- The US Dollar Index (DXY) surged as markets anticipated a Donald Trump victory in the US presidential election.

- Market sentiment suggests a Trump presidency and Republican majority will boost the US economy, leading to a stronger US dollar in the medium term.

- Trump’s proposed policies on tariffs and tax cuts could impact US inflation and interest rates expectations.

The US Dollar exploded to the upside as Donald Trump is expected to be confirmed as the 47th President of the United States in a remarkable comeback. Markets appeared buoyed by the news with Wall Street Indexes, the US Dollar and Bitcoin all rallying as results filtered through.

US Dollar Strength to Continue?

The US Dollar Index (DXY) had been on the back foot since the start of the week but roared to life in the Asian session. The DXY erased early week losses to hit a fresh high around 105.300 as the potential for a Trump clean sweep grows.

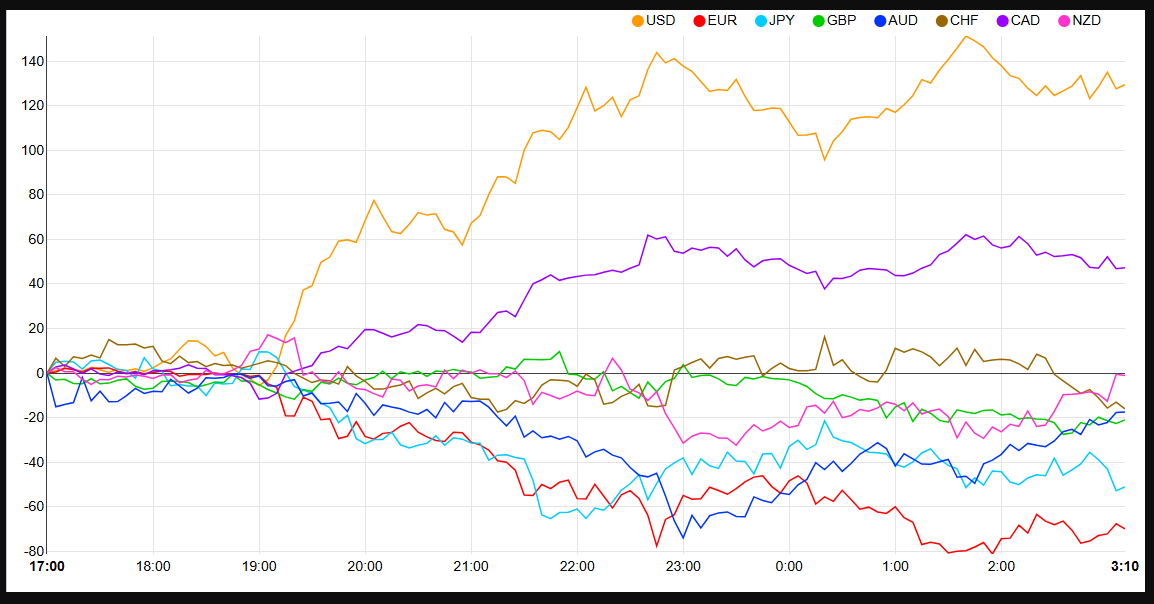

Currency Strength Chart (Strongest to Weakest): USD, CAD, NZD, CHF, AUD, GBP, JPY, EUR.

Source: FinancialJuice

The Strength in the US dollar is largely down to expectations that Donald Trump’s idea around tariffs could contribute to a renewed rise in US inflation and lead to less rate cuts moving forward. This is reflected by the OIS curve which has recorded some 10bp+ repricing across 2025 tenors. That embeds a policy rate close to 4.0% in June 2025, almost 100 bps higher than mid-September pricing.

Market participants also seem to be of the opinion that a Trump Presidency and Republican majority will be good for the economy. The surprise for me here is that the US economy has actually been strong this year, which begs the question what changes are markets expecting?

There have been a few comments already from Trump, who has promised to lower taxes and pay down debt as well. This may prove to be a challenge but time will tell. Trump has also stated that he doesn’t wish to start more wars but rather end them, something which could have an impact on safe-haven currencies like the CHF, JPY and of course Gold prices moving forward.

The Federal Reserve meeting on Thursday may be overshadowed by the election as markets have largely priced in a 25 bps cut. This meeting will also be too soon for any updates to the Feds projections due to changes in policy by a potential Trump Presidency.

Until announcements around tariffs and tax cuts are made and the implications begin, the Fed is likely to maintain its current stance. However, market participants as always are already moving to price in such eventualities and this in theory could keep the USD on the offensive moving forward. Intriguing times are ahead for the US Dollar and global markets as the year-end approaches.

Technical Analysis

The DXY enjoyed an impressive rally from the back end of September until October 24, before beginning a period of consolidation. This was followed be a brief pullback this week as markets prepared for the US election. The drop in the DXY could also be attributed to potential profit taking following the DXY’s impressive rally.

Moving forward however, a lot will depend on whether the Republicans secure a clean sweep and control the house and congress. Such a move would make it easier for Trump to push through changes around tariffs and potential tax cuts which will be driving force for the US Dollar in the months ahead.

The DXY briefly traded above the psychological 105.00 handle for the first time since July. The question now is whether the DXY will experience a pullback or push on and immediately gain acceptance above the 105.00 handle. I would suggest paying attention to what happens with the house, while a congress split could have severe implication for the DXY and other markets moving forward.

A republican clean sweep however, will likely see the DXY gain acceptance above the 105.00 handle with the next areas of resistance resting around 105.63 and 106.00.

Conversely, a push lower in the DXY would see the index face support at previous highs around 104.50 before the confluence area between 103.80 and 103.00 comes into focus. This could be a key area of support for the DXY as it holds the 100 and 200-day MAs as well as a few key levels and is a strong area of support.

US Dollar Index (DXY) Daily Chart, November 6, 2024

Source: TradingView.com

Support

- 104.50

- 103.80

- 103.00

Resistance

- 105.00

- 105.60

- 106.00

Most Read: Trump or Harris? Why the Nasdaq 100, S&P 500 Might Not Care Who Wins