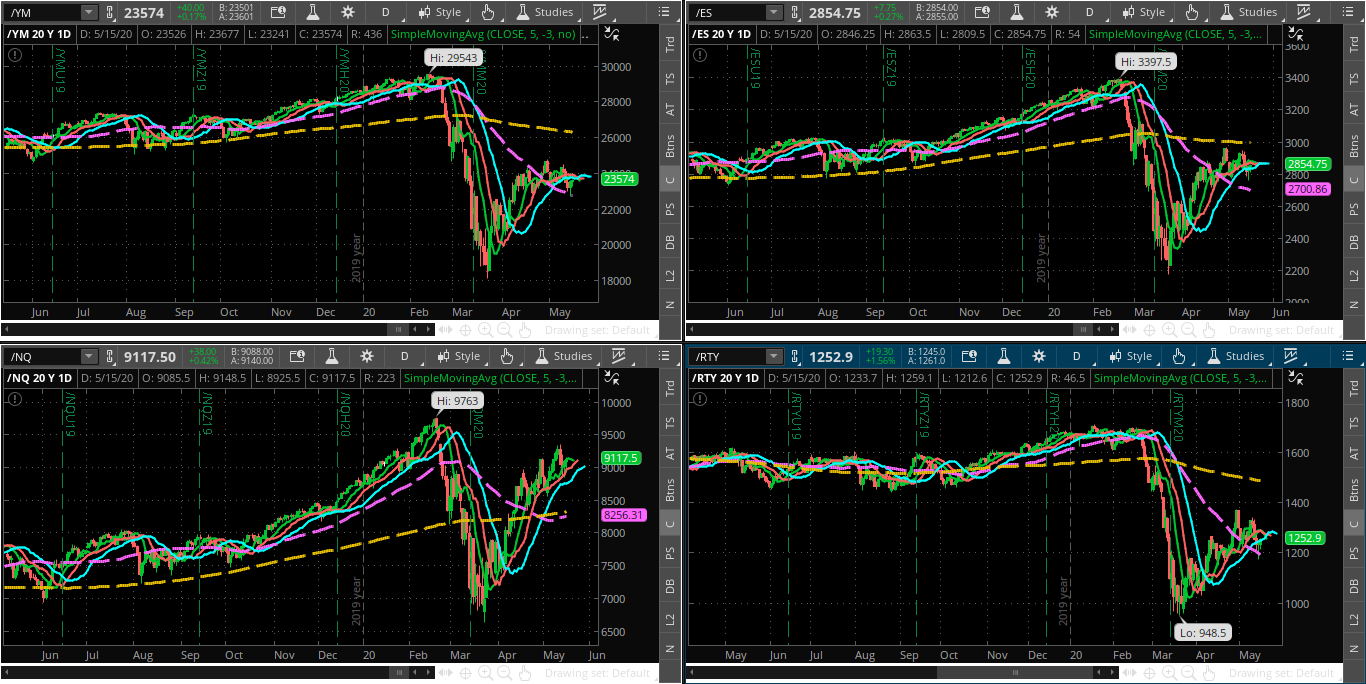

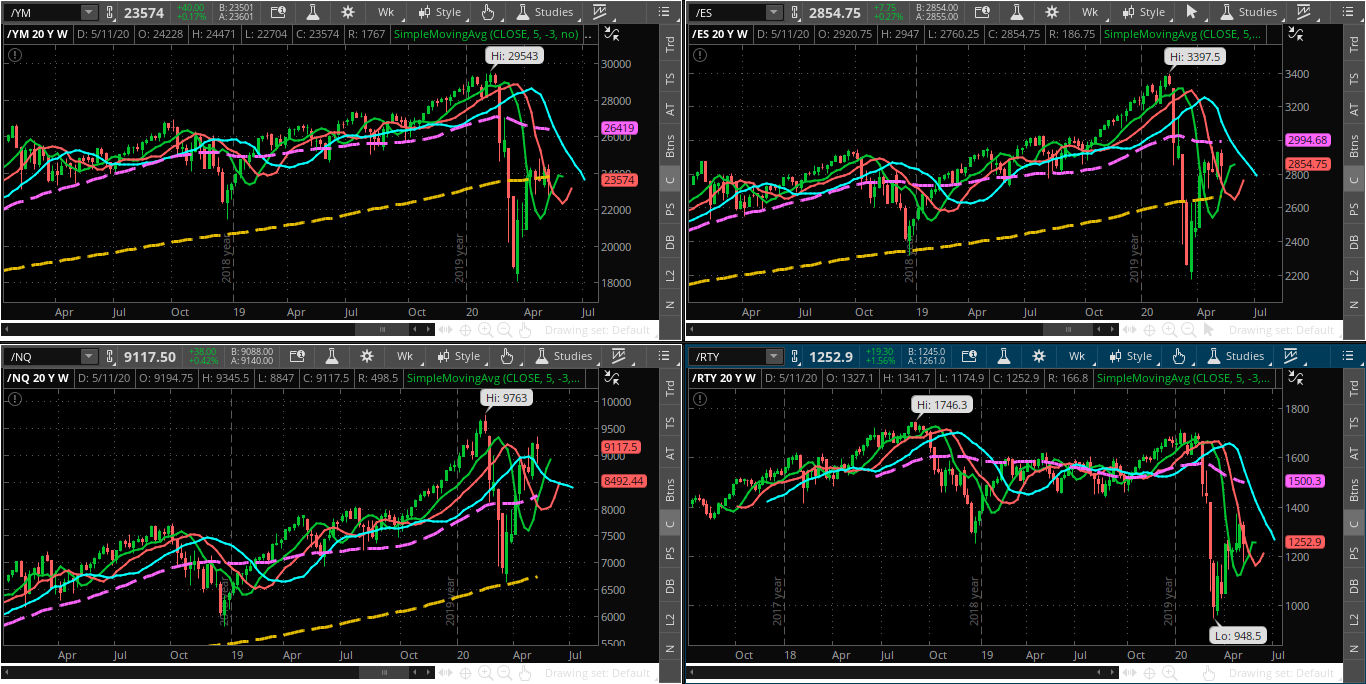

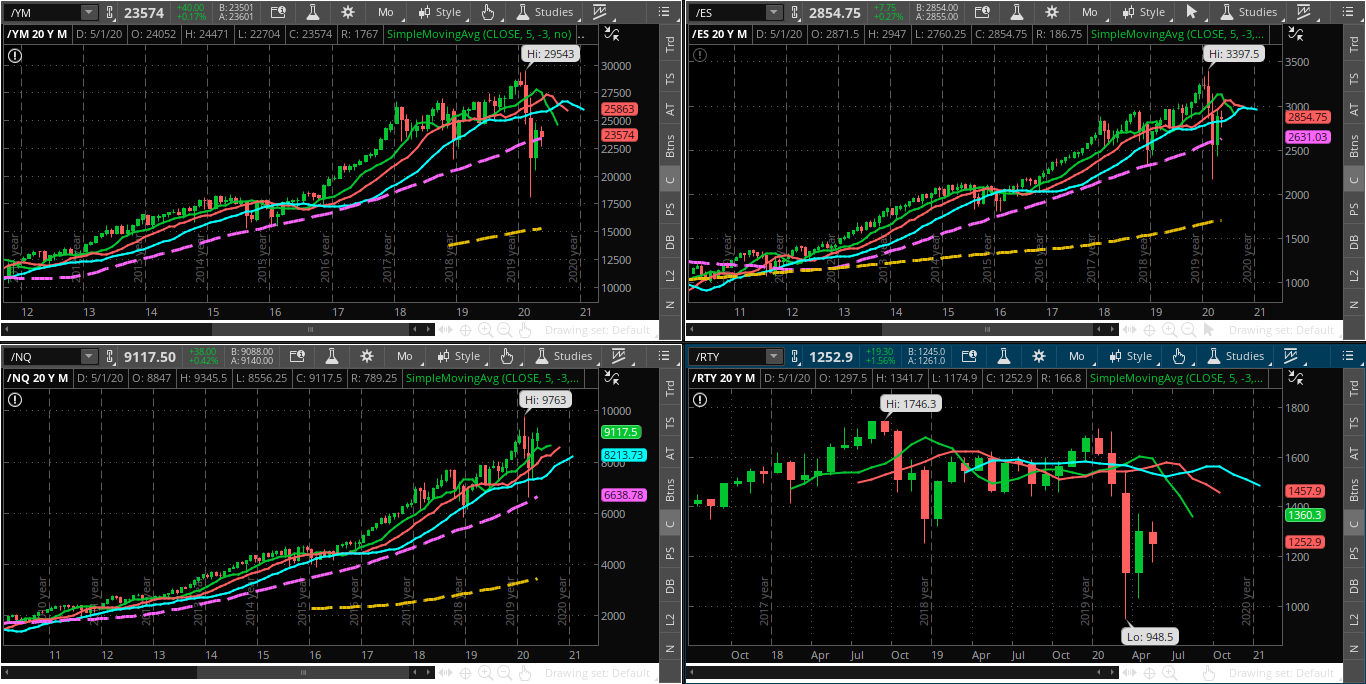

The following daily, weekly and monthly charts of the four U.S. E-mini Futures Indices show that they are at the emerging edge of chaos [which is defined by three future-offset moving averages (green 5MA, -3), (red 8MA, -5), and (blue 13MA, -8)].

