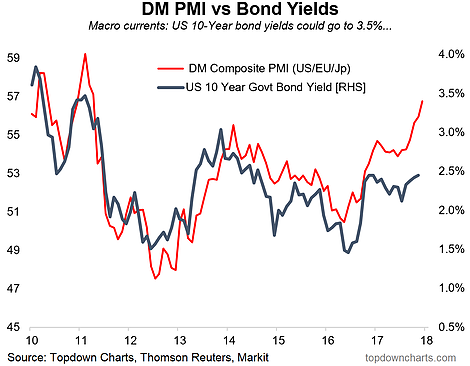

A couple of things are happening in the bond space right now. Last week we got the flash PMIs for the major DM economies and on all fronts they were strong—all improved, and the composite flash PMI for developed markets rose to a new 6-year high. The first chart below shows how that indicator in recent years has moved in step with US 10-year bond yields (and for good reason): the clear implication being that bond yields look "too low" at this point.

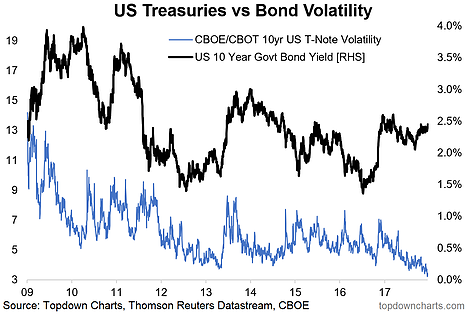

At the same time, the US Government is about to pass new tax legislation which could have big implications for the growth/inflation outlook (bearish bonds) and the deficit (likewise). You also have the US Federal Reserve now running quantitative tightening - passively running down its balance sheet by progressively reinvesting less principal from maturing bonds. This is happening at a time when bond market implied volatility is at a record low, which signals complacency and is also a familiar sign from previous turning points.

So as the macro backdrop looks more and more consistent with higher bond yields, it seems the market is just looking for a catalyst and the tax legislation could be just that. Our view is inflation heads higher across developed economies next year, so aside from the risk of spikes in bond yields, the odds are that a multi-year turning point is in place for global bond markets.

The acceleration in the DM composite manufacturing PMI is consistent with a drive higher in bond yields.

Bond market implied volatility is at record lows. This represents a certain degree of complacency creeping through the market, and is a familiar sign from previous major turning points.