For US equity markets last week was a case of being back where we started, with the plunge of Monday and Tuesday on a nervous reaction to further trade talk tension, then eased on Wednesday and Thursday, with Friday delivering an injection of momentum following the monthly Non-Farm Payroll data.

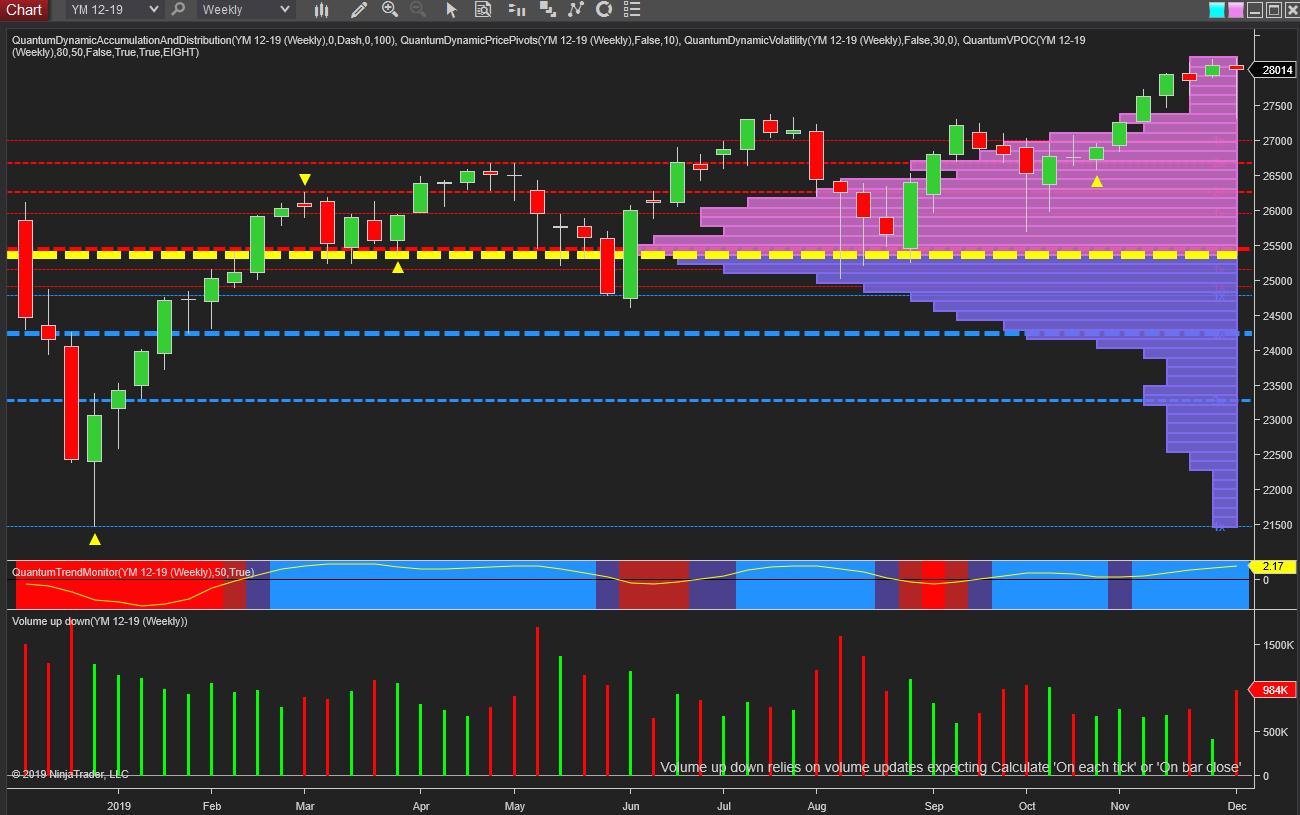

From a trading perspective, such weeks offer perfect opportunities for two reasons. First, we have volatility, and second, the opportunity for rapid reversals which I highlighted on Tuesday would be the case, given the extreme volume and buying during the latter part of the session. All part of volume price analysis 101 with the YM, NQ and the ES Emini all following the same pattern and closing on the weekly chart with a narrow-bodied candle with a very deep wick to the lower body and supported with strong volume.

Once again the doom-mongers have been proved wrong. This pattern of price behavior is one we have seen several times this year most notably in August and again in October with the indices reacting strongly to events and falling sharply, only for the buyers to step in with stopping volume, before reversing and continuing the longer-term bullish trend. So Santas sleigh may be a little battered and windblown but is still on course to take the indices for a breakout into new high ground as we approach the end of the trading year.

And the sleigh may be given an additional shove by the FOMC later this week.