- The US Dollar Index (DXY) has seen a strong rally this week, fueled by expectations of a 25 bps Fed rate cut in November and safe-haven flows amid rising Middle East tensions.

- Meanwhile, the GBP/USD pair experienced a sharp selloff following comments by BoE Governor Bailey.

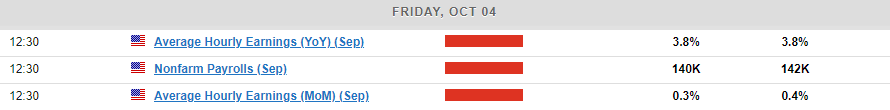

- The NFP report and US unemployment rate will be key catalysts for both the DXY and GBP/USD tomorrow.

US Dollar Index Starts Q4 with a Bang

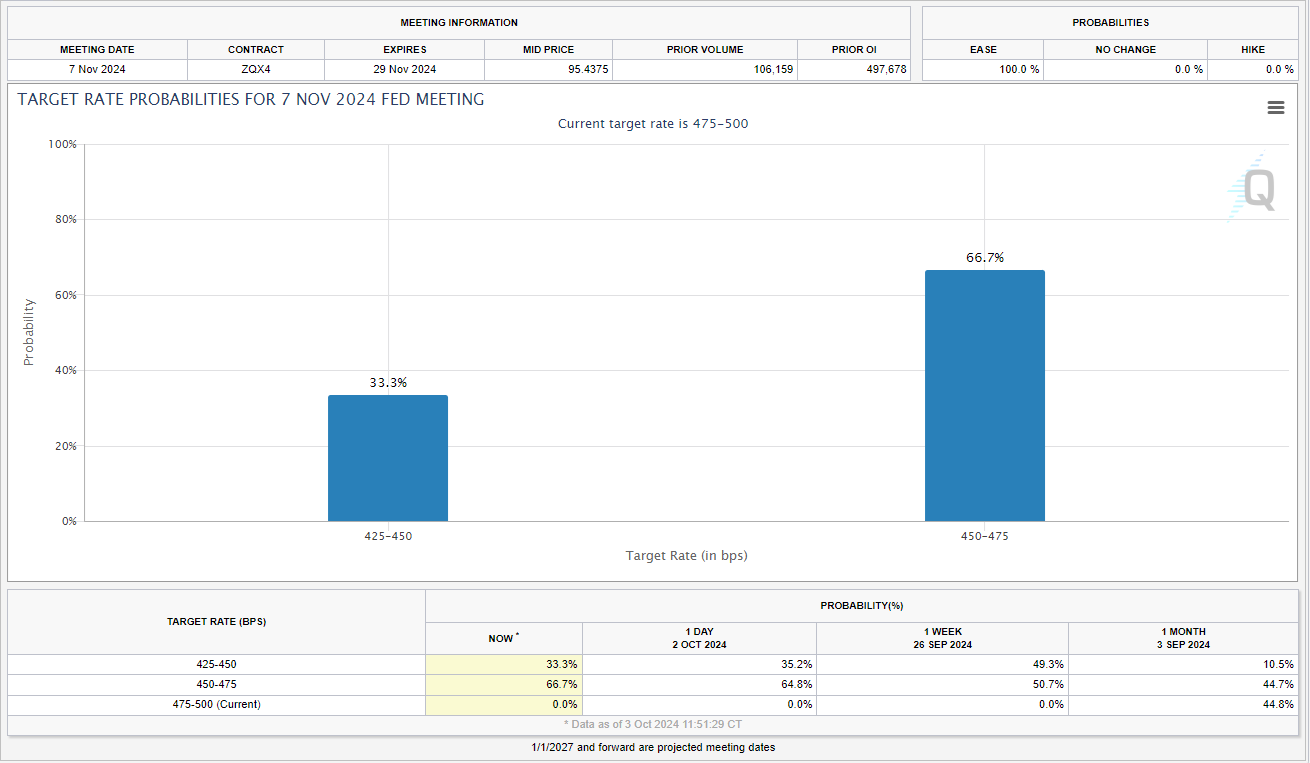

The US Dollar has been enjoying somewhat of a renaissance this week, up around 1.57% at the time of writing. Consensus has been growing throughout the week for a 25 bps cut from the Fed in November and this has fueled a US Dollar recovery.

Comments overnight from former Fed Policymaker William Dudley overnight have only added fuel to the fire.

Former Policymaker Dudley appeared to back up comments from Fed Chair Powell this week where the Fed Chair himself appeared to rule out a 50 bps cut in November.

Source: CME FedWatch Tool

The US Dollar has also benefited from safe haven flows this week as rising Middle East tensions have helped the greenback. The Dollar recovery has come at a time when many of its peers are experiencing a dovish tilt as well which has exacerbated the losses in pairs like EUR/USD, GBP/USD and USD/JPY.

US Dollar Index (DXY) Technical Analysis

The US Dollar Index (DXY) has been on a four-day winning streak this week but is now in overbought territory on a four-hour chart (H4). There is a key resistance area resting just above the 102.00 handle which could cap gains ahead of the NFP report tomorrow.

I expect a lot of rangebound price action ahead of the NFP report. The weekly and daily close tomorrow will be crucial in determining whether the USD index rally will continue on into next week.A daily and weekly candle close above the 102.165 could open up further gains next week.

US Dollar Index Daily Chart, October 3 , 2024

Source:TradingView.com

Support

- 101.18

- 100.50

- 100.00

Resistance

- 102.16

- 102.64

- 103.00

GBP/USD Slides as Governor Bailey Hints at Aggressive Rate Cuts

Cable experienced an accelerated selloff today following an impressive rally since the beginning of August. Having topped off around the 1.3400 handle the pair has since shed about 300 pips to trade just above the 1.3100 handle.

The selloff today was down largely to comments by Bank of England (BoE) Governor Andrew Bailey. In an interview with the Guardian, Bank of England Governor Andrew Bailey mentioned that they might take a more active approach to rate cuts if inflation continues to improve. These remarks led to a selloff of the Pound Sterling during the early European session on Thursday. As a result of the widespread GBP weakness, the GBP/USD pair fell around 1.11%.

Immediate resistance rests at 1.3143 before the 1.3250 comes into focus. Immediate support is provided by the daily low around 1.3100 before attention turns to the all important 1.3000 psychological level.

GBP/USD Daily Chart, October 3, 2024

Source:TradingView.com

Support

- 1.3100

- 1.3000

- 1.2942

Resistance

- 1.3143

- 1.3262

- 1.3354

Looking ahead and tomorrow brings the NFP report and US unemployment rate which could be the catalyst needed for the rally to continue.

The DXY is approaching some key technical levels and could benefit from a stronger-than-expected NFP print. Will the greenback be able to hold onto the week’s gains?

Most Read: JPY Price Action Ideas: EUR/JPY, GBP/JPY and USD/JPY