The first thing that we would have to mention is that Monday is the Memorial Day holiday in the United States, so that of course will greatly influenced the liquidity and motion of the markets for the trading day. There is almost nothing coming out economic announcement wise, so we have no worries about headlines.

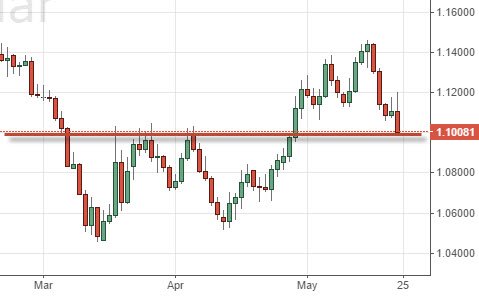

The EUR/USD pair crashed during the session on Friday, falling all the way down to the 1.10 level. Due to this, we would highly recommend staying away from this pair today because we are at an area that could determine the next 500 pips in a blink of the eye. That being the case, the market needs to make up its mind before we start placing a trade. With the likelihood of liquidity on Monday, we believe a lot of traders will get chewed up and spit out. By all means, we suggest stepping on the sidelines as far as this pair is concerned.

Looking at the DAX, we fell slightly during the session on Friday, and we are much more comfortable in placing a trade in this market. We need to see some type of supportive candle in order to start buying calls, or simply a move above the highs of the session on Thursday and Friday, as we believe the market will then target the €12,000 level.

The precious metals markets continue to be very volatile, and as a result, silver keeps bouncing off of the $17 level. With this, we are willing to buy short-term calls in that general vicinity, and taking short-term gains. We have no interest in placing longer-term trades, and with all of the motion in the US dollar all of a sudden, you can expect volatility to pick up in the precious metals markets.