Daily Briefing

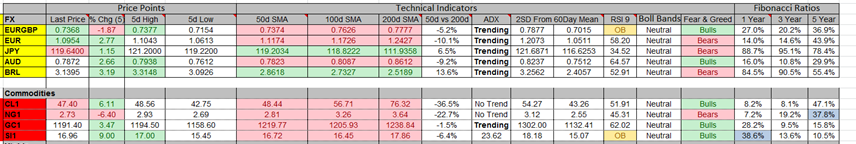

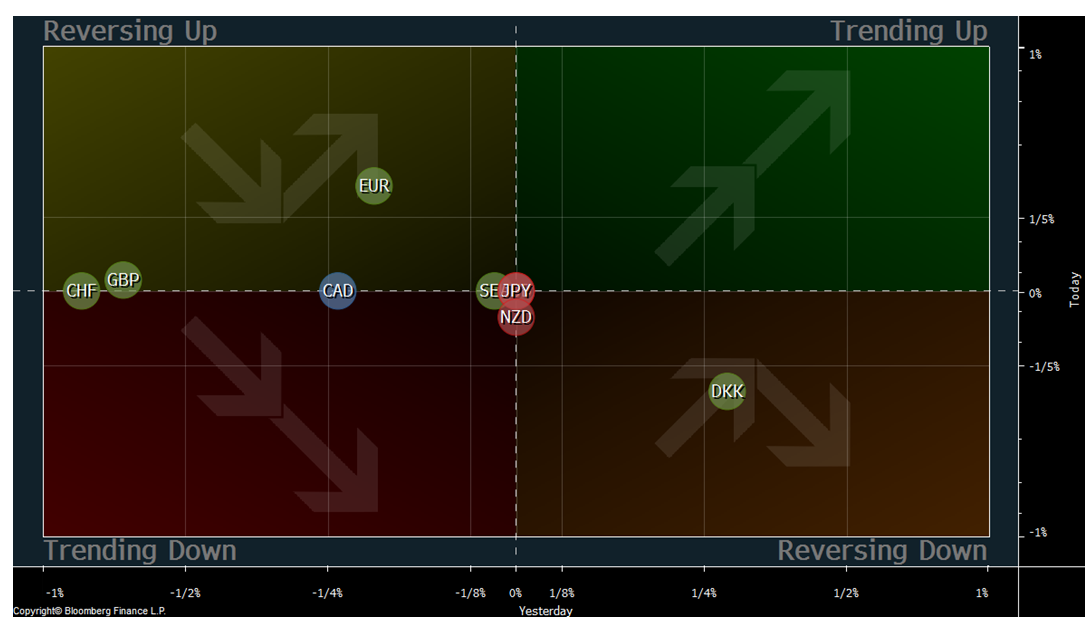

Currencies

- EUR/USD: The pair is trading below its downward trend line on a 30 minute time frame. The next resistance is at 1.1211 and the support is at 1.0751.

- USD/JPY: The pair is trading below its downward trend line on a 30 minute time frame. The next support is at 119.32 and resistance at 121.06

- GBP/USD: The pair has formed a symmetrical triangle on a 30 minute time frame. The resistance is near the 1.5112 and support is at 1.4745

Indicator

Indices

- Asian Markets closed mostly higher by building their gains on top of yesterday. The Hang Seng index is the best performing index during the session and it closed higher with a gain of 0.53%. The index is up nearly by 2.02% in the past 5 days.

- European stock futures are trading lower during the early hours of trading. The CAC 40 index is the worst performing index during the session and it is trading lower with a loss of 0.08%. The index is up by almost 0.84% in the past 5 days.

- US futures are also trading lower ahead of the core durable data. Most indices closed lower during the last session and the NASDAQ Composite index was the worst performer with a loss of 0.58%.

TOP News

- The German IFO business climate data was as healthy as it could be, and have printed another strong reading this morning

- The Swiss UBS consumption indicator came in at 1.19 while the previous reading was at 1.11

Things to Remember

Stop loss is your biggest friend so make sure you use it

Market Sentiment

- Gold: The precious metal is trading above its upward trend line on a 30 minute time frame. The next support is near the 1140 and the next resistance is near the 1230.

- Crude Oil: The black gold is trading in a sideway pattern on a 30 minute time frame. The near term support is at the $46.0 mark and the resistance is at 48.50.

- VIX: Volatility index gained nearly 1.57% on the last trading day.

News Agenda For Today

09:00 GMT

EUR- German IFO Business climate

12:30 GMT

USD – Core durable good order

14:30 GMT

USD – Crude Oil Inventories

Trends

Disclaimer: The above is for informational purposes only and NOT to be construed as specific trading advice. responsibility for trade decisions is solely with the reader.