As discussed in Bull Mania, the signs of market exuberance did not diminish during the recent correction. With the market well ahead of fundamentals, as money continues to chase performance, the “risk” remains elevated.

In this past weekend’s newsletter, “Wall Street Wins Again,” I stated:

“[The expected rally] was indeed the case as the markets successfully tested and held the 50-dma (red dashed line.) Despite the fact money flows remained weak, as shown in the chart below, the market did manage to regain previous highs.”

“While the money flow ‘buy signal’ will likely trigger next week, the market is already trading 2-standard deviations above the 40-dma. Such suggests that the upside may be more limited over the next couple of weeks.”

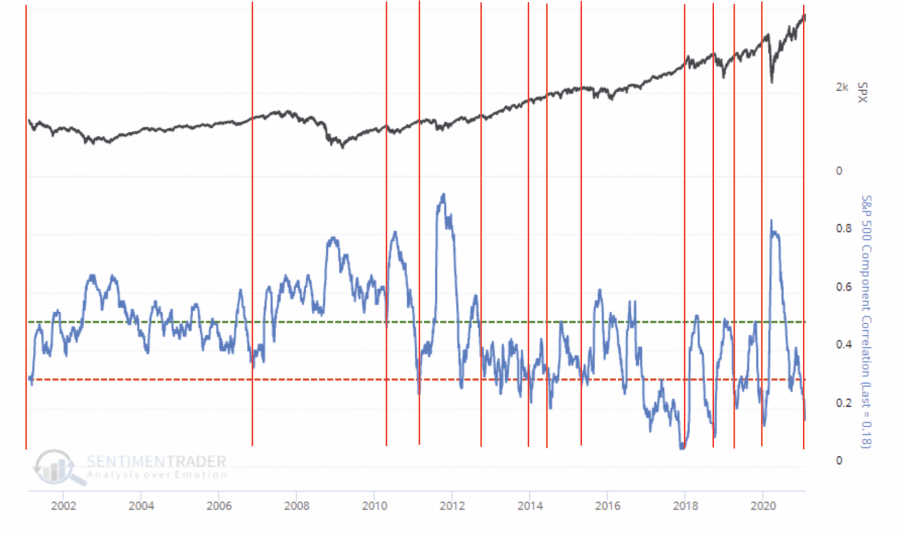

The more critical point in the newsletter concerning the market was the breakdown in correlations between the market and its underlying constituents. To wit:

“Currently, the number of stocks outperforming the market is dropping sharply. Such is notable because the correlation among stocks in the S&P 500 plunged to the lowest level in over a year.’ – Sentimentrader

“What is also notable is that these periods of low correlations typically align themselves with previous market tops. Topping process can take some. Generally, it is long enough for investors to dismiss the warning as ‘wrong this time.’ The subsequent correction can range from mild to more extreme.”

What we know is that markets move based on sentiment and positioning. Such makes sense considering that prices are affected by buyer’s and sellers’ actions at any given time. Most importantly, when prices, or positioning, become too “one-sided,” a reversion always occurs.

As Bob Farrell’s Rule #9 states:

“When all experts agree, something else is bound to happen.”

So, how are traders positioning themselves currently?

Positioning Review

The COT (Commitment Of Traders) data, which is exceptionally important, is the sole source of the actual holdings of the three critical commodity-trading groups, namely:

- Commercial Traders: this group consists of traders that use futures contracts for hedging purposes. Their positions exceed the reporting levels of the CFTC. These traders are usually involved with the production and processing of the underlying commodity.

- Non-Commercial Traders: this group consists of traders that don’t use futures contracts for hedging and whose positions exceed the CFTC reporting levels. They are typically large traders such as clearinghouses, futures commission merchants, foreign brokers, etc.

- Small Traders: the positions of these traders do not exceed the CFTC reporting levels, and as the name implies, these are usually small traders.

The data we are interested in is the second group of Non-Commercial Traders (NCTs.)

NCT’s are the group that speculates on where they believe the market will head. While you would expect these individuals to be “smarter” than retail investors, we find they are just as subject to “human fallacy” and “herd mentality” as everyone else.

Therefore, as shown in the charts below, we can look at their current net positioning (long contracts minus short contracts) to gauge excessive bullishness or bearishness.

