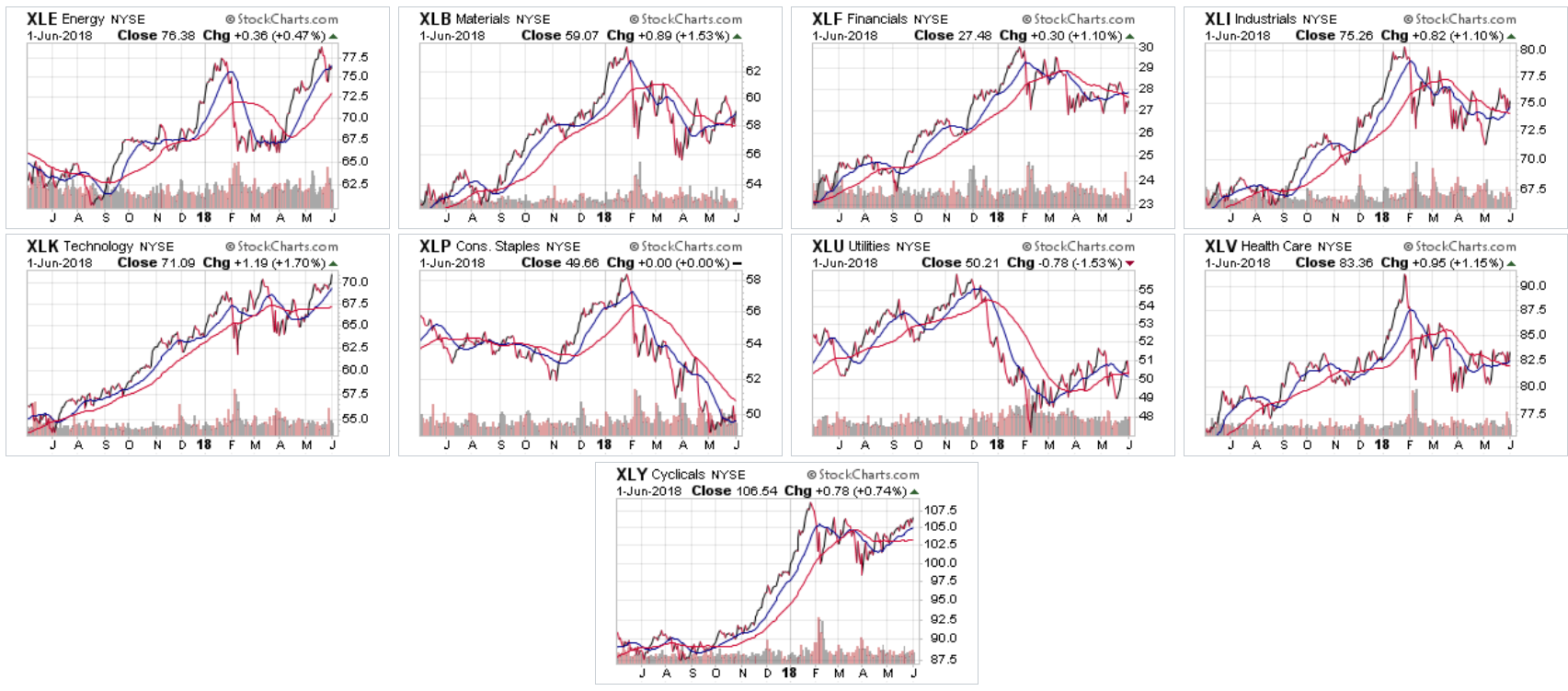

Next, let's look at the 1-year charts:

Notice anything? If you said, "there's not much leadership among the sectors" give yourself a prize. The XLE (NYSE:XLE) (top row, far left) is a possible candidate; it's seen two price spikes in the last six months and prices are currently using the 20-day EMA for technical support after a pullback. But it only makes-up 6.26% of the SPDR S&P 500's (NYSE:SPY), so they're really not a viable candidate to lead the market higher. The Technology Select Sector SPDR (NYSE:XLK) (second row, far left) is a far better candidate; it's the largest member of the SPYs, accounting for slightly more than 25% of the index. The XLYs (lowest chart) could also contribute, but its rally isn't that inspiring. All the other charts are weak and meandering. There's just not that much support from the other sectors for a broader market rally.

