The session on Thursday should be fairly calm, as there isn’t much in the way of announcements to move the markets. Ultimately, the only thing that we see is the Initial Jobless Claims coming out of the United States. However, with the Nonfarm Payroll numbers coming out on Friday, it’s very unlikely that the markets will move much.

The EUR/USD pair tried to break out during the session on Wednesday, but struggled at the 1.08 handle again. By doing so, the market turned back around and formed a resistive looking candle. We believe that this market eventually will go much lower, and head to the 1.05 handle. We are buyers of puts going forward as the market should continue to struggle overall.

The gold markets broke out during the course of the session on Wednesday, cracking above the 1200 level. If we can get above the 1220 level, we feel that the market should continue to go much higher and we would be buyers of calls. On the other hand, if we struggle to get above the 1220 level, we think that a resistive candle could be a nice put buying opportunity.

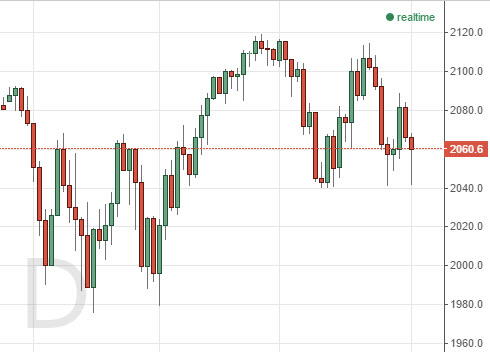

We believe that the S&P 500 will eventually go higher, but it did fall on Wednesday. We found plenty of support below at the 2040 level, and therefore ended up forming a nice-looking hammer. If we can break above the top of the hammer, we believe that it is a nice call buying opportunity as the market should then head back to the 2120 handle. We have no interest in buying puts, but ultimately we believe that the S&P 500 will be a market that continues to go much higher over the longer term.