Volatility

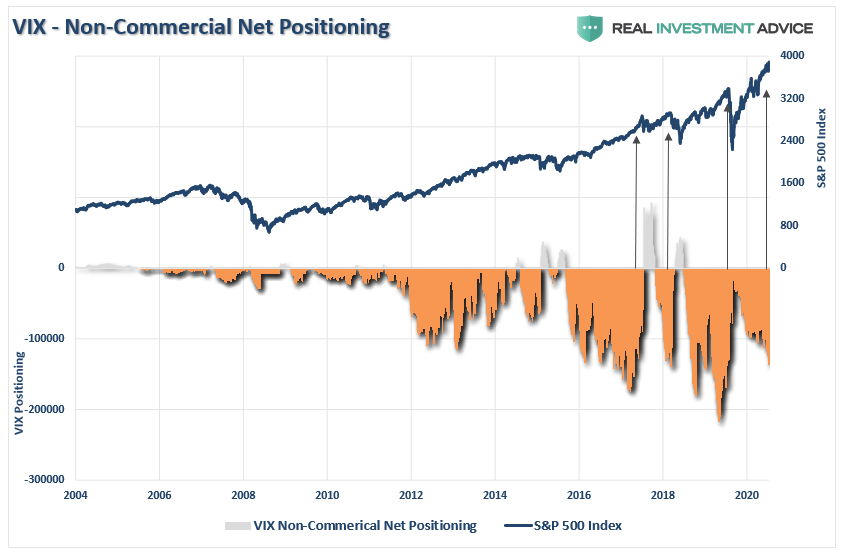

Since 2012, the favorite trade of bullish speculators has been to “short the VIX.” Shorting the volatility index remains an extraordinarily bullish and profitable trade due to the inherent leverage in options. Leverage is one of those things that works great until it doesn’t.

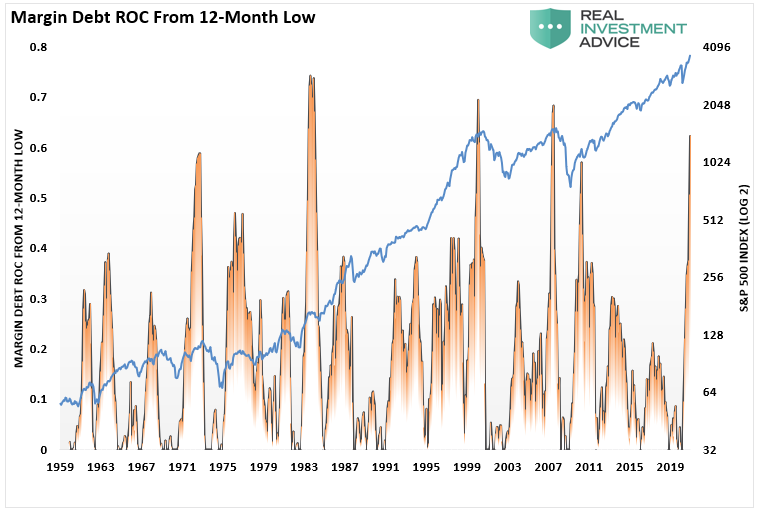

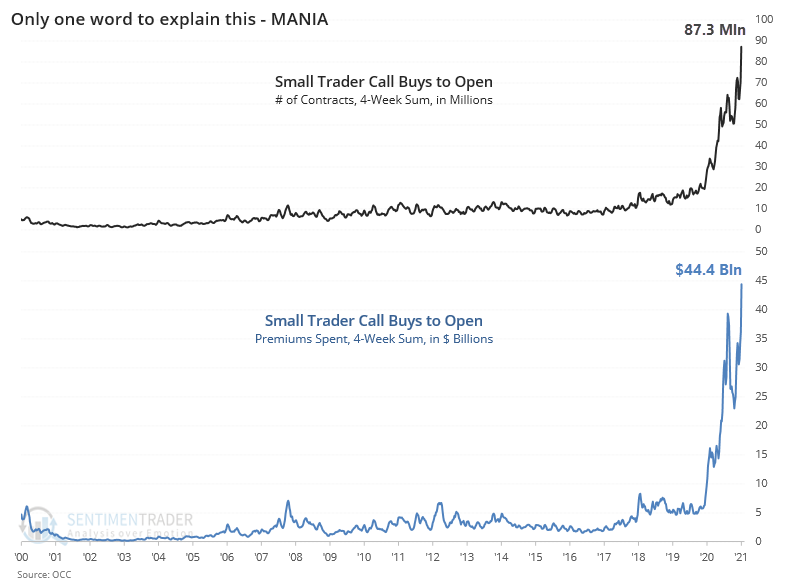

One of the more astonishing data points is that retail investors have increased risk markedly since the March lows. As noted last week, investors have not only taken on record levels of risk via speculative call buying but have also simultaneously increased margin debt to record levels.

