Investing.com’s stocks of the week

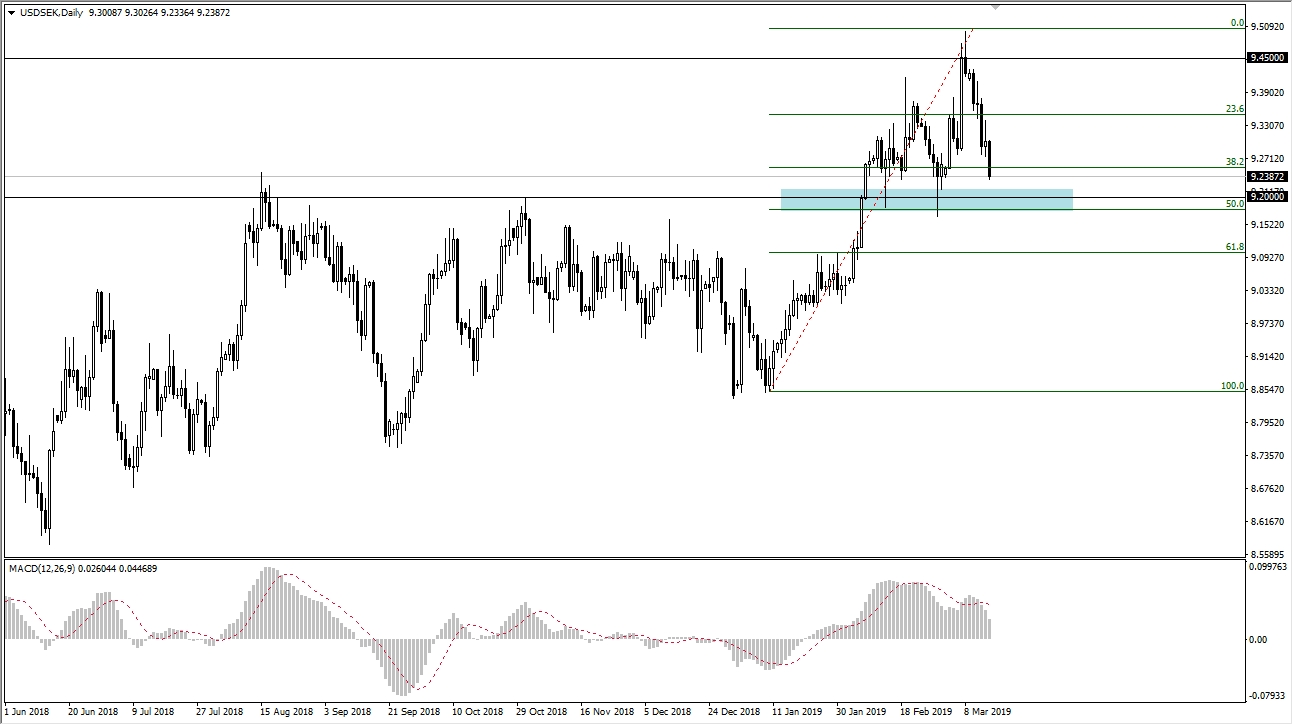

The US dollar has pulled back against the Swedish krona again during trading on Friday. As we approach the 9.20 level, it’s an area that has been supportive more than once. The question now is whether or not we can break down through it?

The candle stick from the Friday session is rather negative, and we had recently hit a psychologically important level in the form and 9.50, so it makes sense that we will pull back from that level. At this point, if we break down below the 9.17 level, then the market goes down to the 9.10 level after that. It’s at that area that we will find the 61.8% Fibonacci retracement level, and we can reassess whether or not we are getting ready to bounce.

That being said, if we do bounce from the 9.20 level, the market could very well turn around to go towards the 9.33 handle. Expect a lot of volatility in this pair, but that makes sense considering that the Swedish krona is a proxy for risk, and as this pair falls it is essentially a “risk on” signal. All things being equal though, we have fallen rather hard and rather quickly. Beyond that, we have also wiped out a massive bullish candle stick from last week, and that of course is a very negative sign as well.

The market will continue to go back and forth, showing signs of volatility as per usual, as this pair typically does, but I think we are looking at the potential of a break down which would be good for all risk assets such as the S&P 500, or perhaps even the precious metals markets. Even if you don’t trade the USD/SEK pair, it’s a great tertiary signal for other markets around the world. Since the financial crisis, we have essentially been either “risk on” or “risk off”, which this pair is a great demonstration of.