Key Points:

- Crude oil inventories decline by 2.89 million barrels.

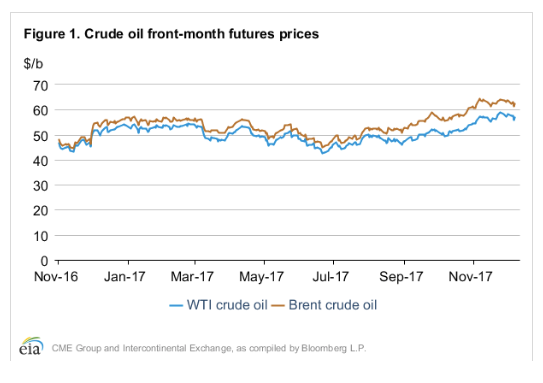

- Brent and WTI prices increased 36, and 50 cents, respectively.

- Higher prices likely to bring about additional U.S. shale oil production.

Crude Oil prices have continued to feel the pinch of increased rig counts as additional supply has constrained the recent rally. However, an inventory draw of 2.89 million barrels caught the market by surprise and has helped to largely stabilize markets overnight. Subsequently, West Texas Intermediate (WTI) rose around 36 cents on the news whilst Brent was up 50 cents. However, it remains to be seen if the result was simply an anomaly or part of a new trend in lower stocks.

Interestingly, the American Petroleum Institutes (API) forecast actually exceeded the official numbers with the industry association estimating that there had been a fall of 7.4 million barrels last week. This is a relatively staggering number and far exceeds what most analysts were expecting by a factor of at least two. Subsequently, there is plenty of evidence that the current production levels are being eroded by increased domestic demand.

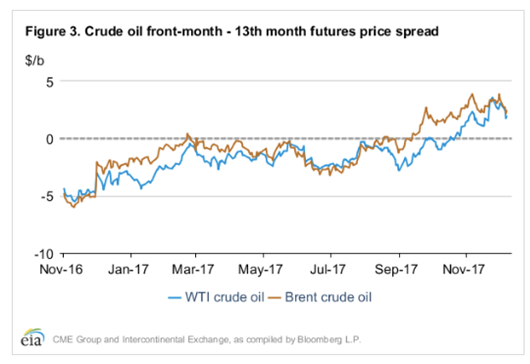

In fact, there is plenty of evidence of growing global demand for oil which bodes well for prices given that the EIA is also projecting that domestic production will rise to 10.02 million bpd in 2018. However, it remains uncertain how OPEC will react to both the increased shale oil production and creeping crude prices.

The reality is that OPEC has largely changed their tune over the past six months and there is likely plenty of political will to curb further production with the view to stabilizing prices above $65.00 a barrel. In fact, compliance has been relatively high for the present OPEC production caps which have surprised me greatly given that previous agreements have typically been fraught with cheating across the board.

Subsequently, we could see crude oil prices moving back towards a multi-year high in the ensuing months. However, the medium-term to long-term view is relatively different with higher prices likely to drive additional shale oil production activity as well as inward investment in the sector. So it is difficult to see Brent prices persisting above $65.00 a barrel in the long run.

In fact, advancements in shale oil techniques will only undermine the oil cartel's power in the long run and bring about further re-balancing in a market that is already moving away from Middle Eastern dominance.