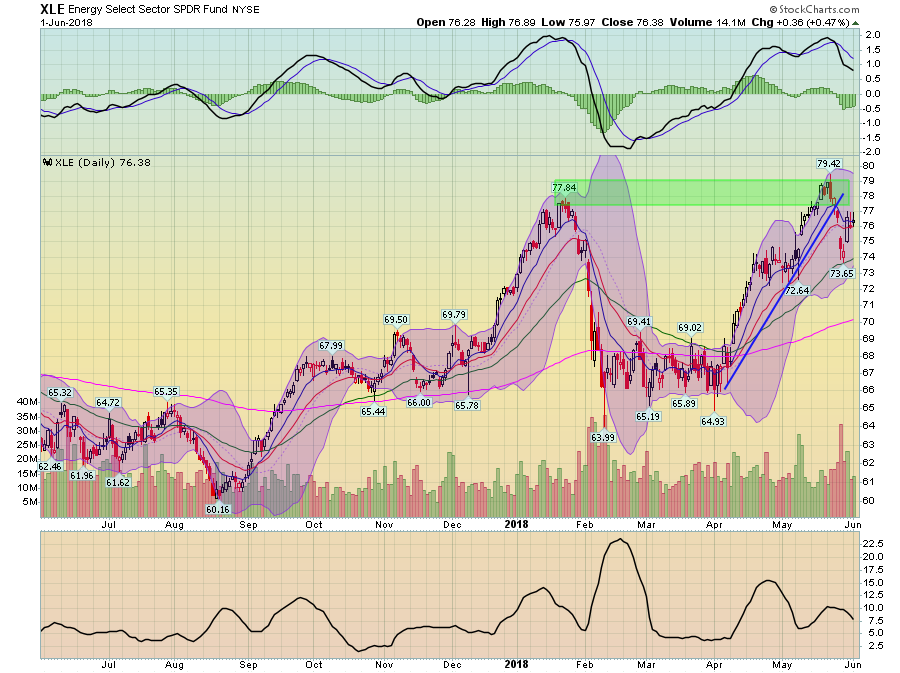

Let's take a deeper look at some of the sectors, starting with energy:

This is a mixed chart. On the plus side, the ETF has seen two solid rallies over the last six months, rising in sympathy with the oil market. And with the rise in geopolitical tensions, it's likely that oil will continue rising. But the ETF has struggled to move through the upper 70s, which have twice provided resistance to a rally. Also on the downside, the ETF recently broke a trend line that started in early April. Its MACD is also pretty stretched right now.

