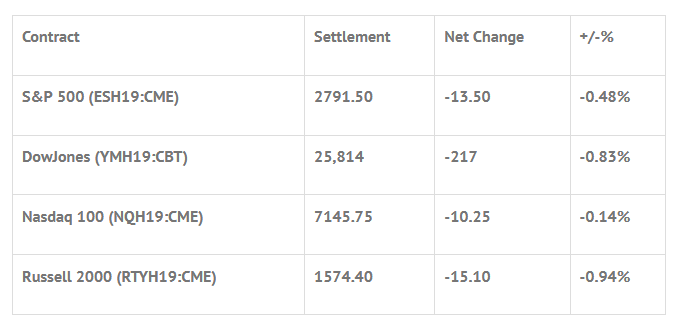

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 7 out of 11 markets closed lower: Shanghai Comp +0.88%, Hang Seng +0.01%, Nikkei -0.44%

- In Europe 12 out of 13 markets are trading lower: CAC -0.35%, DAX -0.34%, FTSE +0.32%

- Fair Value: S&P +0.24, NASDAQ +2.31, Dow -5.19

- Total Volume: 1.79mil ESH & 672 SPH traded in the pit

Today’s Economic Calendar:

Today’s economic calendar includes the 8-Week Bill Settlement, Eric Rosengren Speaks 7:30 AM ET, Redbook 8:55 AM ET, Neel Kashkari Speaks 9:30 AM ET, PMI Services Index 9:45 AM ET, New Home Sales 10:00 AM ET, ISM Non-Mfg Index 10:00 AM ET, and Treasury Budget 2:00 PM ET.

S&P 500 Futures: Timing Is Everything

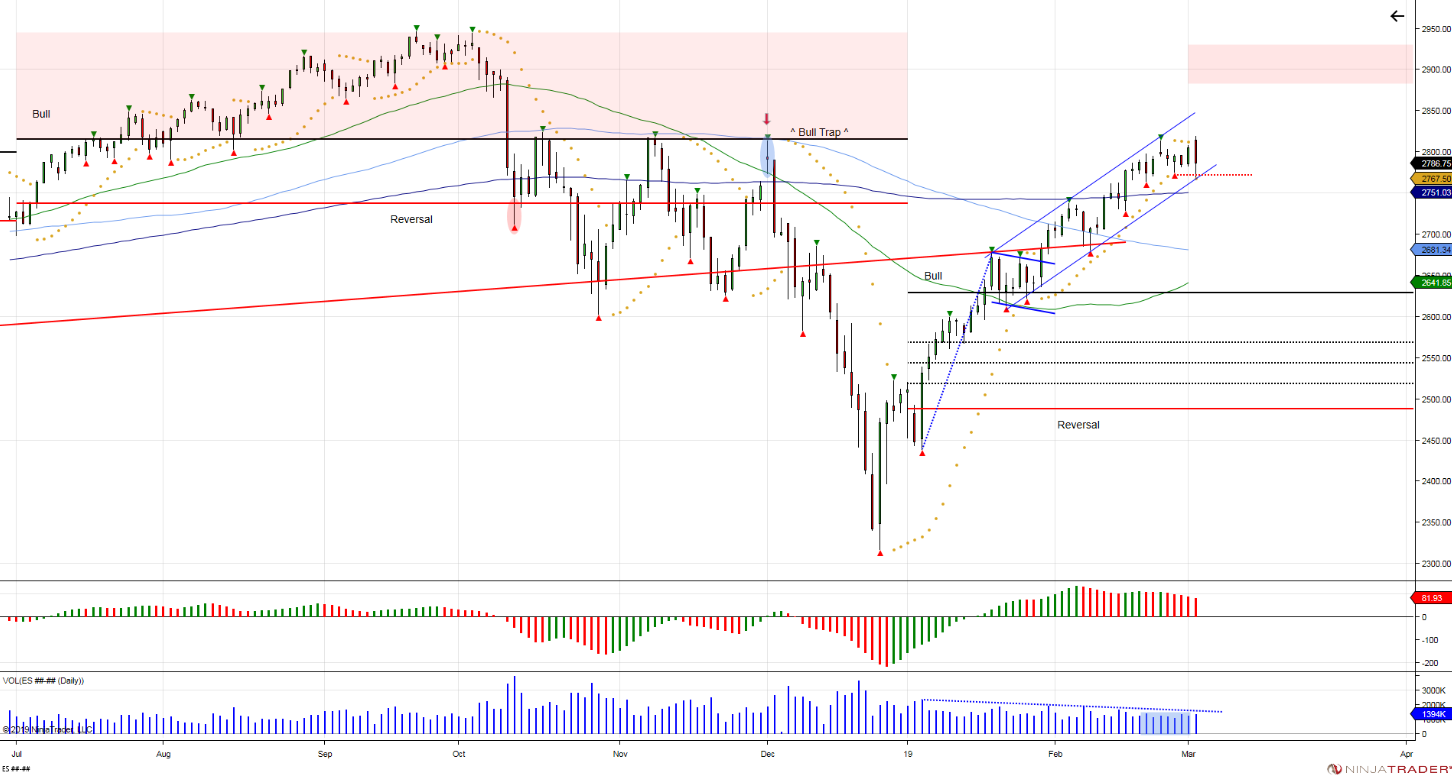

Chart courtesy of Stewart Solaka @Chicagostock – $ES_F Daily little shakeout after running stops above 2814. Bullish channel intact. Next major upside 2880-2920, failure to hold 2775 gives way to search for support down to 2710.

Timing is everything when it comes to trading the S&P 500 futures. After a 10 week rally, and news that the U.S. and China were nearing a trade deal, the ES rallied Friday, and followed through on the upside during Sunday nights Globex session, making an overnight high of 2819.75.

On Monday’s 8:30 CT futures open the ES traded 2815.50, upticked to 2818.25 two minutes after the bell, then got hit by a sequence of sell programs that pushed the futures all the way down to 2767.50 as news broke that a U.S. congressional panel had served document requests to 81 government agencies, entities and individuals, including the president’s sons Donald Trump Jr. and Eric Trump, WikiLeaks, and Trump son-in-law Jared Kushner.

After making the low, the ES rallied up to 2794.50 on the 3:00 CT cash close, as the MiM jumped from $200 million to buy to over $400 million to buy, and settled at 2791.50, down -13.5 handles, or down 0.48%.

In the end it was a scary drop, and despite the rally, the overall tone of the ES was weak at best. My feeling is that there were two things going on; 1) the rally overnight and early gap up used up all the buying power, and 2) that someone had to know the House of Representatives document request was leaked. In terms of the days overall trade, total volume was high, with 1.8 million futures contracts traded.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.