Friday, the U.S. increased tariffs on $200B of Chinese goods as the U.S./China trade deal broke down. China has vowed to retaliate for the move. The past trading week saw global markets shocked by two items: Iran sanctions and a U.S./China trade breakdown. The markets had been expecting a U.S./China trade deal to be reached and optimism was quite high – hence the rally in the Chinese stock market and the rally in the U.S. stock market. What next?

Well, we believe this news, as well as future news that will likely hit the markets over the next 3+ months, will continue to prompt the Shake-Out we have been warning about. Depending on how severe these news events are, the rotation in the markets could be quite severe as well.

Our recent analysis suggests that recent lows in the U.S. stock market may be near-term support and that the U.S. stock market may attempt to form a bottom near these lows. Our research shows the Transportation Index is leading this move. We believe the ORANGE Moving Average level, as well as the RED and GREY Fibonacci projection points, will act as a temporary price floor this week and next. The YM recovered near the end of the day.

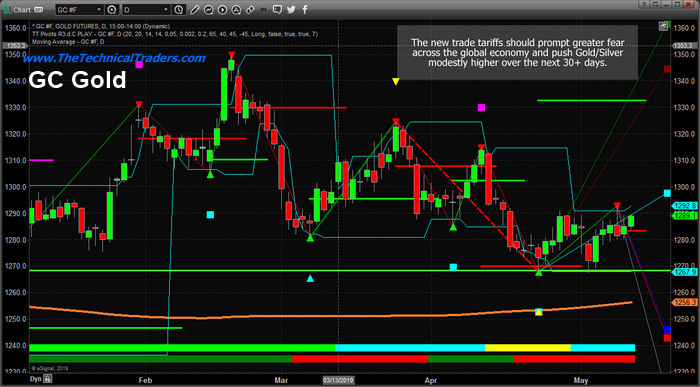

Gold is showing signs of a potential upside price leg in the early stages, just as we had been suggesting. Our April 21~24 momentum base call from months ago appears to be incredibly accurate. At this point, we are just waiting for the upside price swing to begin. When it starts, the momentum behind this upside move will increase as it will catch the attention of many gold traders and solidify the “fear” aspect of this move.

Silver is still lagging behind gold – as usual. We continue to believe the real opportunity for a great trade lies in silver. The potential for a $22 ~ $28 upside price swing on a market breakdown or fear play is still very solid. Headed into the 2020 U.S. election cycle and with all the uncertainty in the global markets, we believe this is the “sleeper trade” of the next 16+ months. When gold begins to breakout to the upside, silver should follow about 20 days later.

These new U.S. trade tariffs puts pressure on China to come to the table and develop and honest deal. This is not the old way of slow negotiations with no real consequences. For China, the lack of access to the U.S. market could be devastating in both the short and long run. Skilled traders should not be overly optimistic throughout this weekend. Protect your longs and prepare for more news over the next few weeks. This is the type of market that will make or break many traders.