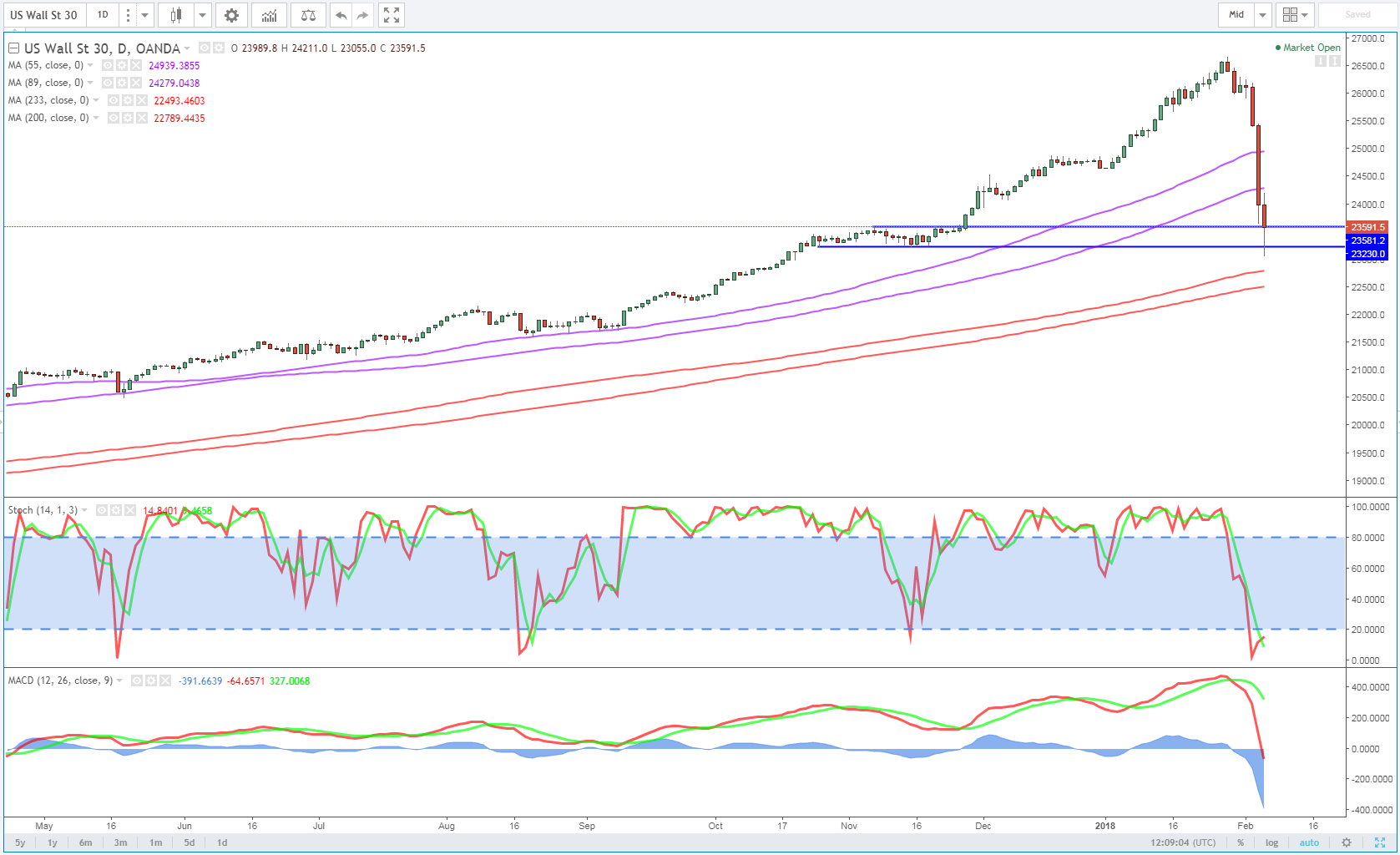

Markets Stabilise Ahead of the Open on Wall Street

US futures are gradually stabilising again ahead of the open on Wall Street on Tuesday, following an extremely volatile session at the start of the week and more of the same in overnight trade.

The sudden and sharp declines in equity markets over the last couple of sessions is still being attributed to higher interest rate expectations although the move appears to have been exacerbated by a combination of automated trading and panic selling. We’ve become so accustomed to dips being bought over the last couple of years that this appears to have caught people off-guard and that’s generated some of the panic responses that we’ve seen.

Now that the dust appears to be settling, people seem to be reflecting on this as a reminder that market corrections are perfectly normal and not always a sign that something is about to go terribly wrong. The rally over the last couple of years has been very strong and without any corrections of note and it’s possible that this has led to some complacency in the markets, with investors perhaps getting a little ahead of themselves.

Dow (US30) Daily Chart

Of course we’ll have to wait and see over the next couple of days if the sell-off generates and further fear-driven selling but I’m not currently convinced it would be warranted. The economic fundamentals appear fine and the environment has been gradually improving over the last couple of years. This has led to higher interest rate expectations and it’s possible that these have gone a little too far.

Bitcoin Falls Below $6,000 For First Time Since November

It’s not just stock market investors that have been burned in recent days, cryptocurrency traders are also feeling the heat, as another plunge in bitcoin sees it trading back around $6,000, almost 70% off its December highs. Some other cryptocurrencies have fared even worse, with Ripple now more than 80% off its peak which was reached only a month ago. A constant flow of negative news flow hasn’t helped the market for cryptocurrencies and neither, I would imagine, will the exit of speculators that helped inflation the bubble late last year.

Bitcoin (CME) Daily Chart

Bitcoin has found some support again after dipping back below $6,000 earlier today for the first time since the middle of November. With cryptocurrencies being such a sentiment driven market, I wouldn’t be surprised to see further losses even if prices do stabilize or even bounce in the near-term. Most cryptocurrencies are still up a considerable amount since the start of last year which some will point to as evidence that they have a lot further to fall and others as evidence of the belief that still exists in the space. Ultimately, we’re seeing the market being flushed out which could prove handy in highlighting which players are serious and which simply piggybacked on the success of others.

No Room For Bitcoin When Traders Sought Safe Havens

Interestingly, despite the insistence of some that bitcoin could be the new Gold, we’ve seen little evidence of it benefiting from the recent panic. Gold on the other hand did see some safe haven flows late on Monday and is trading a little higher once again today. As is the yen, which is typically seen as a safe haven currency and is trading higher against the euro and pound today. It has pared its gains in the last few hours though as equity markets have pared losses.