Last week’s news was just barely bullish: while the third and final reading of 1Q GDP was positive, weaker personal consumption expenditures were concerning. In contrast, this week’s news is better: ISM data pointed to continued business expansion. While auto sales continue to be a bit weaker, they are still increasing at stable – albeit lower – rates.

The ISM released both manufacturing and non-manufacturing numbers. The manufacturing PMI increased 2.9 points to a strong 57.8; the service number rose a smaller .5 but printed an impressive 57.5. Both reports’ internals pointed to continued expansion; each also contained very bullish anecdotal comments. It’s important to remember these indexes measure sentiment; these indicators have been stronger than the actual data since the election. Sentiment is a component of overall demand, which highlights the importance of these reports.

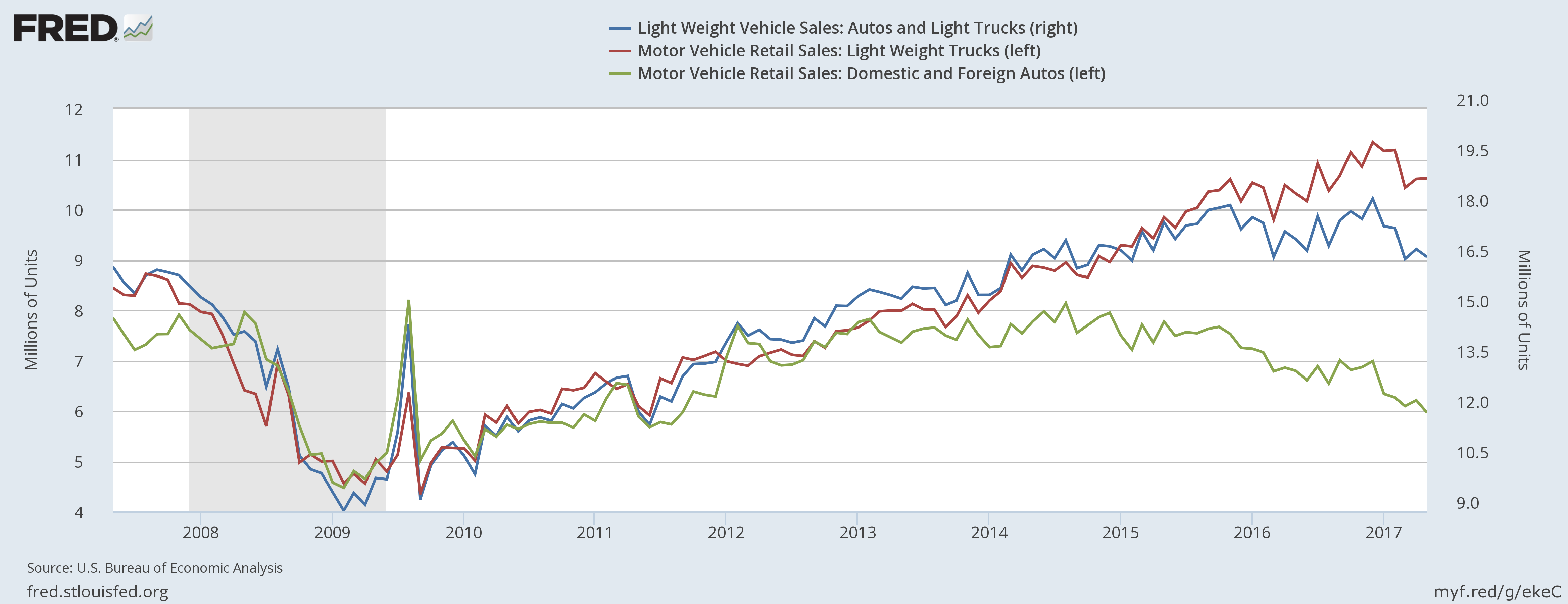

Auto sales were down 2% Y/Y and 1% M/M. Looking at this data series’ components, car sales have been declining for a few years while truck sales have plateaued:

This data series has been weaker for most of this year. There are several news reports detailing higher incentives on the part of auto manufacturers, which indicates demand is waning a bit. However, overall sales levels are slightly lower; they haven’t cratered.

Economic Conclusion: while bullish, these week’s news was sentiment based – people are thinking more positive economic thoughts. This does have an effect on economic activity. But since the election, the split between sentiment and hard data has been pronounced.

