During the session on Wednesday, without a doubt the largest announcement coming out will be the Final GDP numbers coming out of the United States. With that, we believe that the market will focus on the S&P 500 and other US assets.

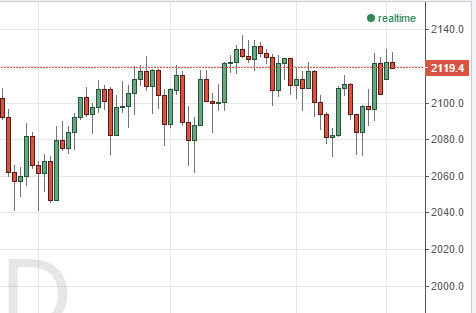

The S&P 500 tried to rally during the session on Tuesday, but found resistance in the same old area. With that, we believe the pullbacks will be call buying opportunities, as the market looks like it’s ready to continue consolidating over the course of the summer. However, the longer-term trend is most certainly to the upside, so buying puts at this point in time would be the more dangerous of our options.

The EUR/USD pair fell rather significantly during the session on Tuesday as well, but at the end of the day, it was more or less a “knee-jerk reaction” based upon nonsense coming out of Athens as per usual. With this, we are picking up calls in the EUR/USD pair in order to take advantage of value.

Silver markets fell as well, but we believe eventually the buyers will step back into this marketplace. We are call buyers as long as we can find some type of support or bounce between here and the 15.80 handle. Ultimately, we do think silver goes higher over the longer term, but in the options markets, it’s going to be difficult to hang onto a trade long enough for anything more than a quick profit.