Currently, net shorts on the VIX are rising sharply and are back to more extreme levels. While not as severe as seen in 2017 or 2019, the positioning is large enough to fuel a more significant correction.

The only question is the catalyst.

Crude Oil Extreme

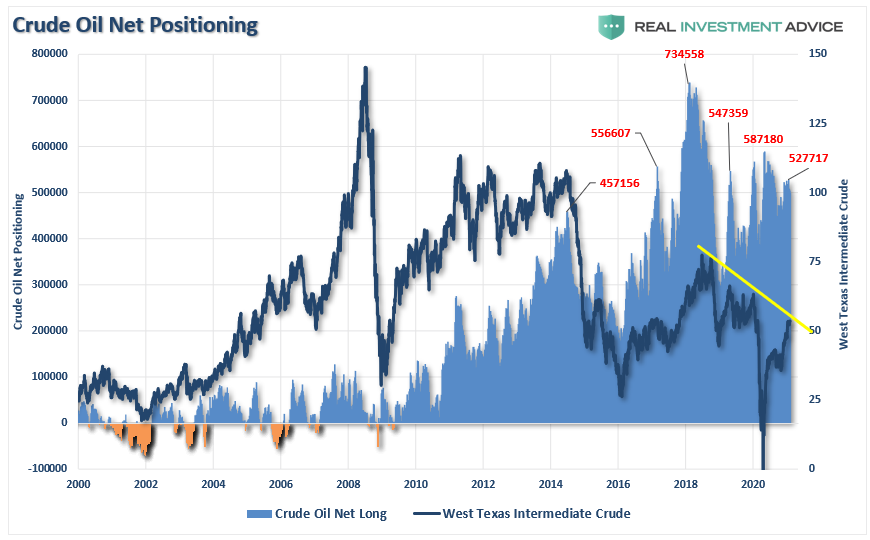

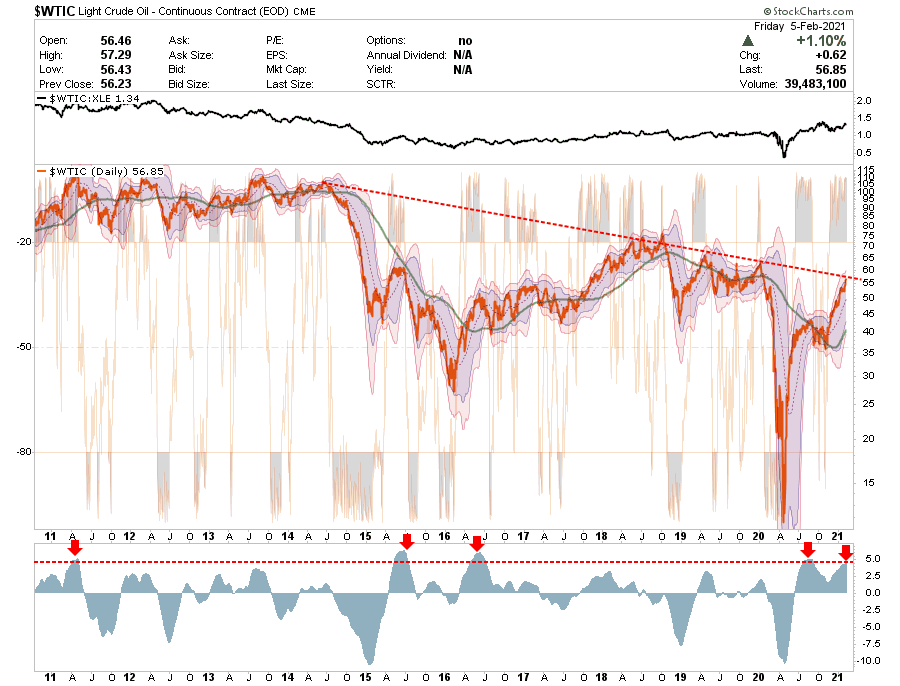

Crude oil has gotten a lot more interesting as of late. After a brutal 2020, with the price of oil futures going negative at one point, oil rebounded above $50/bbl. Given current expectations for a surge in “inflation” from the massive infusions of liquidity, the focus on highly speculative positions is not surprising.

