- The Japanese Yen faces uncertainty due to a new PM, snap elections, and shifting market sentiment.

- Despite a strong US Dollar and GBP, the Yen saw a temporary boost from safe-haven flows amid geopolitical risks.

- USD/JPY is range-bound, with a potential breakout above 146.37 hinting at a run toward 150.00.

The Japanese Yen is going through a bumpy week with a new PM incoming, snap elections and modest safe-haven gains. The list of issues facing the currency continues to expand as markets assess the monetary policy path of the incoming PM.

Comments thus far do not suggest any significant changes with incoming PM Ishiba today stating he expects the monetary easing trend to stay in place. The PM also mentioned that he expects to work closely with the BoJ to overcome deflation and improve the economy.

Governor of the BoJ Kazuo Ueda who was brought in largely to facilitate a normalization in policy looks likely to continue his work without too much outside influence. At present markets are still unsure as to when the BoJ may raise rates again and this is in part responsible for the recent Yen weakness.

The Yen did catch a bid on Tuesday as heightened geopolitical risks saw a flood into haven assets as the risk-off mood began to take hold.

However, today we are seeing a strong US Dollar and GBP in particular which has pushed yen pairs higher on the day.

Economic Data Ahead

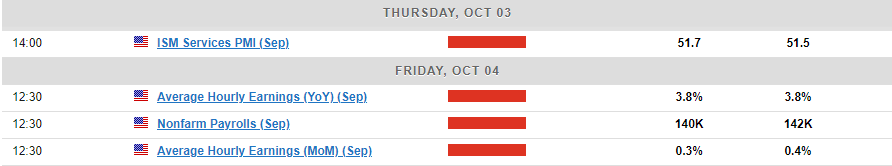

On the economic data front, there is nothing major expected this week from Japan, the EU or the UK. The biggest data release is the NFP and jobs report on Friday out of the US which could affect USD/JPY but could also have a knock-on effect on overall market sentiment.

Beyond that, it is key to keep an eye on developments in the Middle East. Any changes could see a flood into safe havens once more which could work in the Yen's favor, even if it only proves to be temporary.

Technical Analysis

USD/JPY

The USD/JPY pair has been hovering in a range of about 500 pips for the last 8 trading days. The return of USD strength has helped the pair stave off a retest of the psychological 140.00 handle.

At the time of writing USDJPY is eyeing a candle close above a key resistance area which could open up a run toward the 150.00 psychological mark. A rejection at the 146.37 handle could however lead to a push toward the most recent lows.

On the daily timeframe price action is messy as well with a higher high followed by a lower low and change in structure. A daily candle close above the 145.00 is enough to see another change in structure which would suggest that favor currently rests with the bulls.

Support

- 145.00

- 143.65

- 141.67

Resistance

- 146.37

- 147.20

- 150.00

USD/JPY Daily Chart, October 2, 2024

Source: TradingView.com

GBP/JPY

GBP/JPY is at a key confluence area which could help define the upcoming price action for the pair. Having been stuck in a range since Monday it was nice to see a bit of GBP strength return and push the GBP/JPY to closer to the 200.00 psychological mark.

Immediate resistance rests at 195.859 which is provided by the 100-day MA. A break beyond this level opens up a potential run toward 200.00.

GBP/JPY Daily Chart, October 2, 2024

Source: TradingView.com

Support

- 192.77

- 190.00

- 185.00

Resistance

- 195.86

- 198.00

- 200.00

EUR/JPY

The EUR/JPY is almost identical in terms of price action to the GBP/JPY. The increasing rate cut bets where the ECB are concerned has failed to dampen the spirits of EUR/JPY bulls.

Technically speaking, following the significant selloff in EUR/JPY which began on July 11, EUR/JPY has yet to retrace even 50% of that move.

This means room for a deeper recovery remains in EUR/JPY and given the lack of data expected out this week we could very well get a continuation of the recent bullish price action.

Immediate resistance rests at 161.85 with a break higher facing a key confluence zone around the 163.50-164.00 handles.

EUR/JPY Daily Chart, October 2, 2024

Source: TradingView.com

Support

- 160.00

- 158.00

- 156.72

Resistance

- 161.85

- 163.50

- 165.00