Investing.com’s stocks of the week

Market Brief

USD/JPY falls to 18-month low

For the start of the trading week risk appetite in Asia was poor as the JPY sunk to an 18-month low. USD/JPY fell to 106.28 following economic data indicating that April manufacturing PMI declined to 48.2, versus a flash read of 48.0 and March final 49.1. Asian regional equity markets were in the red, led by the sharp fall in the Nikkei of -3.50%. However equity trading volumes were limited as China, Hong Kong and Singapore were closed for Labor Day. Recently, Japan's Finance Minister Taro Aso commented that current yen appreciation reflects increased speculative action and that Japan stood ready to respond. This confirmation to conduct direct FX intervention comes despite the US Treasury's semiannual currency report to Congress, citing Japan’s, but also China's, South Korea's, Taiwan's and Germany’s use of competitive devaluation to gain export advantage. The report reiterated the importance of countries sticking to the G7 and G20 agreements regarding exchange rate policy. While verbal intervention should increase as USD/JPY falls to 105, we believe that any FX intervention will be seen as a last ditch effort as a unilateral approach to push USD/JPY meaningfully higher without a recovery in Fed interest rate expectations would be futile.

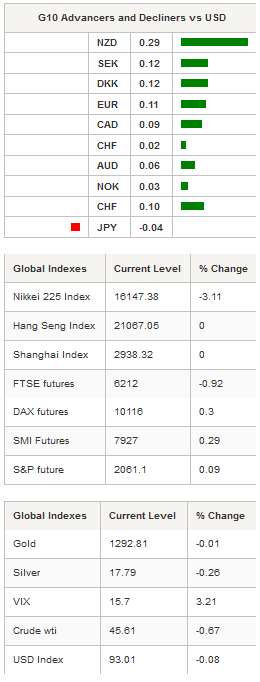

In FX markets USD was weaker versus the G10 and mixed against Asia EM providing traders with few indicators for sustained direction this week. As the Fed signals expectations for two 25bp hikes in 2016 and amid lingering expectations for a June increase, we still anticipate a single hike and we see no material reason for the USD to strengthen in the near term. This week will see several Fed members delivering public addresses, potentially signaling a shift in views on the June meeting. In addition, markets should see another strong payroll report with expectations for April NFP to come in above 200k. While markets have become numb to strong labor data another solid read should have markets chattering again and bidding up USD in the short term.

As further evidence of stabilisation, China's Manufacturing PMI printed at 50.1 versus expectations of 50.4. China's March non-Manufacturing PMI was softer at 53.5, down from 53.8. With both above the 50 threshold this would ordinarily indicate expansion, however, we view these numbers as merely evidence of stabilisation rather than as an indicator of acceleration.

In Australia, April business condition indications slipped to 48.2 from March's final read of 49.1, while business confidence fell to 5 versus 6 in March. In addition, Australia's April AIG Performance of Manufacturing Index slipped 4.7 points, down to 53.4. This disappointing data and softer commodity prices failed to drive AUD/USD with the pair consolidating around the 0.7610 level. Last week’s surprising collapse in Australia’s underlying inflation and soft incoming growth data is likely to push the RBA to cut its policy rate 25bp to 1.75%. We remain bearish on AUD and see short AUD/JPY as a clear way to materialise this view.

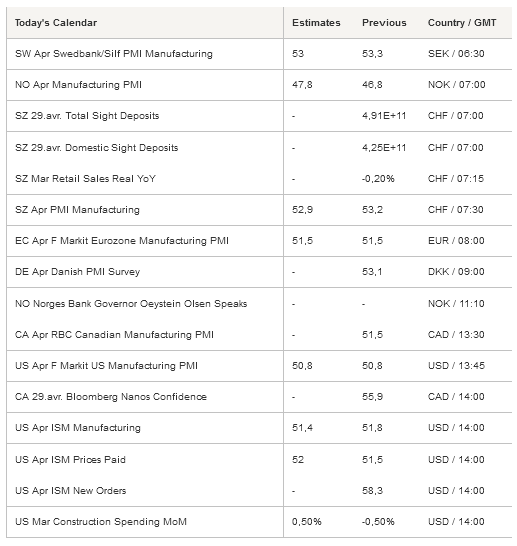

On the calendar today Switzerland will release retail sales, EU Markit Manufacturing PMI, and US ISM data.

Currency Tech

EUR/USD

R 2: 1.1714

R 1: 1.1465

CURRENT: 1.1396

S 1: 1.1217

S 2: 1.1144

GBP/USD

R 2: 1.4959

R 1: 1.4668

CURRENT: 1.4643

S 1: 1.4300

S 2: 1.4132

USD/JPY

R 2: 112.68

R 1: 111.91

CURRENT: 106.94

S 1: 105.23

S 2: 100.78

USD/CHF

R 2: 1.0093

R 1: 0.9913

CURRENT: 0.9621

S 1: 0.9476

S 2: 0.9259