Despite the massive surge in oil prices since March, “energy” stocks, as noted by the correlation of crude to XLE, have underperformed. Such is because the leverage in options increases speculative returns. It is worth noting that “expectations” of economic recovery are likely well ahead of reality. As such, the extreme overbought, extended, and deviated positioning in crude will likely lead to a rather sharp correction.

The speculative long-positioning is driving the dichotomy in crude oil by NCTs. While levels fell from previous 2018 highs during a series of oil price crashes, they remain more extreme at 527,717 net-long contracts. While not the highest level on record, it is definitely on the “extremely bullish” side.

Also, note in both charts, the declining trend in oil prices remains intact and continues to provide significant resistance.

As noted in the “Energy Rally Is Likely Premature,” The supply of oil, and lack of global demand, remains a longer-term problem for oil prices. Furthermore, rising interest rates, combined with a dollar rally, will likely derail the economic “reflation” story.

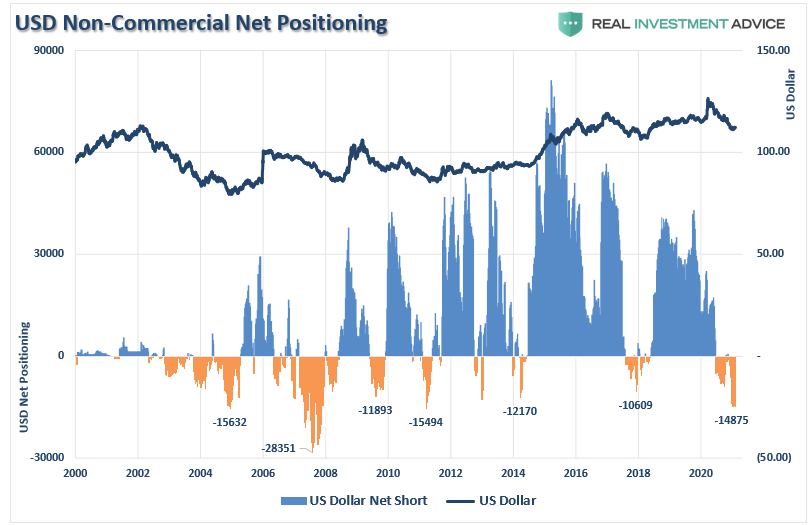

US Dollar Extreme

There are two major risks to the entire “bull market” thesis: interest rates and the dollar. For the bulls, the underlying rationalization for high valuations has been low inflation and rates. However, given an economy that is pushing $85 trillion in debt, higher rates and inflation will have immediate and adverse effects:

- The Federal Reserve gets forced to begin talking about hiking rates, tapering QE, and reducing accommodation; and,

- The consumer will begin to contract consumption as higher costs pass through from producers.

Given that personal consumption expenditures comprise roughly 70% of economic growth, higher inflation and rates will quickly curtail the “reflation” story.

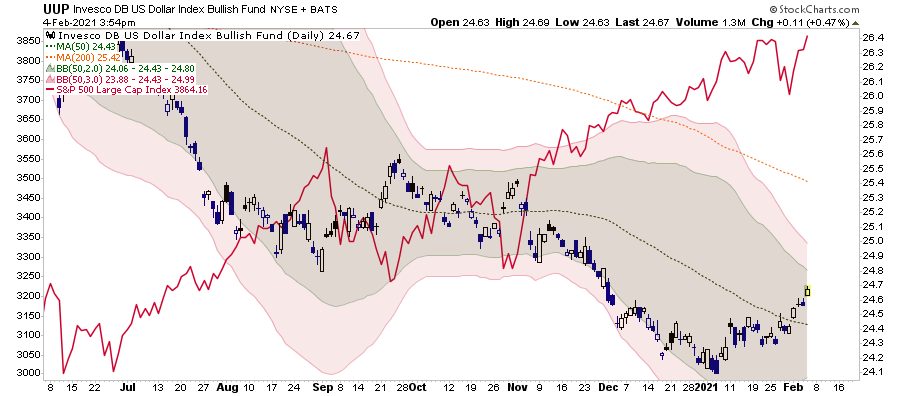

With the market currently priced for perfection, a disappointment of economic growth caused by a rising dollar or rates or a contraction in consumer spending will lead to a repricing of risk. As noted this past weekend, the dollar is the risk we are watching.

The one thing that always trips of the market is the one thing that no one is paying attention to. For me, that risk lies with the US Dollar. As noted previously, everyone expects the dollar to continue to decline, and the falling dollar has been the tailwind for the emerging market, commodity, and equity ‘risk-on’ trade. Whatever causes the dollar to reverse will likely bring the equity market down with it.”

