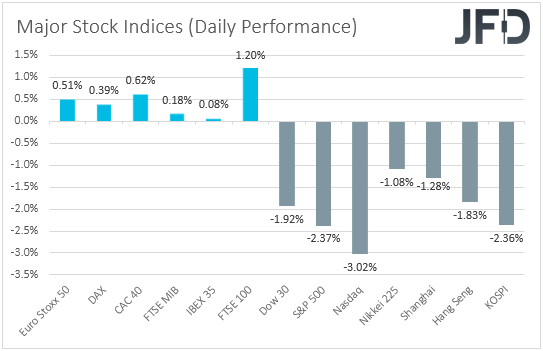

Even though EU indices finished their trading in positive waters, US and Asian Shares traded in the red on increasing fears of a slowdown in the global economic recovery due to a second round of coronavirus-related restrictions.

As for today, we have two central banks deciding on monetary policy, and those are the SNB and the Norges Bank. Neither Bank is expected to proceed with any policy changes and thus, we will look for any material changes in the accompanying statement’s language.

U.S. And Asian Stocks Slide As Economic Recovery Hopes Fade

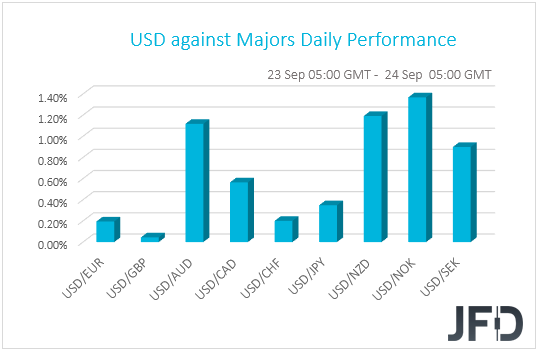

The US dollar continued to outperform the other G10 currencies on Wednesday and during the Asian morning Thursday. It gained the most versus NOK, NZD, AUD, and SEK in that order, while it eked out the least gains against GBP, EUR, CHF, and JPY.

The strengthening of the US dollar, the weakening of the risk-linked Aussie and Kiwi, and the fact that the other safe-havens, the yen and the franc, were among the currencies that lost the least ground, suggest that markets turned back to “risk off” at some point yesterday.

Indeed, looking at the performance in the equity world, we see that , although major EU indices finished their session in positive territory, all three of the main US ones tumbled on average 2.44%, with the negative investor morale rolling into the Asian session today.

Yesterday, the main events on the economic agenda were the preliminary PMIs for September. In Eurozone, the manufacturing index rose, but the services one slid into contractionary territory, more than offsetting the improvement in the manufacturing sector. The composite PMI slid to 55.7 from 59.1.

Even though this has not affected European shares much, a similar pattern in the US PMIs was more than enough to prompt more investors to abandon US stocks. Warnings over the US economic outlook by Fed officials may have also added some pressure.

Vice Chair Richard Clarida said that the economy remains in a “deep hole” of joblessness and weak demand, and called for more fiscal stimulus, with Cleveland President Loretta Mester echoing his remarks by saying that the nation is still in a “deep hole, regardless of the comeback we’ve seen.”

As for our view, the PMIs add to concerns with regards to the global economic recovery, while the new restrictions in several nations, and the prospect of others following suit, suggest that if the virus continues to spread at a fast pace, the October indices may be much worse. We would stick to our guns that further declines in equities and other risk-linked assets are possible, something that could keep the safe-havens dollar and yen elevated.

We will hold some reservations with regards to a strengthening Swiss franc, due to the fact that the SNB remains committed to intervene in the FX market when it judges necessary in order to weaken the currency.

SNB And Norges Bank Decide On Monetary Policy

Speaking about the SNB, today the Bank announces its monetary policy decision. Its latest meeting, in June, proved to be a non-event, as officials kept interest rates unchanged at -0.75% and repeated that they remain willing to intervene more strongly in the FX market. They also reiterated the notion that the Swiss franc remains highly valued, with President Jordan saying that they made substantial interventions since March, and that there is no specific limit to that.

With the franc now trading at higher levels against the euro than back then, we expect Jordan and his colleagues to reiterate once again that the franc is highly valued and to continue signaling willingness to intervene when necessary. Having that in mind, a similar stance to the prior one is unlikely to prove a major market mover for the franc.