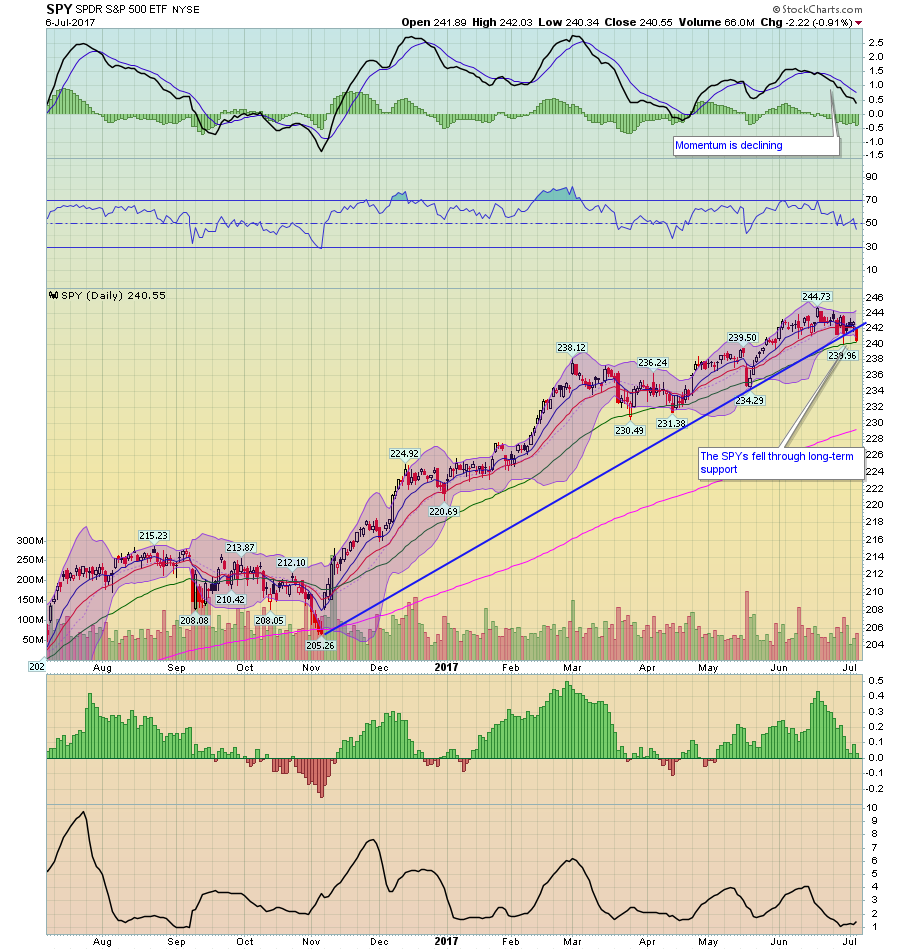

Market Overview: This past week the markets barely moved. The strongest price movement occurred in the Treasury market, where the TLTs and TLHs each continued their recent move lower. In the equity markets, the SPYs joined the QQQs in breaking through technical support:

As of now, however, I wouldn’t classify this as a signal that we’re about the see an impending mass sell-off. The underlying economy remains in a “modest” growth mode. There are some pockets of modest weakness – look at sub-categories of industrial production and personal consumption expenditures – but nothing indicating the economy is headed for an imminent recession. And earnings are trending in a positive way:

Of such companies with fiscal quarters end in May, we have seen results from 23 S&P 500 members. This is too small a sample to draw any firm conclusions from. But for whatever it is worth, the growth and proportion of positive surprises for these 23 index members are tracking above what we had seen from the same cohort of companies in other recent periods.

Q2 Estimates have come down since the quarter got underway, but the magnitude of negative revisions nevertheless compares favorably to other recent periods.

Total Q2 earnings for the S&P 500 index are expected to be up +5.7% from the same period last year on +4.6% higher revenues. The Energy, Aerospace, Finance, Technology, Construction and Industrial Products sectors are expected to be big growth drivers in Q2, with the quarterly earnings growth pace dropping to +3.3% on an ex-Energy basis.

It's most likely that the current market weakness is a combination of an expensive market, high levels of underlying bullishness and the summer doldroms coming home to roost. Plus, a move lower at this point wouldn't be a bad thing. But don't expect a massive sell-off, either. With earnings growing and the underlying economy still expanding at a "moderate" pace, we should be in good shape for now.