Very quietly, the dollar has been rising and recently broke above its 50-dma. With a substantial net short position outstanding, a further rise could trigger shorts to begin covering, pushing the dollar up further.

As noted, such would not be welcome for the equity markets due to the non-correlation between the dollar and equities. Most importantly, a surging dollar, with rising interest rates, could put a severe dent in the “reflation trade.”

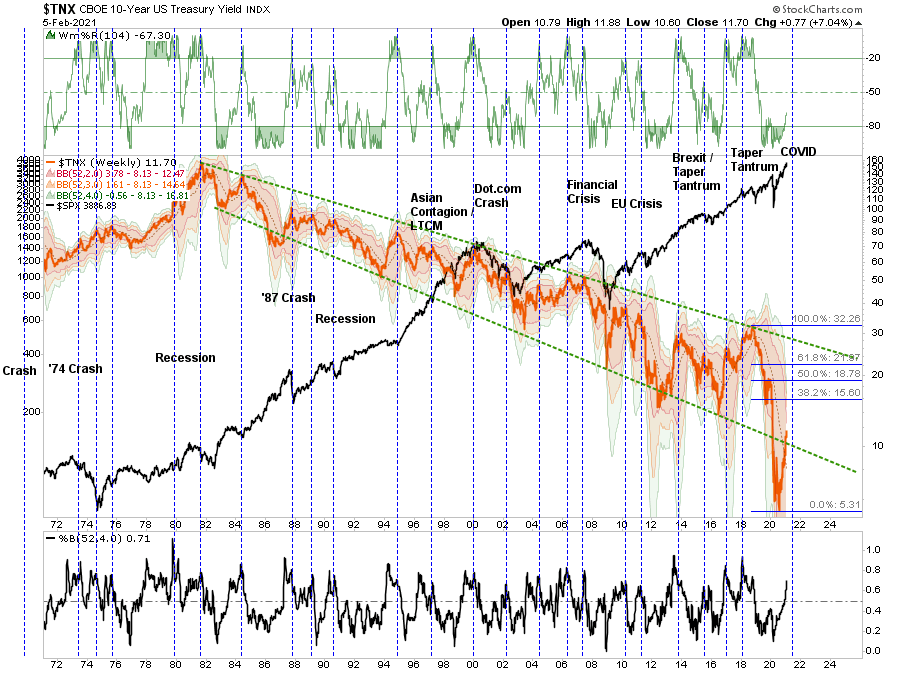

Interest Rate Conundrum

Over the latest several years, I have repeatedly addressed why financial market “experts” have been confounded by why interest rates fail to rise. In March 2019, I wrote: “The Bond Bull Market,” which followed up our earlier calls for a sharp drop in rates as the economy slowed.

