Daily Briefing

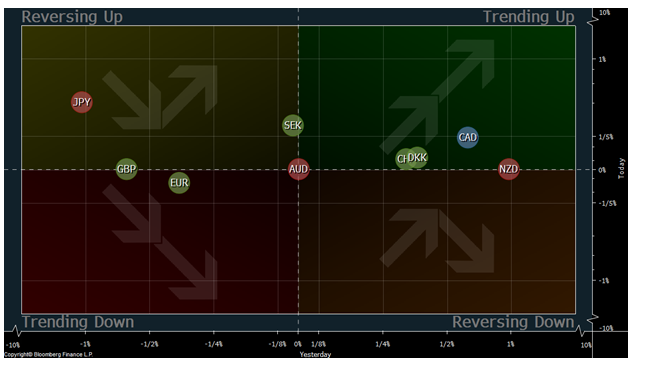

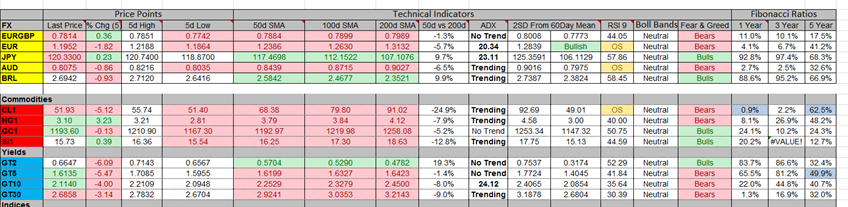

Currencies

- EUR/USD: The pair is trading near the support zone of 1.1842-1.1801 on a 30 minute time frame. The next resistance is at 1.2173.

- USD/JPY: The pair has formed a reverse head and shoulder pattern on a 30 minute time frame. The next support is at 117.01 and resistance at 120.30

- GBP/USD: The pair is trading below the downward trend line has broken its downward channel on a 30 minute time frame. The resistance is near the 1.5747 and the support is at 1.5087

Indicator

Indices

- Asian Markets closed higher be recovering some of their losses from yesterday. The Hang Seng index was the best performing index during the session and it closed higher with a gain of 0.83%. The index is up nearly by 0.77% in the past 5 days.

- European stock markets are trading higher during the early hours of trading. The CAC40 index is the best performing index during the session and it is trading higher with a gain of 0.77%. The index is down by almost 3.12% in the past 5 days.

- US Indices futures are trading higher ahead of the FOMC minutes. Most indices closed lower during the last session and the NASDAQ index was the worst performer with a loss of 1.28%.

TOP News

- Divergence is the biggest trend today as the Italian unemployment number printed the record high number while the German unemployment number was at record low

Things to Remember

Manage your stops, not the expectations.

Market Sentiment

- Gold: The precious metal has fallen from OUR predicted resistance zone of 1223-1220 which was given yesterday. The price is trading above its upward trend line on a 30 minute time frame. The next support is near the 1160 and the next resistance is near the 1240.

- Crude Oil: The black gold is trading in a downward on a 30 minute time frame. The near term support is at the $45.0 mark and the resistance is at 50.

- VIX: Volatility index dropped nearly -7.34% on the last trading day.

News Agenda For Today

10:00 GMT

EUR – CPI Flash Estimate y/y

13:30 GMT

USD – ADP Non-Farm Employment Change

USD – Trade Balance

CAD – Trade Balance

15:00 GMT

CAD – Ivey PMI

15:30 GMT

USD – Crude Oil Inventories

19:00 GMT

USD – FOMC Meeting Minutes