- US Dollar stabilizes ahead of tomorrow’s Fed minutes.

- Yen gains on BoJ hike bets, euro slides.

- RBA cuts rates but sounds cautious about future moves.

- RBNZ to deliver another bold cut, focus to fall on guidance.

Dollar Steady Ahead of Fed Minutes

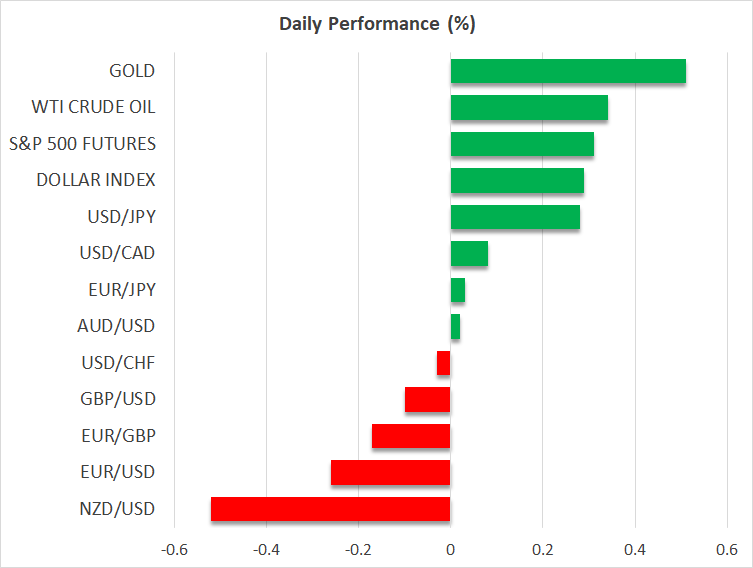

The US dollar traded lower against most of its major counterparts on Monday, but it is recovering some of the lost ground today as traders are preparing for tomorrow’s Fed minutes.

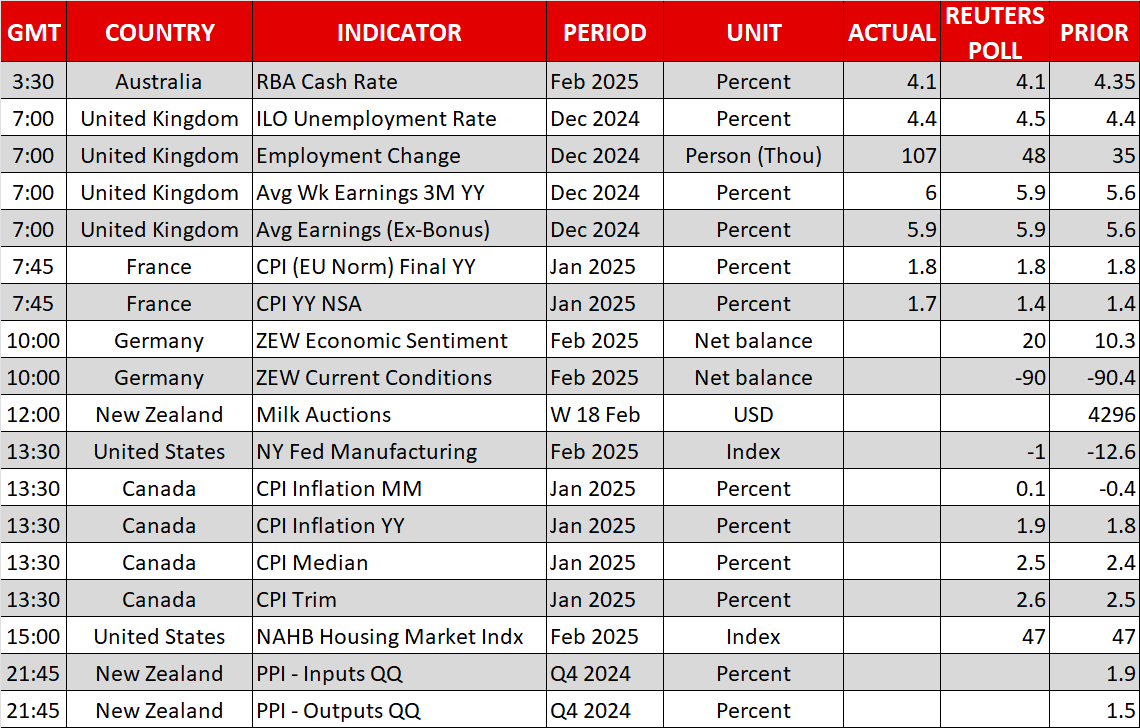

There was no top-tier US data on Monday’s agenda as the nation was on holiday for Presidents' Day. However, three Fed officials voiced their opinion on monetary policy, with two of them, Philadelphia President Harker and Governor Bowman, noting that keeping interest rates untouched is the appropriate strategy for now, with Bowman expressing concerns about Trump’s trade policies. Only Governor Waller sounded a bit more dovish, saying that his “baseline” view is that Trump’s tariffs will have only a modest impact on inflation and that the Fed should look through these effects when setting policy.

With all that in mind, investors may scrutinize the minutes of the latest Fed decision tomorrow for clues on how willing policymakers are to adjust their policy should upside risks to inflation become more prominent. According to Fed funds futures, investors are now penciling in 40bps worth of rate reductions this year, a slightly more hawkish view than the Fed’s projection of 50bps cuts.

BoJ Could Hike in July, Euro Traders Focus on Ukraine Peace Talks

The Japanese yen was the biggest gainer on Monday, boosted from Japan’s upbeat GDP data, which cemented the case for more rate hikes from the BoJ this year. Investors are now expecting 37bps worth of additional rate increases while assigning an 80% chance of the next hike being delivered in July.

The euro was among the currencies that failed to take advantage of the dollar’s slide yesterday, and it is on the back foot today as traders are likely biting their nails in anticipation of potential Ukraine peace talks. Officials from the US and Russia are scheduled to meet in Saudi Arabia today, excluding representatives from Kyiv and Ukraine's European allies.

RBA Delivers Hawkish Cut, RBNZ Meets Next

In Australia, the RBA has begun its own easing cycle by delivering a 25bps rate cut today, as was broadly anticipated but sounded more cautious about future rate cuts. The Aussie gained at the time of the decision but was quick to give back a large portion of the immediate gains. As for investors’ expectations about the RBA’s future course of action, they are now penciling in an additional 40bps worth of cuts.

Tonight, the central bank torch will be passed to the RBNZ. Expectations are for another bold 50bps reduction, but investors are pricing in a slower easing pace for the remainder of the year. Therefore, another double cut is unlikely to shake the Kiwi much, and investors are likely to turn their attention to the forward guidance and the updated economic projections for clues on how the Bank may proceed hereafter.

With Trump imposing tariffs on China, New Zealand’s main trading partner, and the New Zealand economy already in recession, it may be hard for Governor Orr to sound more hawkish at this gathering. Thus, leaving the door open to more reductions than the market is currently penciling in could weigh on the Kiwi.

US Stock Futures Rise to Start Shortened Week

Wall Street was closed yesterday, while futures are pointing to a higher open today despite Trump reiterating yesterday his plans for imposing reciprocal tariffs against countries trading with the US. Although Trump’s plans are inflicting uncertainty, the fact that Trump signaled the reciprocal tariffs will be imposed by April may be allowing for some near-term relief.