Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

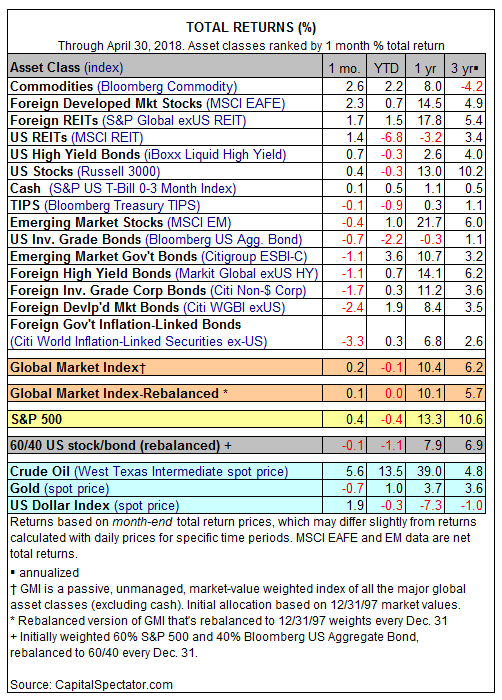

Commodities bounced back in April, topping the performance list for the major asset classes. Rebounding after two straight monthly declines, a broad measure of raw materials jumped 2.6%, based on the Bloomberg Commodity Index.

Overall, market returns were mixed in April. Foreign stocks in the developed markets, along with property shares generally, enjoyed solid gains last month. Fixed-income, by contrast, was broadly lower in the US and abroad.

The biggest loser last month: foreign government inflation-indexed bonds (in unhedged US dollar terms). The Citi World Inflation-Linked Securities ex-US Index fell a hefty 3.3% in April – the benchmark’s biggest monthly decline in well over a year.

US stocks generated a middling performance last month compared with the rest of the field. The Russell 3000 Index edged higher by 0.4% — the benchmark’s first monthly gain since January. US bonds, by contrast, slipped into the red. The Bloomberg US Aggregate Bond Index fell 0.7% in April and for year so far is down 2.2%.

The Global Market Index (GMI), an unmanaged benchmark that holds all the major asset classes in market-value weights, clawed back into positive terrain last month. The benchmark’s 0.2% total return for April marks the first monthly advance since January. Year to date, however, GMI is in the red with a fractional 0.1% decline.