The US GDP numbers are by far the most important announcements coming out during the course of the session on Friday, so we believe that most of the market will focus on the US stock markets as well as the US dollar.

With that being said, expect a lot of volatility in both the S&P 500 and the EUR/USD pair. In the S&P 500, we initially fell during the course of the day on Thursday, but we continue to see plenty of support below, especially at the 2100 level. With this, we are call buyers in general and believe that ultimately the S&P 500 goes higher.

As far as the EUR/USD pair is concerned, as long as we remain below the 1.10 level, we are bearish of the pair, and believe that the puts will be the best way to go. We have no interest in buying calls, not until we get above that level, but do recognize that there is going to be a lot of volatility due to not only GDP numbers coming out of America, but all of the nonsense coming out of Athens.

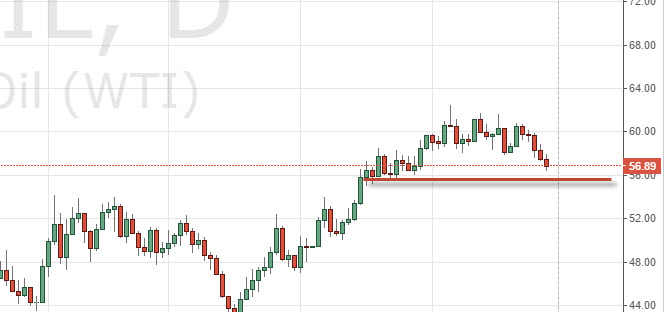

Looking at the oil markets, the WTI Crude market fell during the session on Thursday, testing the $56 region which is rather supportive. Because of this, we believe that the market could very easily bounce during the session today and it houses buying calls.