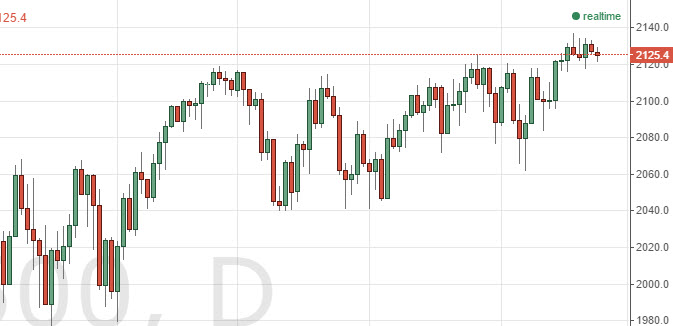

Looking at the upcoming session, without a doubt the real market moving event will be the Core Durable Goods Orders number, coming out of the United States. With that, we feel that the S&P 500 will come into focus, and the fact that Monday was a national holiday in the United States of course will make this market a little bit more anxious to move. As long as we are above the 2120 level, we are bullish of the S&P 500, in buying calls.

S&P 500

We look at the EUR/USD pair as significantly pressing against a support level in the form of the 1.10 level, and if we can get below there substantially, we are put buyers. We believe that once we touched the 1.09 level, the market will then reach towards the 1.08 level, and possibly the 1.06 level below there. If we get a bit of a bounce from here and back above the 1.10 level, we are call buyers and aiming for the 1.12 handle.

Gold markets continue to be very tight, and seemed to be set on bouncing between the $1200 level on the bottom, and the $1215 level on the top. We will continue to use short-term binary options in order to trade the range, until proven wrong by seeing the market break out in one direction or the other.