- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

U.S. Jobs Report: Headline Disappoints, But It Will Turn Round

US payrolls growth of 157,000 is disappointing but there were upward revisions, and forward-looking indicators suggest more big jobs gains to come.

Mixed report

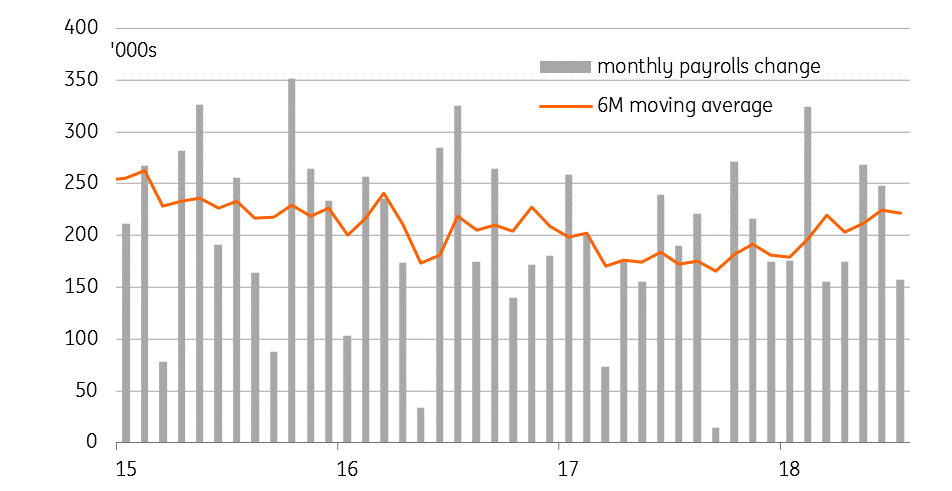

The July US jobs report shows payrolls rising 157,000 versus the 193,000 Bloomberg consensus, but there were 59,000 upward revisions to recent history so overall it’s close to market predictions. Wages rose 0.3% month-on-month, in line with expectations, which leaves the annual rate of wage growth at 2.7%. The unemployment rate moved back down to 3.9% from 4% while U6 underemployment is at 7.5% versus 7.8% previously.

The headline payrolls number is softer than hoped given the rise in the ISM employment component, the strong ADP private payrolls report (219,000) and another really firm NFIB employment data release. Nonetheless, the marked step up in employment gains versus 2017 remains in evidence. Last year averaged 182,000 jobs per month whereas the first seven months of 2018 have averaged 215,000 job gains. This will help underpin consumer sentiment and spending through the rest of the year.

Monthly change in US nonfarm payrolls

Outlook still looks good

In terms of the outlook for employment, the fact that the economy is growing so strongly bodes well for ongoing job creation. There are certainly worries about protectionism and its potential economic impact, but we also have to remember that the stimulus from tax cuts dwarfs the tax hit from higher tariffs. As such we are still expecting the US economy to expand 3% this year.

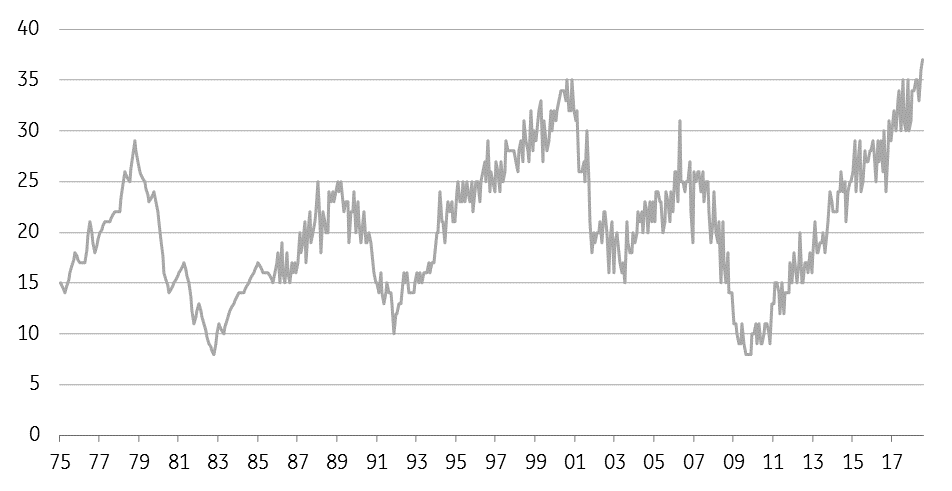

This view is seemingly supported by the employment numbers released by the National Federation of Independent Businesses yesterday. According to them, the proportion of small businesses with unfilled vacancies has never been higher in the survey’s 45-year history and nor has the “job creation plans” for the coming three months.

NFIB: Unfilled job openings (% with at least one unfilled opening)

So the US has an economy that is growing incredibly strongly with a robust jobs market. At the same time, consumer price inflation is set to hit 3% next week with the core rate (ex-food and energy) coming in at 2.3%. This will ensure the Federal Reserve keeps hiking rates, with September and December moves looking probable.

Content Disclaimer: The information in the publication is not an investment recommendation and it is not an investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument.

This publication has been prepared by ING solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. “For more from ING Think go here.”

Related Articles

Investor’s bearish sentiment has surged to levels that generally align with server market corrections and crashes. While concerns about the recent market correction have risen,...

The latest economic indicators aren’t supporting our resilient-economy thesis. Nevertheless, we are sticking with it for now. Consider the following: The Atlanta Fed’s GDPNow...

US imposes increased tariffs on its closest trading partners US equities decline as risk appetite remains weak Dollar records losses against major currencies Oil and cryptos...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.