In all of these three timeframes, the NQ is the strongest and is the most favoured to continue its rally, while the ES is next, followed by the YM and RTY.

In the short term, watch for all three of the moving averages to curl upwards on the daily timeframe (with the green above the red above the blue), and for price to break and hold above all of them, to confirm that a sustainable rally is supported.

In the medium term, watch for all three of the moving averages to curl upwards on the weekly timeframe (with the green above the red above the blue), and for price to break and hold above all of them, to confirm that a sustainable rally is supported.

In the longer term, watch for all three of the moving averages to curl upwards on the monthly timeframe (with the green above the red above the blue), and for price to break and hold above all of them, to confirm that a sustainable rally is supported.

As well, the NQ is the only index that is above both the 50 and 200 moving averages on all three timeframes. These two moving averages pose as resistance or support levels on the YM, ES and RTY on all three timeframes. Look for the YM, ES and RTY to eventually break and hold above both of these moving averages in order to support any further rally and breakout to new record highs by the NQ.

Furthermore, we're about to see a bullish Golden Cross form on the 50 and 200 MAs on the NQ daily timeframe. If that occurs and holds, we'll likely see the rally continue.

If the NQ fails to continue its bullish leadership, we may see all four indices drop to, potentially, new lows, especially if the NQ drops and holds below its 50-week MA (currently at 8245).

As of Friday's close, the Balance of Power still rests with the bulls on the SPX, as shown on the monthly chart below.

If the BOP drops and holds below the zero level, that control will switch to the bears on this timeframe, and we may see the SPX drop to around 2675 (the apex of the expanding triangle), or lower.

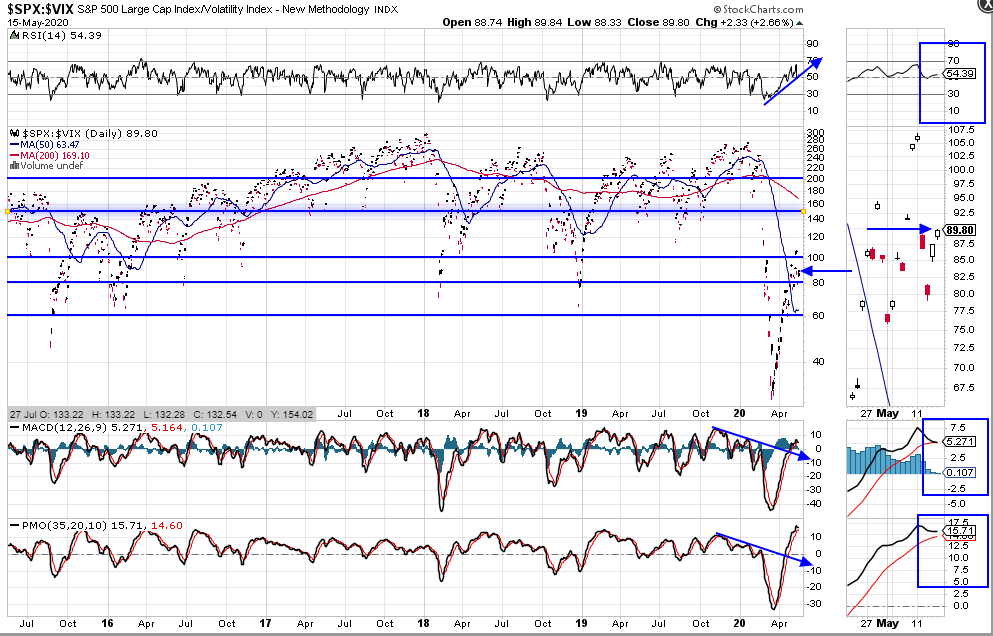

The SPX:VIX ratio is holding above 80 and may be headed towards its next resistance level at 100, as shown on the following daily ratio chart.

All three technical indicators (RSI, MACD and PMO) are hinting of higher prices for the SPX.

Under that scenario, the RSI should hold above 50, and the MACD and PMO should begin to swing upwards.

SUMMARY

If I were a betting woman, I'd say that the SPX has around a 55% chance of moving higher over the coming days/weeks, albeit in a choppy and, sometimes, volatile manner.

Keep an eye on the information and charts that I've shown above as potential directional gauges in the days/weeks ahead.