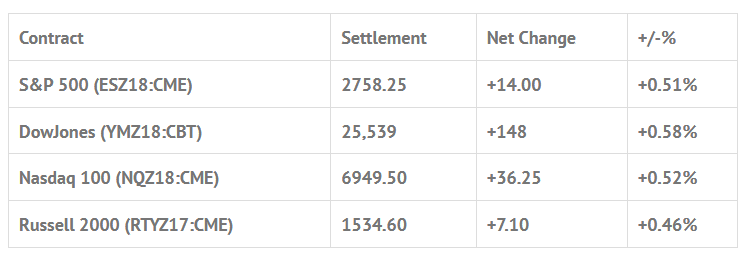

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 11 out of 11 markets closed higher: Shanghai Comp +2.57%, Hang Seng +2.55%, Nikkei +1.00%

- In Europe 13 out of 13 markets are trading higher: CAC +1.01%, DAX +2.21%, FTSE +1.66%

- Fair Value: S&P +0.53, NASDAQ +3.78, Dow +16.16

- Total Volume: 1.47mil ESZ & 566 SPZ traded in the pit

As of 8:00 AM EST

Today’s Economic Calendar:

Today’s economic calendar includes John Williams (NYSE:WMB) Speaks 9:15 AM ET, PMI Manufacturing Index 9:45 AM ET, ISM Mfg Index 10:00 AM ET, Construction Spending 10:00 AM ET, Lael Brainard Speaks 10:30 AM ET, and Robert Kaplan Speaks 1:00 PM ET.

S&P 500 Futures: U.S / China Global Market Teeter Totter

The S&P 500 futures traded down to 2729.00 on Globex early Friday morning, and traded 2736.75 on the 8:30 futures open, down -7.50 handles. The first move after the bell was a break down to 2733.25, followed by a rally up to 2748.50, just 6 handles shy of Thursdays 2754.50 high. After the high the ES sold off and made a higher low at 2735.75, and then rallied up to a lower high at 2745.50. From there, the futures sold back off down to another higher low at 2737.25, and then shot up to 2752.00 after a headline hit the tape that the U.S. and China were ‘reaching points of consensus’, though some areas of disagreement remain.

At 2:03 CT the MiM opened up showing $948 million to buy, and the ES was trading 2751.50 with 926,000 contracts traded. As the MiM increased to $1.42 billion to buy, the ES broke out above the highs and traded up to 2759.25. At 2:45 the benchmark futures traded 2755.50 as the final MiM showed $1.6 billion to buy. On the 3:00 cash close the ES traded 2757.00, and then traded up to a new high at 2664.75 at 3:13, then went on to settle at 2764.25 on the 3:15 futures close, up +22.25 handles, or +0.81% on the day.

In the end it was clearly about the China tariff headlines. Prior to the headline there was only 640,000 ES contracts traded, 45 minutes later it was 1 million. In terms of the days overall tone, it acted good, but I just have lingering doubts about the Trump / Xi tariff meeting. In terms of the days overall trade, 1.39 million ES traded, the lowest volume in almost two months.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.