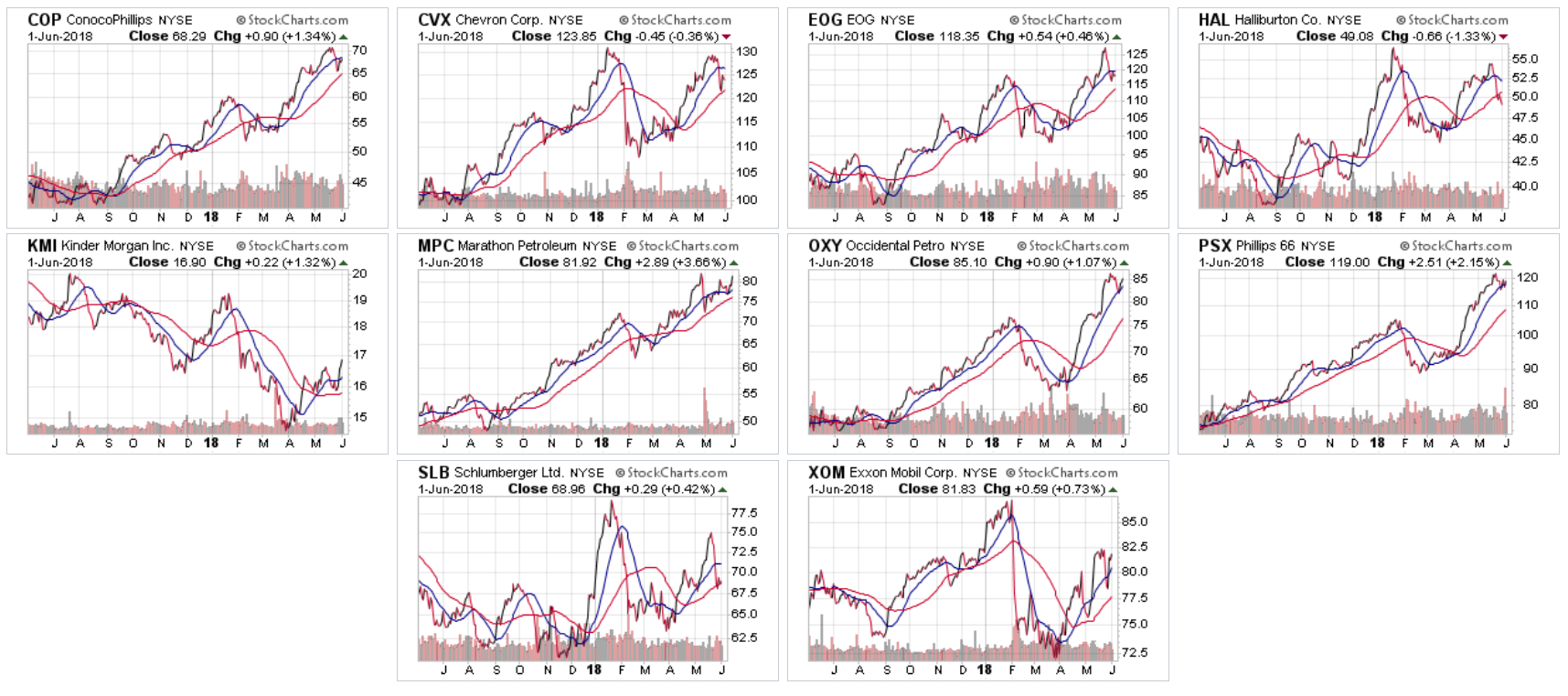

Let's look at the XLE's 10 largest holdings:

There's actually a fair amount of strength in this collection of charts. At least half are in a general SW-NE pattern, indicating a rally that has lasted a year. Weakness is coming from the oil industry support stocks (Kinder Morgan (NYSE:KMI) and Halliburton Company (NYSE:HAL)), which need a longer period of oil market strength to start rallying. But the sector, in general, is in pretty good shape.

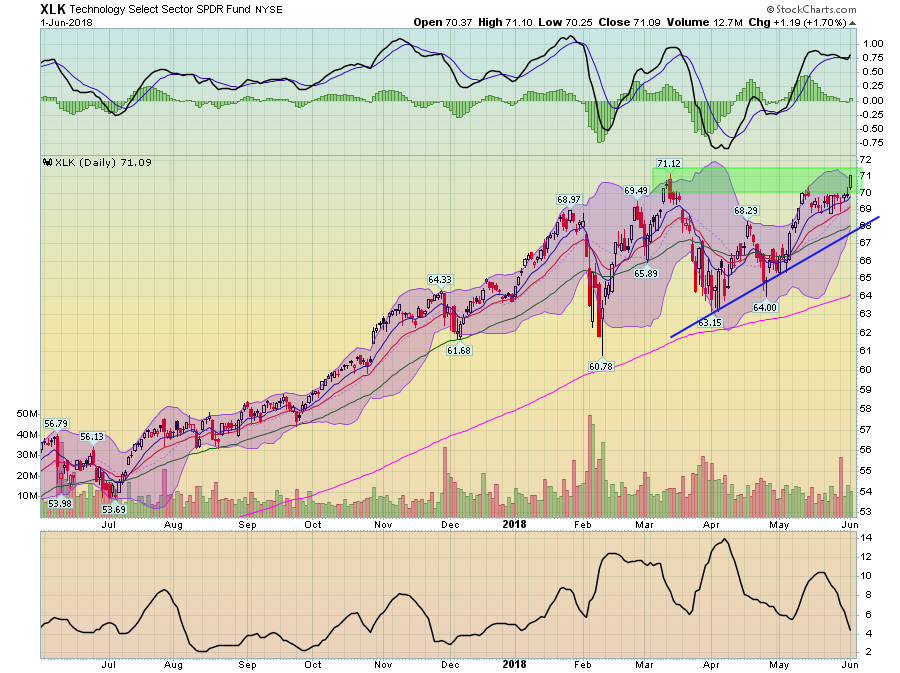

Let's turn to the tech sector:

This is a bullish chart with prices forming a rising wedge pattern. That means we're seeing higher and higher bottoms as prices meet upside resistance at the same price level. This signals that traders are continually raising their lowest price for the ETF. In an ideal trading pattern, prices rocket through topside resistance when they break out. Friday's strong print should encourage traders to keep bidding this ETF higher.

