- Soft US PPI and reports of Fed dilemma revive bets of 50bps cut

- Dollar plunges as yields fall, pushing gold to new all-time high

- Euro climbs as ECB trims rates but does not signal October cut

Fed Rate Cut Expectations Swing Wildly

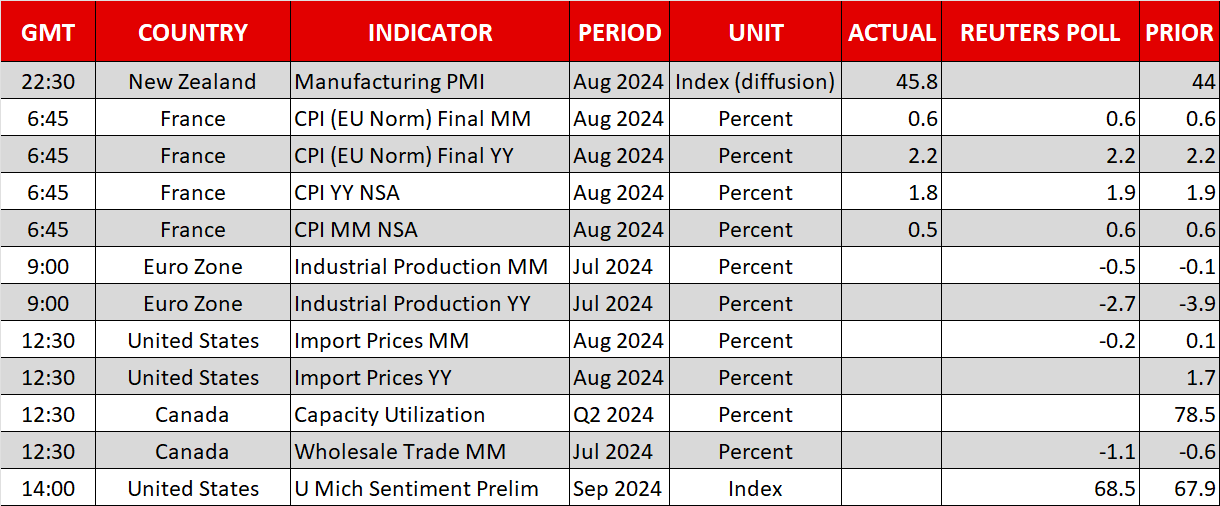

Expectations of a 50-basis-point rate cut by the Fed in September had all been priced out by investors. But softer-than-expected US producer prices and reports that Fed officials are debating the size of next week’s anticipated rate reduction have refueled market bets of a larger move.

The odds of a 50bps cut initially started to regain traction after yesterday’s August PPI numbers provided some much-needed reassurance to investors that price pressures in the US are indeed subsiding. Doubts about the inflation and broader economic outlook were seeded by the recent mixed NFP and CPI reports.

However, it wasn’t until both the Financial Times and the Wall Street Journal published articles late in the US session about the Fed facing a dilemma on whether to slash rates by 25bps or 50bps that investors started to reevaluate their expectations for next week’s decision.

Fresh Blow for Dollar Bulls as Gold Shines

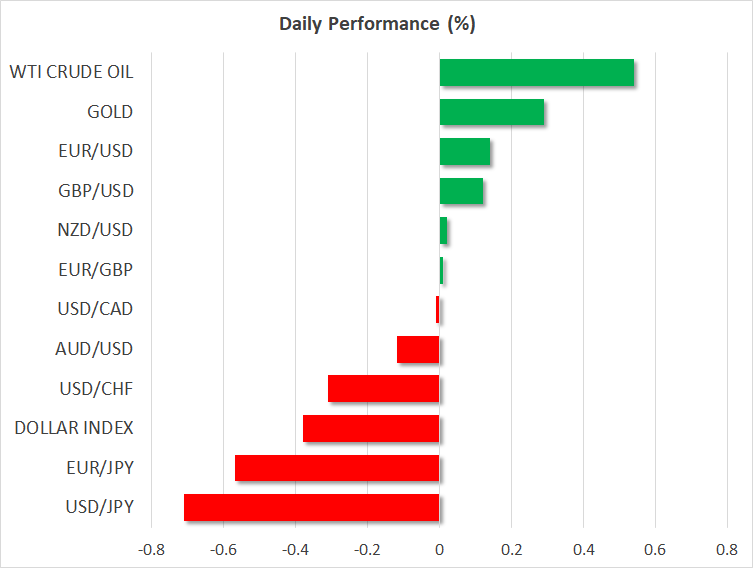

The probability of a double rate cut has risen to more than 40% overnight, bringing fresh pain for the US dollar but boosting shares on Wall Street and gold prices. The moves in bond markets were more muted, but with Treasury yields already at more than one-year lows, the greenback came under heavy selling pressure.

Against the Japanese yen, which has been bolstered this week by hawkish remarks by Bank of Japan officials, the dollar slumped to its lowest since December earlier today, hitting 140.41 yen.

Gold, meanwhile, jumped by 1.9% on Thursday and is extending its gains today to climb to new record highs above $2,570/oz.

The dovish pivot by the world’s major central banks is now well underway, underscoring gold’s uptrend. The ECB cut rates by 25bps yesterday for the second time this year and the Fed will likely follow suit on Wednesday. The Bank of England is not expected to cut next week but may flag one for its next gathering, while the BoJ will also probably stand pat, although the latter stands out as being the only one that’s on a hiking cycle.

Euro Up as ECB Uncommitted to October Cut

The ECB’s decision lifted equities in Europe but barely dented the euro, as investors were disappointed that President Christine Lagarde offered no clues about the pace of future reductions. There were some hopes that with the Eurozone economy weakening and headline inflation edging closer to 2%, Lagarde would have opened the door to a back-to-back cut in October.

But whilst that’s still possible, the odds are very low at this point and the euro is set to finish the week slightly higher against its US counterpart as it eyes the $1.11 handle. For the dollar, however, there is still one more test to go before the week is over and that is the University of Michigan’s preliminary consumer sentiment survey where traders will be watching the inflation expectations for September.

Weekly Gains for Stocks, Gold and Oil

On Wall Street, the Nasdaq is headed for strong weekly gains on the back of a rebound in tech stocks as well as the renewed bets of aggressive Fed easing, although some pullback is possible today.

In commodities, gold isn’t the only winner as oil futures have also posted a solid recovery over the past couple of sessions despite both the IEA and OPEC forecasting weak demand growth for oil for this year and next. However, disruptions to supply in the Gulf of Mexico due to Hurricane Francine passing through the region has provided a short-term reprieve for oil prices.