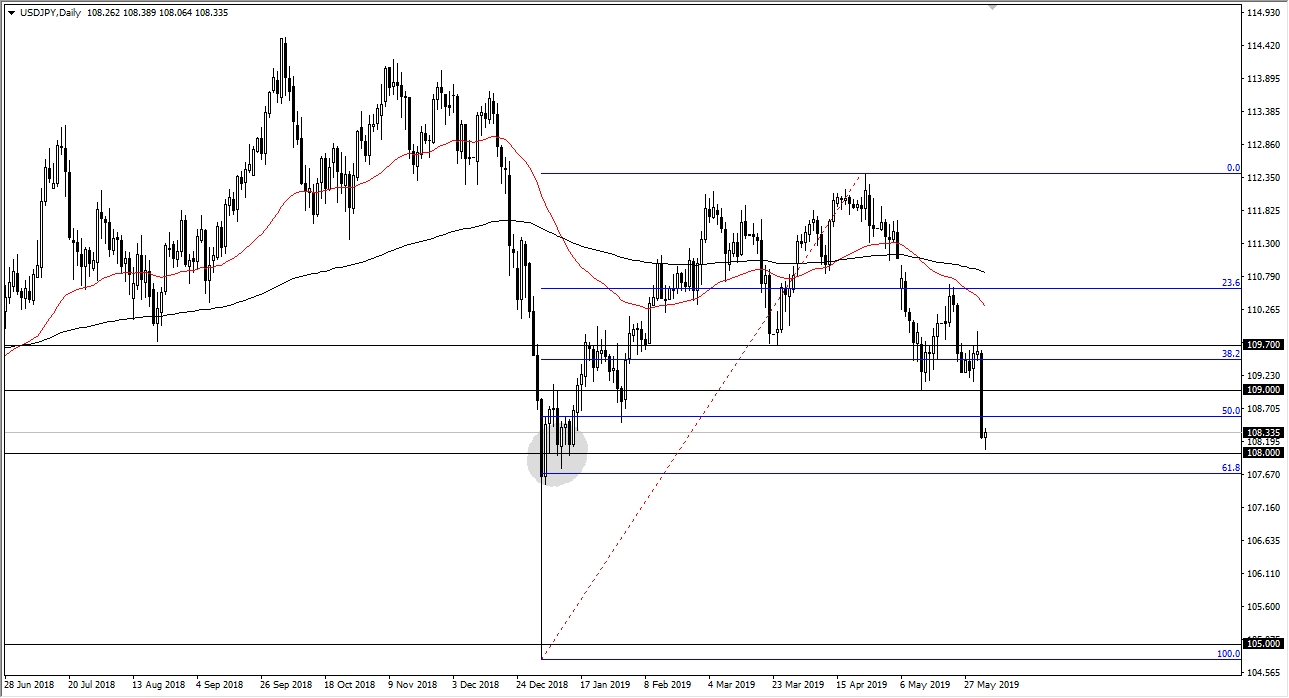

The U.S. dollar initially fell during trading on Monday but seems to be finding a bit of a floor near the 100 yen level. At this point, the question now is whether or not we continue to break down. Obviously, there is a lot of negativity out there but we are testing a major support level in the form of ¥108. This is an area that has been important more than once, and below there we also have the 61.8% Fibonacci retracement level.

If we were to break down below there, that opens up the door all the way down to the ¥105 level, which would suggest a significant break down and risk appetite around the world, not just in this pair but perhaps all the way over in the S&P 500 and many other risk appetite related markets.

In the short term though, we could see a bounce towards the ¥109 level. If that’s going to be the case then other markets will probably rally as well. Clearly, at the end of the Monday session we should have more answers. It’s a bit of a binary trade right now, if we can break above the top of the range for Monday, then we should go towards the ¥109 level. However, if we break down from here we could have an even bigger trades to the downside as the trapdoor falls open for risk appetite around the world. It’s very likely that this pair will move in congruence with the CAD/JPY pair, the EUR/JPY pair, the GBP/JPY pair, and pretty much anything else with the JPY attached at the end of it.

Between the ¥109 level and the ¥109.70 level there is a significant resistance barrier, so breaking above there could send this market much higher, perhaps reaching towards the 100 level ¥0.15 level above which is still the scene of a slight gap.