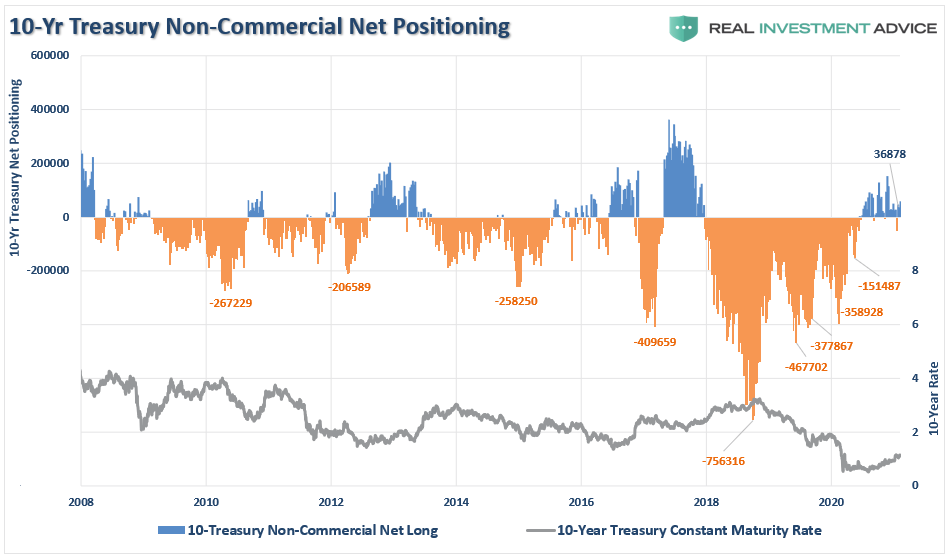

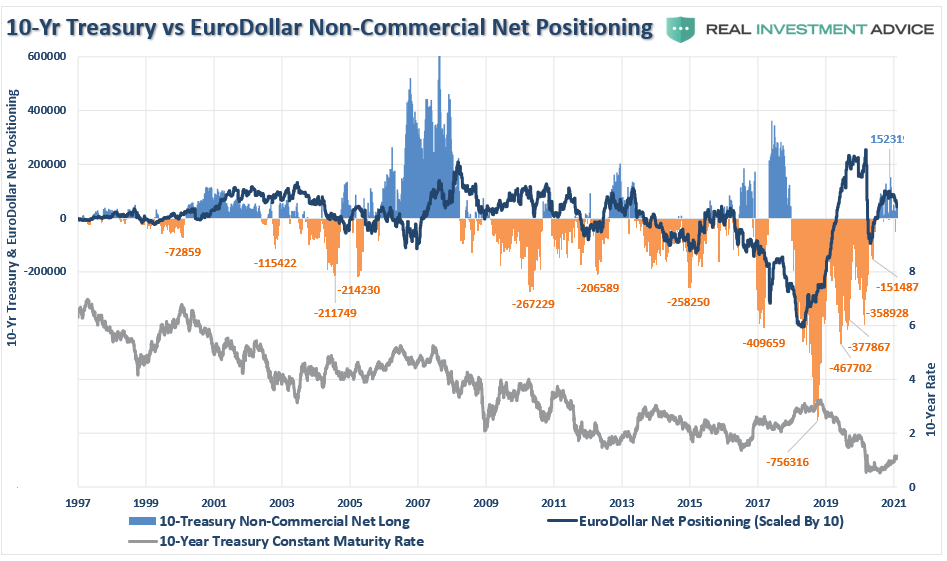

At that time, the call was a function of the extreme “net-short positioning” in bonds, which suggested a counter-trend rally was likely.

In March 2020, unsurprisingly, rates fell to the lowest levels in history as economic growth collapsed. Notably, while the Federal Reserve turned back on the “liquidity pumps,” juicing markets to all-time highs, bonds continued to attract money for “safety” over “risk.”

Recently, “bond bears” resurfaced, suggesting rates are going higher due to explosive economic growth. As noted above, such is unlikely given that higher inflation, a rising dollar, and rates all harm a debt-laden economy.

Can rates rise in the near-term due to “checks to households” that get spent to pull-forward consumption? Absolutely.

However, the limit of that increase in rates is between 1.56% and 2.19%. At these points, rates will collide with the outstanding debt.

The number of contracts “net-long” the 10-year Treasury already suggests the recent uptick in rates, while barely noticeable, maybe near its peak.

Importantly, even while the previous “net-short” positioning in bonds has reversed, rates failed to rise correspondingly. The reason for this is due to increasing levels of Eurodollar positioning as foreign banks push reserves into U.S. Treasuries for “safety” and “yield.”

With the number of bonds with “negative yields” rising globally, the U.S. Treasury bond’s positive yield and liquidity will likely keep it a preference for storage of reserves for now. Such will increase further if economic growth fails to appear as expected.

Conclusion

In today’s market, the majority of investors are simply chasing performance.

Ultimately, investing is about managing the risks that will substantially reduce your ability to “stay in the game long enough” to “win.”

Robert Hagstrom, CFA, penned a piece discussing the differences between investing and speculation:

“Philip Carret, who wrote The Art of Speculation (1930), believed “motive” was the test for determining the difference between investment and speculation. Carret connected the investor to the economics of the business and the speculator to price. ‘Speculation,’ wrote Carret, ‘may be defined as the purchase or sale of securities or commodities in expectation of profiting by fluctuations in their prices.’”

Chasing markets is the purest form of speculation. It is just a bet on prices going higher than determining if the price paid for those assets is a discount to fair value.

Historically, such sentiment excesses from around short-term market peaks, not investable bottoms.

Investors miss that while a warning doesn’t immediately translate into a negative consequence, such doesn’t mean you should ignore it.

“There remains an ongoing bullish bias that continues to support the market near-term. Bull markets built on ‘momentum’ are very hard to kill. Warning signs can last longer than logic would predict. The risk comes when investors begin to ‘discount’ the warnings and assume they are wrong.

It is usually just about then the inevitable correction occurs. Such is the inherent risk of ignoring risk.'”

The cost of not paying attention to risk can be extraordinarily high.