U.S. stocks rose on Tuesday, lifting the S&P 500 to a record, as Wall Street considered quarterly earnings and data that cast a benign light on inflation and progress in the housing market. Asian stock markets rose for a second session on Wednesday thanks to a positive lead from Wall Street but geopolitical concerns remained firmly in focus. European market also ended higher as Ukraine rebellions started co-operating by handing over the black box of Malaysian airlines for further investigation.

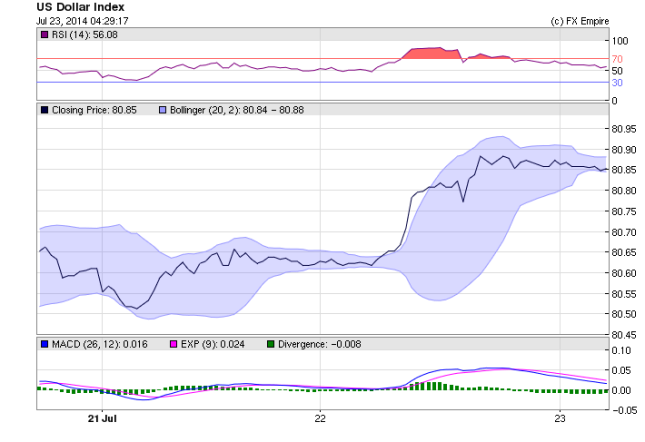

The US dollar gained steadily on Monday as traders shifted to the greenback as the beneficiary of safe haven trades leaving gold and the yen longing. The US dollar surged to trade at 80.86 also supported by a mix of data. The surprise fall in the euro is one of the reasons for the strength in the US dollar index. The euro and pound are trading at 1.3464 and 1.7071 respectively.

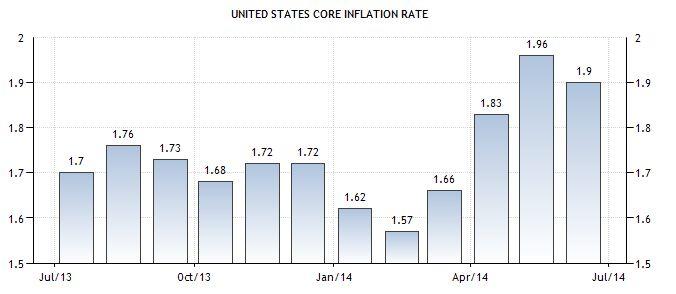

The greenback traded on a positive note and gained around 0.3 percent yesterday on the back of favorable economic data from the country. However, sharp upside in the currency was capped due to upbeat market sentiments which led to decline in demand for low yielding currency. The currency touched an intra-day high of 80.93 and closed at 80.87. US Core Consumer Price Index (CPI) was at 0.1 percent in June as against a rise of 0.3 percent in May. CPI was at 0.3 percent in last month from 0.4 percent in May. House Price Index (HPI) rose to 0.4 percent in May with respect to 0.1 percent a month ago. Richmond Manufacturing Index increased by 4 points to 7-mark in July when compared to 3-level in June.

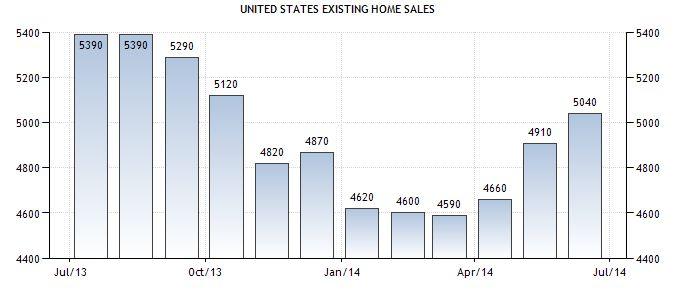

Existing Home Sales grew to 5.04 million in June from 4.91 million in May. The median forecast of 78 economists surveyed by Bloomberg projected sales would rise to a 4.99 million rate. Prices advanced at the slowest pace since March 2012 and inventories rose to an almost two-year high. Historically low interest rates and smaller price increases are helping bring homeownership within reach for more Americans. A pick up in employment opportunities that lead to faster wage growth would provide an added spark for a residential real-estate market that began to soften in the middle of 2013.

Another report today showed the cost of living rose in June, paced by a jump in gasoline that is now reversing. The consumer price index increased 0.3 percent after a 0.4 percent gain the prior month, figures from the Labor Department showed yesterday.

This morning the AUD soared adding 38 points to trade above the 94 level at 0.9432 and continuing to rise after the release of domestic inflation data. The Aussie has gained steadily since hitting an almost four-year low at the start of this year, driven by signs of improvement in its domestic economy and an easing off, at least for now, of nerves over Chinese growth. Governor Glenn Stevens, who has in the past engaged in verbal intervention to support growth, said he was content with the current level of interest rates, prompting markets to pare back slightly bets on another cut in rates this year. Data on Wednesday is also expected to show inflation topping its 2-3 percent target.

The Japanese currency eased a bit, with the dollar and the euro both up 0.1 percent but traders said the market was keeping a nervous eye on events in Ukraine and the Middle East and was unlikely to push it sharply lower in the near future. The USD/JPY is trading at 101.42 this morning.