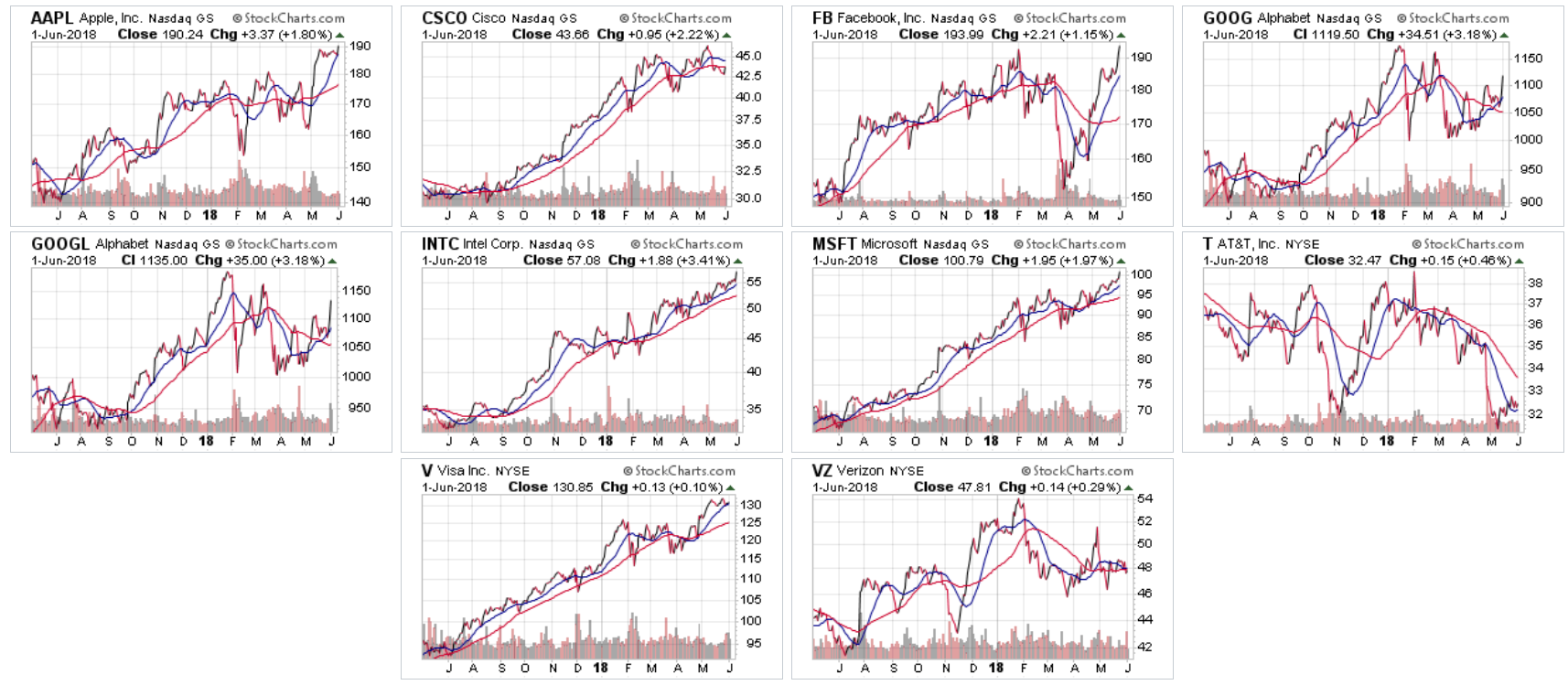

Next, let's take a look at the XLK's largest members:

There's a lot of bullishness in the above charts. Or put another way, there are only two charts (AT&T (NYSE:T) and Verizon Communications (NYSE:VZ)) that are weak; all the other charts are moving higher.

On the downside, we have the financials ETF:

Notice how the 200-day EMA is acting as a center of gravity for prices over the last two months? They tried to move higher in April, only to fall back to the 200-day EMA; that pattern repeated itself on May. The good news is that the 200-day EMA has held. The bad news is that prices just can't gain any traction higher.

While this was a good week for the markets, under the surface we're running into a large problem: lack of breadth to support the move. That's a big problem because, should any of the leaders falter, they'll bring the market down with them.

Disclosure:I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.