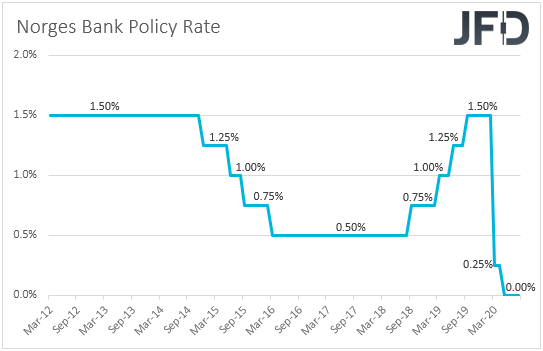

We have another central bank deciding on interest rates and this is the Norges Bank. At its prior meeting, this Bank decided to keep interest rates unchanged at 0.0%, repeating that the outlook and balance of risks suggest that they will most likely stay at that level for some time ahead. Officials acknowledged that the economy is in the midst of a deep downturn, and added that new information largely confirms the picture of developments presented in the June report. With GDP data showing that mainland Norway contracted 6.3% in Q2, very close to the Bank’s estimate, and the CPIs accelerating in August, Norges Bank officials are likely to continue sitting comfortably on the sidelines.

Technical Outlook: NASDAQ

Nasdaq 100 experienced another slide in its yesterday’s trading session, bringing the price closer to one of its key support areas, at 10676, marked by the current lowest point of this week.

The index is still trading below the medium-term upside support line drawn from the low of April 21st and also below a short-term tentative downside resistance line taken from the high of September 16th. Although there are indications of a possible continuation move lower, in order to get a bit more comfortable with the downside, a drop below the 10676 area is needed.

A drop below the previously mentioned 10676 area would confirm a forthcoming lower low and might set the stage for a move to the 10513 zone, marked by the lows of July 29th and 30th. The index may get halted there, or could even rebound slightly. That said, if the price stays below that 10676 zone, the sellers may retake charge and drive Nasdaq 100 down again. If this time the bears are able to bring the index beyond the 10513 obstacle, the next possible support level to consider could be at 10315, which is the low of July 24th.

In order to shift our attention to some higher areas, we would like to see the index rising back above the previously discussed upside line and the 11238 barrier, marked by yesterday’s high. Nasdaq 100 could then travel to the 11549 obstacle, which is the high of September 16th, a break of which might clear the way to the 11845 level. That level marks the low of August 27th and the high of September 4th.

