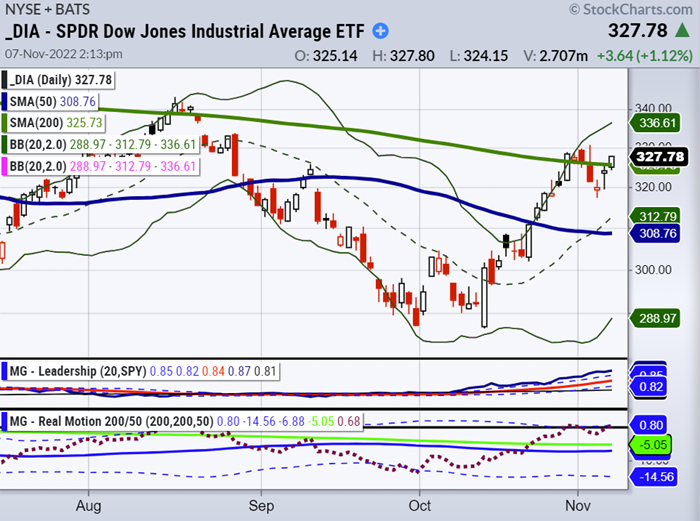

The Dow Jones Industrial Average had a good day and broke over the 200-day moving average.

It is essential to be selective and understand what is driving the market up. Cyclical stocks, many in the DJIA, benefit from continued inflationary pressure.

While all indices are down, the DIA has been less volatile and potentially better investment for the remainder of the year.

DIA is down 10% year to date, with IWM and SPY both down 20% year to date, and the QQQs are down 33%.

Investors looking to position their trading ahead of rising prices should embrace value and cyclical stocks.

Energy and base metals stocks indicate we are in for sustained inflation. This means that traders need to position trades for more price increases.

The DJIA is the oldest barometer of stock market activity and has many cyclical stocks in the index.

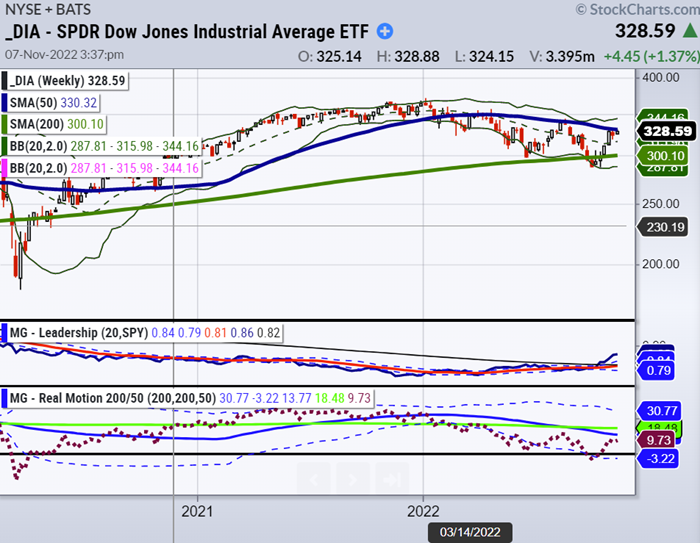

Note on the weekly chart that DIA must clear the 50-week moving average.

Although the chart looks promising, it is essential to see these pivotal resistance areas clearly and track performance.

The fourth quarter is often a time when the market begins to show opportunities for those who are patient.

For example, cyclical stocks like Caterpillar (NYSE:CAT) and others benefit from continued inflationary pressure.

Caterpillar gapped higher and has not looked back. However, note that momentum is leveling out, and there is resistance at the April high.

Interesting week, interesting charts.

And to add to the mystery, the blood moon and last lunar eclipse of 2022 will occur just a few early hours before the mid-terms.

ETF Summary

S&P 500 (SPY) 375 support and 383 resistance

Russell 2000 (IWM) 177 support and 183 resistance

Dow (DIA) 325 support and 330 resistance

Nasdaq (QQQ) 264 support and 270 resistance

KRE (Regional Banks) 62 support and 65 resistance; same as before

SMH (Semiconductors) 190 support and 198 resistance

IYT (Transportation) 212 support and 216 resistance

IBB (Biotechnology) 127 support and 132 first resistance; same as before

XRT (Retail) 58 support and 63 resistance; same as before