Here we go again!

Q4 earnings season kicks off in earnest later this week, with major banks like JPMorgan Chase (NYSE:JPM), Citigroup (NYSE:C), Goldman Sachs (NYSE:GS), and Morgan Stanley (NYSE:MS) all scheduled to report their results by the middle of next week. We’ll have individual previews for each of these names throughout the week, but we wanted to start with a broad overview of the financial sector and highlight some of the key themes that are driving the industry as a whole:

1. Yield curve flattening

“Borrow short and lend long” has been a basic tenet of banking for centuries, referring to the fact that banks tend to borrow money over short-term periods through savings accounts and lend money over longer-term periods in the form of mortgages and business loans. Due to this dynamic, the yield curve, or the spread between short-term and longer-term interest rates, is a critical variable driving bank’s profits.

Over the last quarter of 2021, this spread compressed relatively sharply. Using the 10year-2year Treasury yield spread as a proxy, the yield curve flattened by about 40bps in Q4, with the interest rate premium for 10-year debt over 2-year debt falling from 1.20% to 0.80%. In other words, the difference between traditional lending banks’ revenue and expenses shrunk, presenting a potential headwind for US bank earnings this quarter.

2. Investment banking and trading

Whereas the flattening yield curve could hurt bank profits this quarter, investment- and trading-focused banks could see a considerable tailwind from the ongoing buoyancy in equity markets. Between a record year for IPOs, still low interest rates, and significant volatility in financial markets, trading and investment banking profits at major banks should be strong. Expectations are particularly high for investment-focused banks like Goldman Sachs and Morgan Stanley, though more traditional borrowing-and-lending institutions like Wells Fargo (NYSE:WFC) may not benefit as much from these trends.

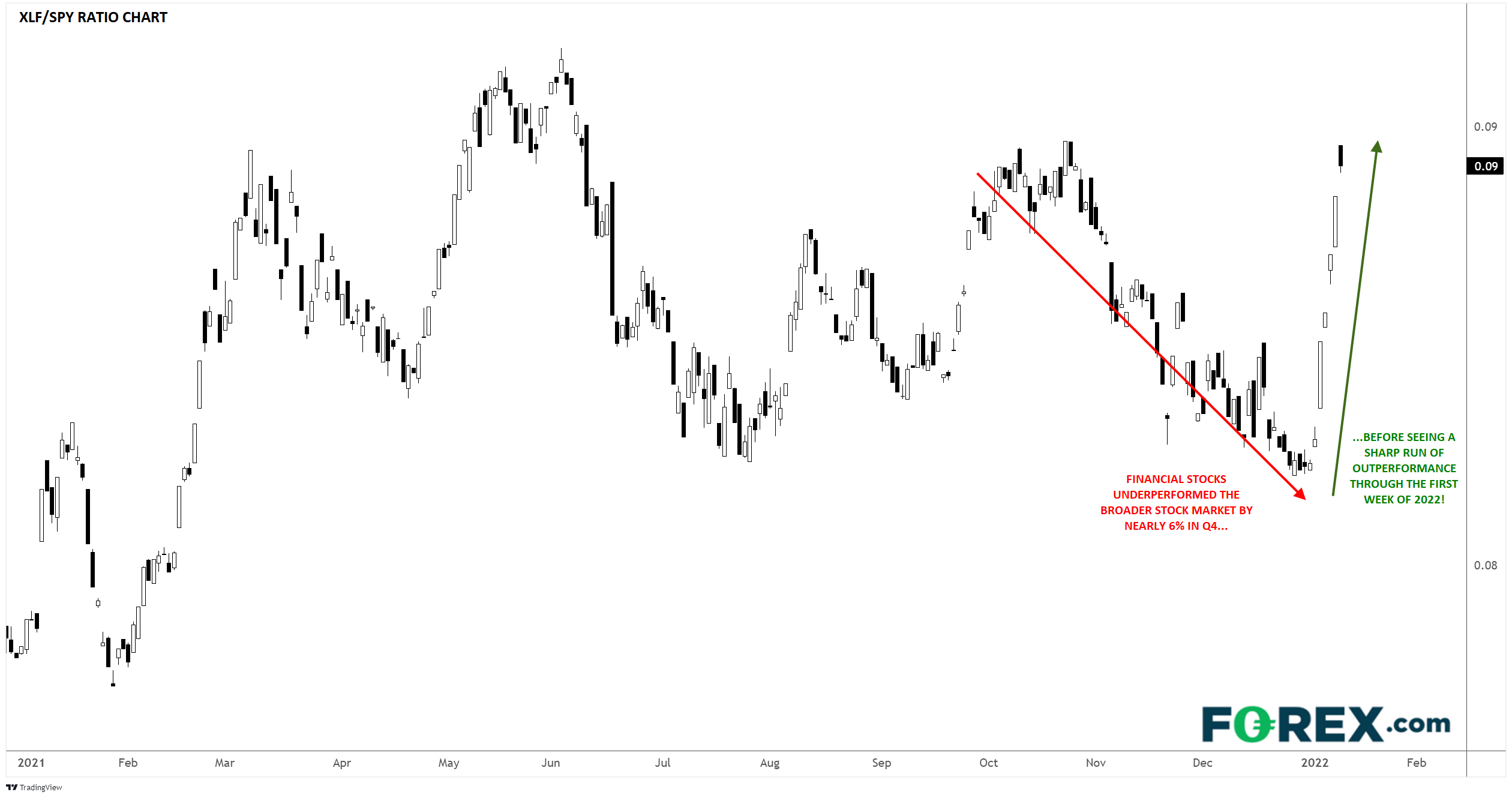

3. Relative stock performance

Q4 was also interesting for the performance of major financial company stocks. The Financial Select Sector SPDR® Fund (NYSE:XLF) underperformed the S&P 500 by nearly 6% through Q4, due at least partially to the aforementioned flattening of the yield curve. That said, the financial sector has gotten off to a roaring start to 2022, more than reversing its Q4 losses and approaching its highest level relative to the broader market since the onset of the COVID pandemic. The results we see in the coming week and a half will go a long way toward determining if the recent burst of outperformance will continue or whether the financial sector will start to underperform the broader market again.

Source: TradingView, StoneX

Stay tuned throughout the week for our updates on the most important individual banks to watch this quarter!