During the session on Tuesday, we think that without a doubt, the biggest mover of markets will be the US Core Durable Goods numbers, as it will directly influence the stock markets and perhaps the US dollar. With that being said, we pay attention to the S&P specifically.

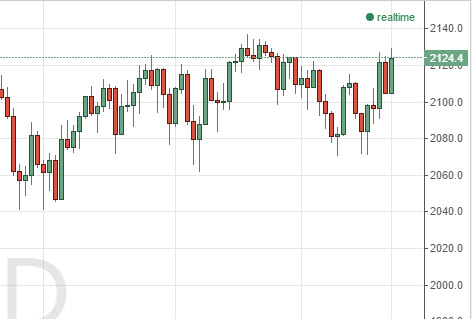

During the Monday session, the S&P 500 rose significantly, testing the highs yet again. If we can finally break above the 2135 level, we feel that this market will enter a longer-term uptrend. Pullbacks at this point in time should continue to be call buying opportunities, but regardless, we have no interest whatsoever in selling this market.

The EUR/USD pair continues to chop around and remained fairly stagnant just below the 1.14 handle. This will probably be the case going forward until we get some type of decision out of the Greek debt talks, so having said that, we can only follow the charts and recognize that buying calls will be the way to go every time we pullback on a short-term chart, but we should also be fairly quick to take profits as the volatility will continue to be a bit of an issue.

Silver markets tried to rally again during the session on Monday, binds as per usual, pullback. With this, we believe that you can keep aiming for the $16 level, once you get about $.20 away from it. In other words, buy calls on dips, and buy puts on rallies. Playing short-term charts will be the best way to deal with silver at this point.