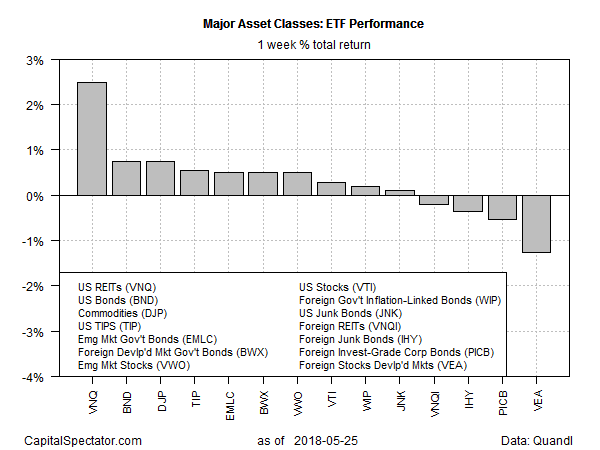

Real estate investment trusts (REITs) posted the strongest gain for the major asset classes last week, based on a set of exchange-traded products.

Vanguard Real Estate (NYSE:VNQ) jumped 2.5% over the five trading days through Friday, May 25, posting an outsized advance vs. the rest of the field. Although the ETF is still down for the year so far, VNQ has been rebounding in the past two months after a sharp selloff in early 2018.

Last week’s biggest loser: foreign stocks in developed markets. Vanguard FTSE Developed Markets (NYSE:VEA) slumped 1.3%, the second weekly decline for the ETF, leaving the fund at its lowest close in a month.

Weakness in European equity markets was a key headwind. Factors weighing on equity prices include a strong dollar and renewed uncertainty related to political turmoil in Italy that’s shaking confidence in the outlook for the European Union.

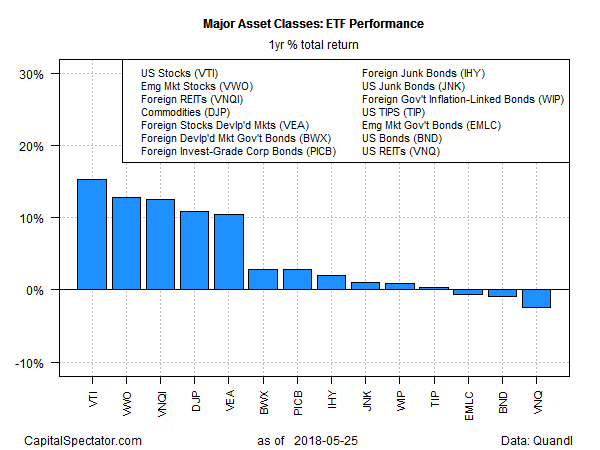

For the one-year trend, US stocks continue to hold the high ground. Vanguard Total Stock Market (NYSE:VTI) is ahead 15.4% on a total return basis for the 12 months through Friday’s close. The gain puts the ETF modestly ahead of the second-strongest one-year performance: Vanguard FTSE Emerging Markets (NYSE:VWO), which closed up 12.6% on Friday vs. the year-earlier level after factoring in distributions.

US REITs continue to suffer the biggest one-year loss among the major asset classes. Despite the recent rally, VNQ has shed 1.7% over the past year.