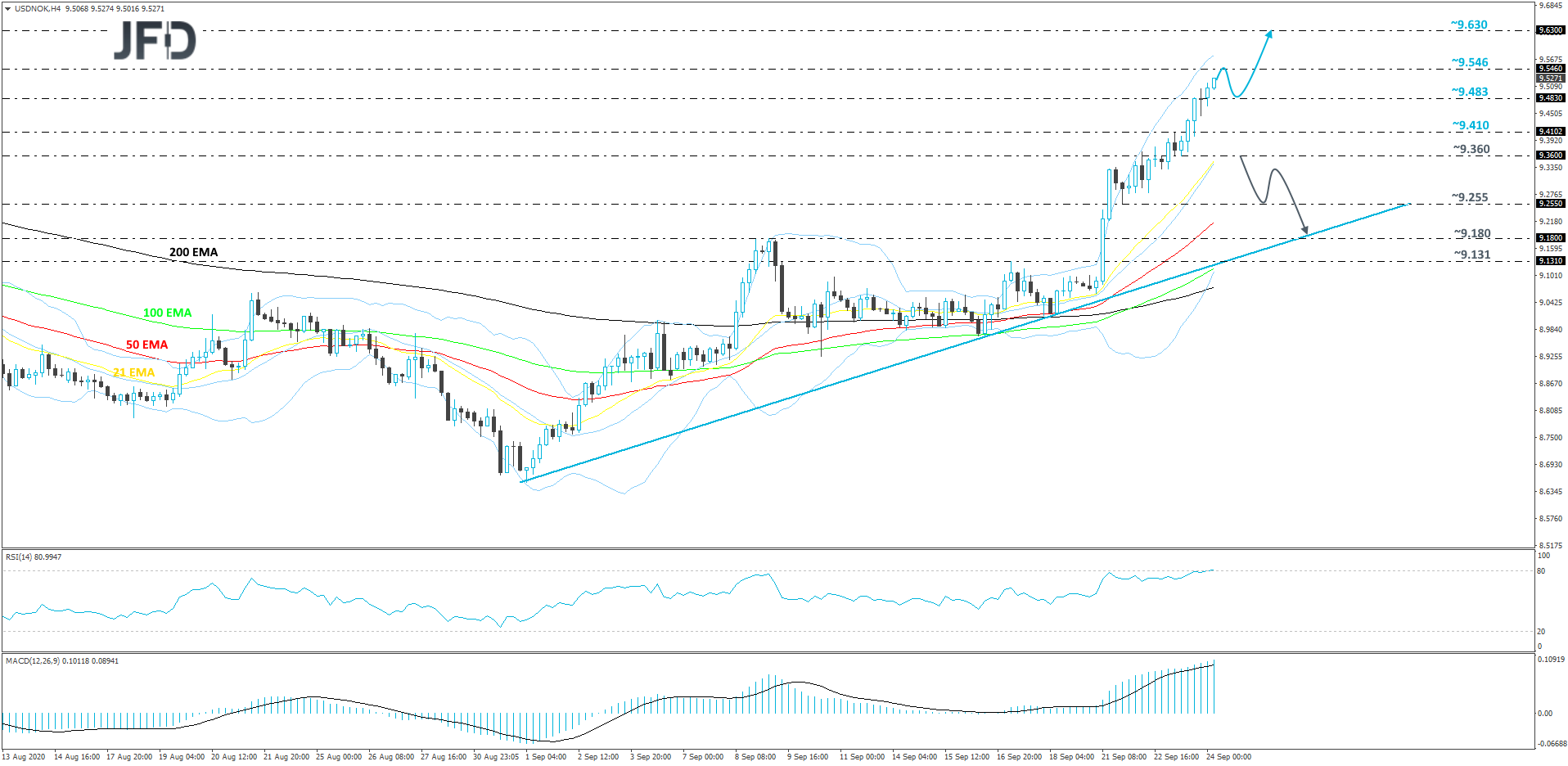

Technical Outlook: USD/NOK

USD/NOK continues to sail north, after it reversed higher on September 1st. The pair is currently trading well above a short-term tentative upside support line taken from the low of that day. Although the trend remains to the upside, a small setback could be possible, before another potential leg of buying. For now, we will stay positive overall.

A small drift higher may bring the rate to the 9.546 barrier, which is the high of July 10th, where the pair might stall temporarily. USD/NOK could even retrace back down a bit, but if it stays somewhere above the 9.483 zone, marked by the high of July 14th, that may attract the buyers again. If so, the rate might travel north again and if this time the 9.546 hurdle surrenders and breaks, the next potential resistance area could be at 9.630, which is near the highest point of July.

Alternatively, if the pair suddenly goes for a larger correction to the downside and drops below the 9.360 zone, marked by yesterday’s intraday swing low, that may place USD/NOK back below the 21 EMA on our 4-hour chart, which some bears could see as a good opportunity to step in. The rate may then slide to the 9.255 obstacle, a break of which might clear the way to the 9.180 level, which is the high of September 9th. USD/NOK might stall there, as it might also test the aforementioned upside line, which could provide additional support.

As For The Rest Of Today's Events

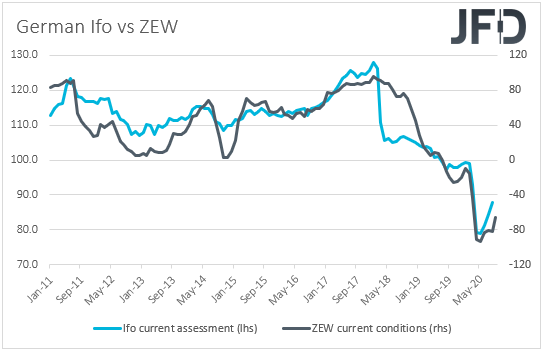

During the European session, Germany’s Ifo survey for September is due to be released. Both the current assessment and expectations indices are expected to have increased to 89.5 and 98.0 from 87.9 and 97.5 respectively. This would drive the business climate index up to 93.8 from 92.6. An improving Ifo survey is supported by the ZEW survey for the month, both indices of which rose by more than anticipated.

In the US, new home sales for August are coming out, with the forecast pointing to a 0.1% mom slide after a 13.9% rise in July. We also get the initial jobless claims for last week, which are expected to have declined slightly, to 840k from 860k the week before.

As for the speakers, we have five on today’s schedule. Fed Chair Powell will speak before Congress for a third day in a row, while we will also get to hear from US Treasury Secretary Steven Mnuchin, Chicago Fed President Charles Evans, New York Fed President John Williams and, and BoE Governor Andrew Bailey.